The beginning of what is now the "new normal", Central Bank overreach and over-accommodataion, started 10 years ago, today. What instigated the Great Recession didn't start 10 years ago, that started years earlier, rather, this is the anniversary of the spanner being placed in the works.

BNP PariBus, a French Bank, closed three of it's Funds to redemptions and subscriptions, on this date, 10 years ago. They were unable to compute net asset value of these funds, which were linked to the US housing market. This was the first crack in the dam that was about to collapse.

It was a credit freeze that started the mortgage crisis, which toppled the financial markets back in 2007. Institutions finally wised up to the fact they had no clue what their exposure was to subprime, mortgage backed securities(mbs), that were in their portfolio of collateral debt obligations(cdo). These CDO's had been monetized and sold to investors in bank managed funds.

That same day, the ECB's Jean-Claude Trichet offered to loan, overnight, any bank, any amount of money they needed to cover a shortfall.

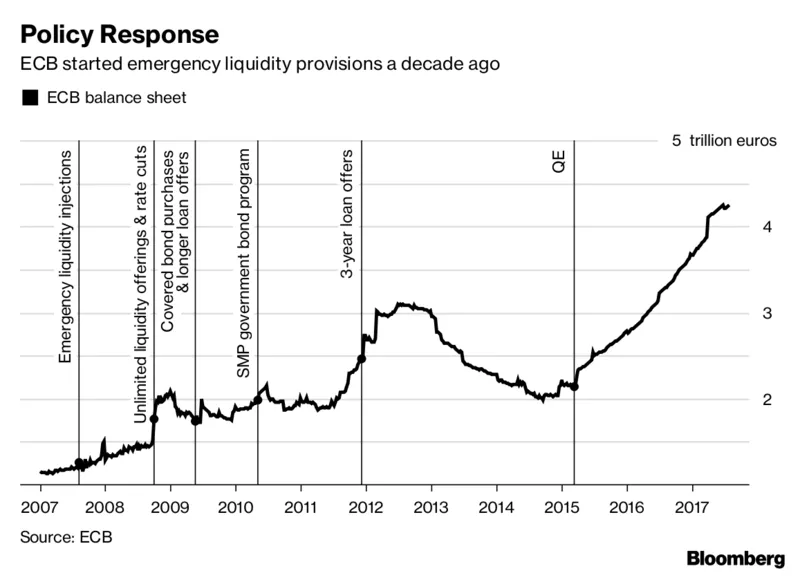

the ECB's €95 billion emergency loan to banks on Aug. 9, 2007, "was the initial response to a financial crisis that would force the Frankfurt-based institution to expand its balance sheet by trillions of euros."

MBS CDO's had been the hottest investments going, for the previous few years. They were rated AAA and were making financial institutions tons of money. In the US, subprime mortgages were being given out to anyone with a pulse.(I should know, I took out a no-doc mortgage myself)

They then took these questionable loans and bundled them together, voila, they now had a AAA rated security. Just as solid as a 30 year Treasury with greater returns. Unfortunately, it was really just a ponzi scheme, a house of cards constructed by the largest financial institutions.

Once BNP PariBas froze their three funds, the liquidity in the MBS market froze, leaving banks that were using them as collateral, essentially insolvent.

A month later, Northern Rock, a British Bank heavily invested in MBS, fell victim to a bank run when it became known that they needed a bail-out from the Bank of England. Northern Rock was unable to divest it's investments in MBS, the market for the subprime securities had frozen.

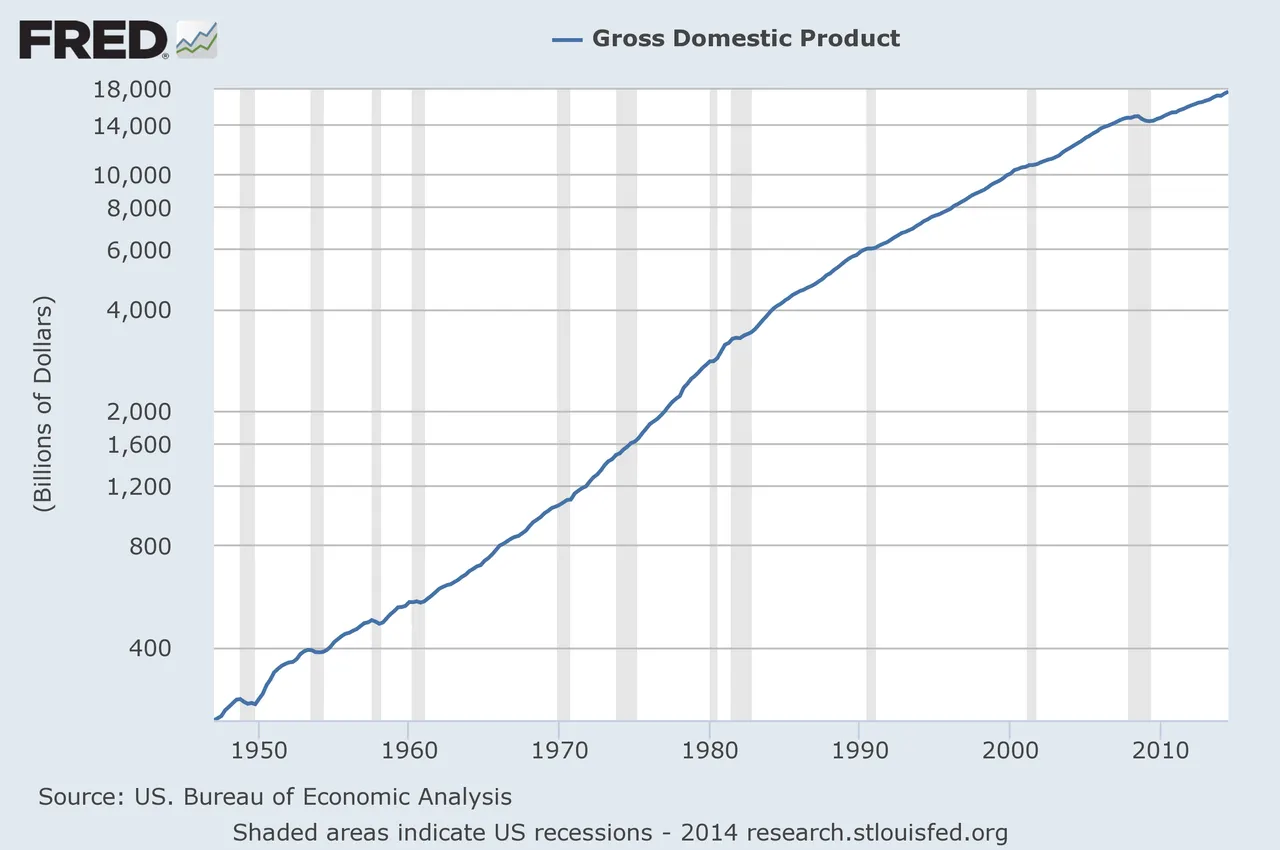

This is what led to the Great Recession of 2008-2009 in the West. To this day the Reserve Banks are still pumping up the markets to give the semblance of stability.

"with the recovery finally holding up after years of stimulus and hard-fought economic reforms", Bloomberg writes that central bankers have started to contemplate a return to more normal policies. One of many milestones on that path is expected in the fall, when ECB President Mario Draghi may offer an outline of a gradual exit from a 2.3 trillion euro bond-buying plan. This will take place at a time when the market is habituated to not only ultra-low interest rates, but over $10 trillion in asset purchases by central banks over the past decade. Whether it will work remains to be seen.

Larry Elliott, economics editor, said: "As far as the financial markets are concerned, August 9 2007 has all the resonance of August 4 1914. It marks the cut-off point between 'an Edwardian summer' of prosperity and tranquillity and the trench warfare of the credit crunch – the failed banks, the petrified markets, the property markets blown to pieces by a shortage of credit"

The 10 year anniversary of the "Shortage of Credit" that got the ball rolling for a recession, that the US never escaped from. Phrases like "muted recovery" exemplify the lack of normalcy and price discovery, in the markets today. Just a little perspective on recent history. A history that is inextricably linked to the world today.

The US stock market at all time highs, the Student Loan bubble, the reinflated Housing bubble, unprecedented unemployment... These different sectors all tell a different story about where the economy stands. This is what you end up with when there is unprecedented intervention by Central Banks. We appear exactly where we were 10 years ago, unable to properly value assets.

http://www.nytimes.com/2007/08/09/business/worldbusiness/09iht-09bnp.7054054.html

https://www.theguardian.com/business/2012/aug/07/credit-crunch-boom-bust-timeline