I’m enjoying my time in Southern Europe right now.

When it comes to these nations that sit on the Mediterranean, you can expect a laid-back atmosphere with plenty of sunny beaches, wining and dining, and, of course, siestas.

It wasn’t always like this. In the days when the Mediterranean offered these countries a strategic advantage, fleets of ships traversed the seas, controlling commerce routes and occupying other tribes and regions.

The Greeks and later on, the Romans, became so rich and powerful that the only enemy, which could defeat them was the mismanagement of their own wealth by their own government.

You see it in wealthy families today as well. The generations, which are handed overwhelming riches without working for it, can piss it away in the blink of an eye.

They haven’t learned the lessons, which led to the accumulation of these assets, such as saving, over-delivering value to others, budgeting, being opportune, or cutting costs.

Europe is learning these lessons the hard way now.

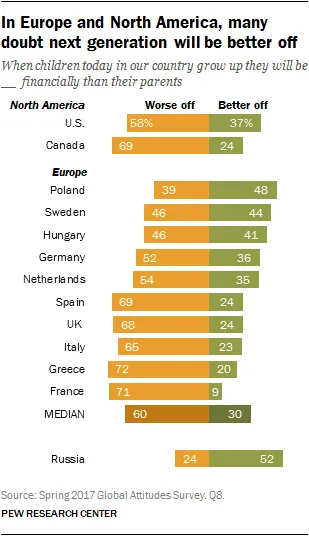

Courtesy: Pew Research Center

Americans, as well as Europeans, know the score.

I am a firm believer in education. My fantasy is that businessmen would lobby the government to get the hell out of the school system and allow the free market to educate the young.

So much untapped potential would be unlocked, if we stopped, as a collective, wasting valuable time, teaching children trivial stuff that doesn’t mean anything.

But, until that day comes, I want to focus on the doable and realistic.

The Dollar’s main threat doesn’t come from other countries. As you can see, no large or developed country can compete with the U.S., and the up-and-coming ones, such as India, China, Russia, or the smaller ones, such as Australia and Singapore, don’t have a large enough currency supply to do any meaningful damage.

The U.S. is facing only one form of cancer, a domestic one.

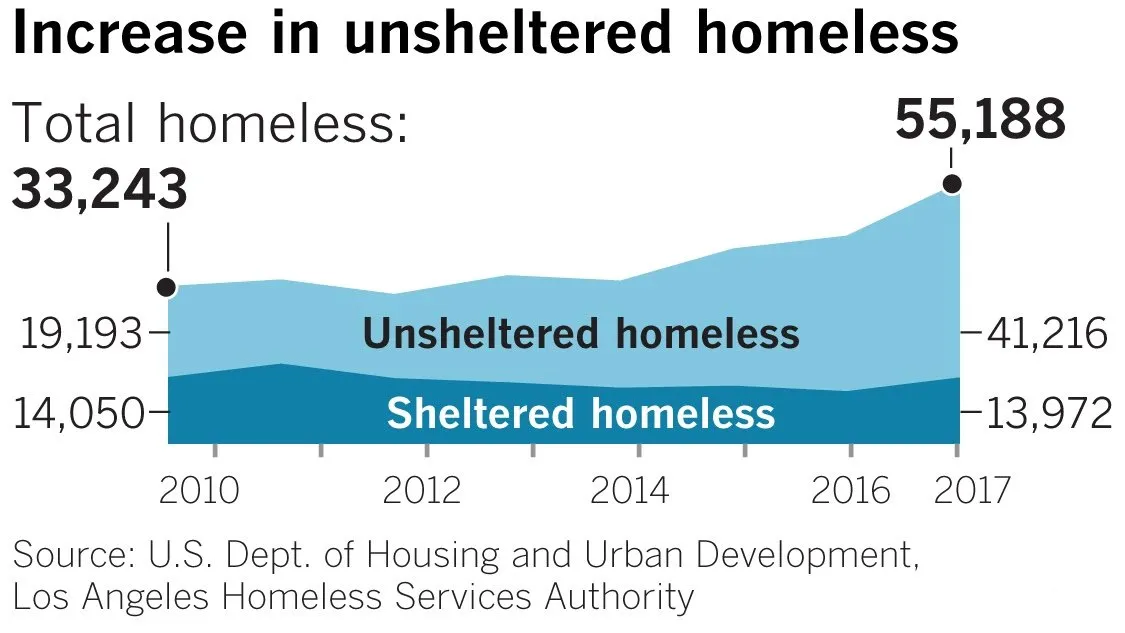

Development, LA Homeless Services Authority

I can’t stress enough the immense wealth gap within the U.S. right now.

Every empire starts to crack by allowing the rich and poor to become polar opposites.

Remember, with money, it is easier to invest in assets, which themselves produce additional income to spend on better education and purer nutrition – it’s a vicious cycle. The poor cannot escape the struggle, while the rich are flying high above the daily rat race.

The Dollar, then, can only crack in a big way, a shock event if you will, like the one Venezuelans and Turkish are undergoing right now, if individual states within the union look to issue state-coins, because the Federal government is not approving budgets for projects the governors are requesting.

California is leading the revolt, a process that gained traction in 2014 when Governor Jerry Brown signed a law repealing a state code prohibiting the issuance of currencies other than the U.S. Dollar.

This opened the floodgates, allowing a rush to create alternative currencies not tied to Federal Reserve policymaking.

Along came the cryptocurrency revolution – already in progress, but gaining steam in recent years – and all bets are off. Once again we have California leading the insurrection as the city of Berkeley announces its interest in creating its own cryptocurrency.

The goal of their proposed ICO would be to tackle local economic shortfalls.

The proposed currencies would be far less exposed to the devastating erosion impact of inflation. The USD has seen a 96% decline in value, but we won’t see that type of result with a pre-programmed coin with a finite and determined amount of units.

Other states are on the move to legislate similar bills and acts: Colorado, Arizona, New York, Tennessee, and Wyoming – the list is growing and it should be a scoop for CNN, NBC and Reuters, but I had to fnd this out from my deep-rooted contacts in the administration and in the business world.

Mainstream media will talk about the collapse of the Dollar only after the fact. To this day, I haven’t seen any full-length documentary, show or series of articles about the massive 96% drop in purchasing power of the USD on any national TV program and I don’t expect to see it.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com