Hello, steemit community. In this opportunity I bring you a topic of interest for all, especially for Venezuelans. I hope it will be you useful.

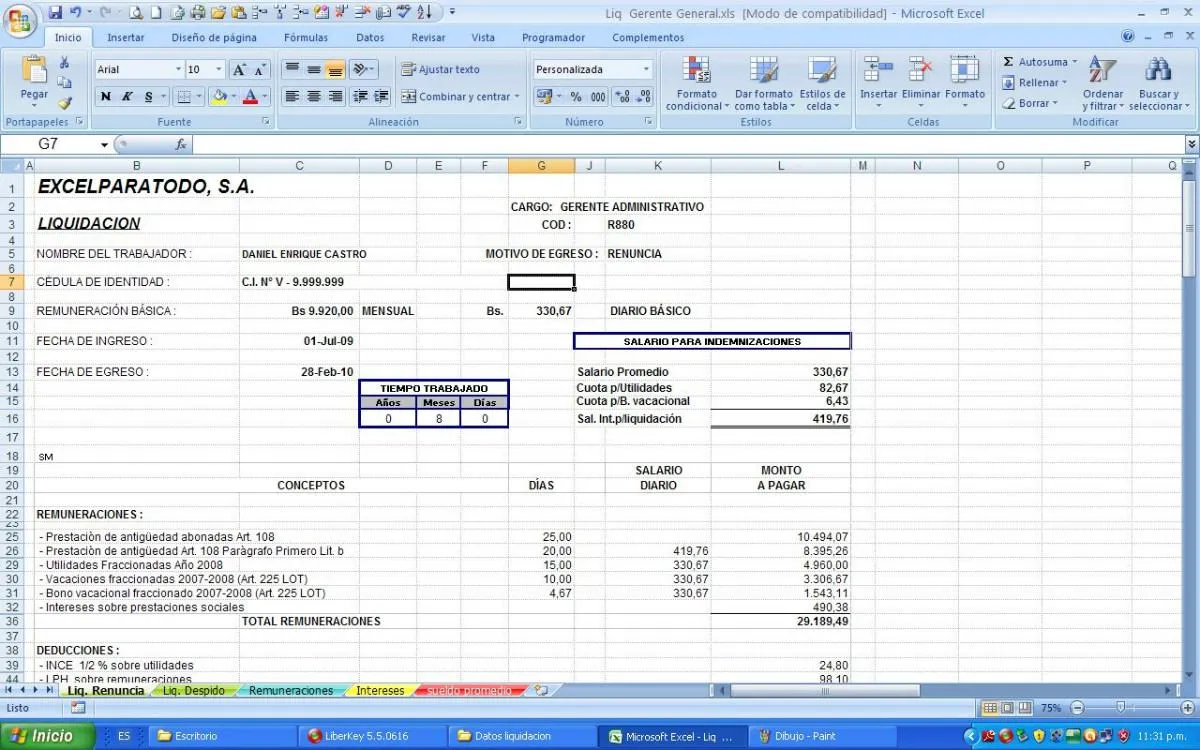

It is the money that is given to the worker for the provision of a service when the employment relationship has ended. Either by: termination of contract, justified or unjustified dismissals, resignation or mutual agreement.

The benefits are the profits that the worker receives for the time of service. No employer must pay social benefits if there is no termination of the employment relationship. The worker can annually request up to 75% of what he has accumulated when the employment relationship has not been completed; 100% when it has finished (in this case, it must be paid immediately).

Golden rule: there is no such thing as two identical calculations.

• Immediate enforceability.

• Remunerative nature.

• At work, never before.

Chapter III

Of the Social Benefits

Article 141

Social benefits scheme

All workers are entitled to social benefits that reward seniority in the service and protect them in case of unemployment. The social benefits regime regulated in this Law establishes the payment of this right proportional to the time of service, calculated with the last salary earned by the employee at the end of the relationship.

• It has to be regular and permanent (to be repeated in time)

• It calculates: aliquots, utilities, holiday bonus and social benefits.

• It is used to calculate overtime, night bonus, Sundays and holidays.

• No food bonus is considered salary. !

There are five types of salaries: Basic, Minimum, Average, Normal and Integral Basic Salary: It is the one agreed upon at the beginning of the employment relationship and during the employment relationship. Minimum Wage: It is that fixed by the national executive, taking into account the basic basket. No worker can earn less than what is established. Average Salary: It is the sum of various remunerations divided by a factor. Normal Salary: It is all that regular and permanent remunerations on a weekly, biweekly or monthly basis. Integral salary: It is the sum of all salary recidivism example: overtime, night, commissions among others

It was promulgated by the Venezuelan national executive in 2002. This decree is to protect the jobs of the working class. We have been promulgated for sixteen years.

It is the right of the worker to keep his job, as long as he does not incur a cause for dismissal. The employer is bound by the legislation to keep the job to the worker.

If you like my publication, do not forget to give UPVOTE and RESTEEM.

Thank you. Images and text cited: https://oig.cepal.org/sites/default/files/2012_leyorgtrabajo_ven.pdf