If the price of EOS tokens stays at the current level, the final valuation of EOS will be around USD 5 billion. Which is around 20% of Ethereum.

What does it mean?

The consequences are much more profound than you might realize.

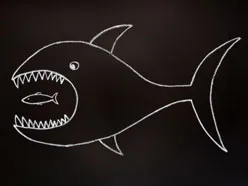

It means that if EOS founders don't dump their ETH immediately after receiving it, they will end up with around 20% of shares of their biggest competitor. Thus they will be able to control its price to a large degree and bring it down significantly whenever this suits them.

I guess I don't need to explain how big an advantage this might be, especially when you synchronize this power with your marketing campaign.