Ron Paul had it right when describing currency devaluation as an “inflation tax.”

Inflation comes with all the gun-in-your-face brute-force you’ve come to expect from taxation, but disguised by a stealthy veneer of Keynesian economic “theory.”

Nothing says “kicking the can down the road” like ramping up the old printing presses while giving people the illusion of growing riches.

Quantitative easing (QE) is a massive fraud the banksters have made so easy for themselves, they don’t even print any more cash---it’s all digital. Yet people say that's why bitcoin has no value - because "it's digital and backed by nothing." 🤦♂️

No, far worse than bitcoin, a bunch of communist-style, unelected fat cats behind the scenes simply add new money into their coffers with just a few keystrokes.

Every time they do this, prices go up, negatively affecting consumers, while government puppets and phony economists distract and deceive with their same old tricks.

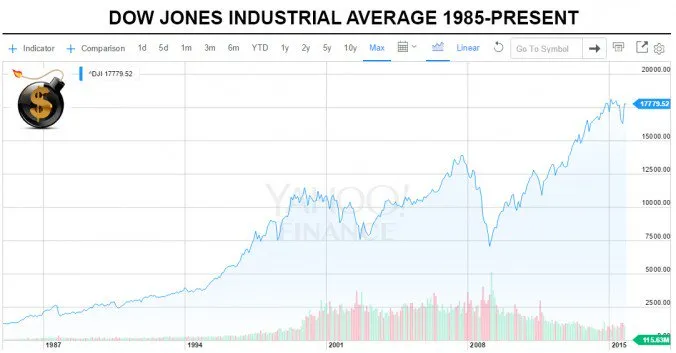

Take, for example, this graph of the Dow Jones Industrial Average from 1985 to 2015:

Wow! Look at this skyrocketing chart! Instinctually, we’re prone to interpret such figures as a sign of soaring economic growth.

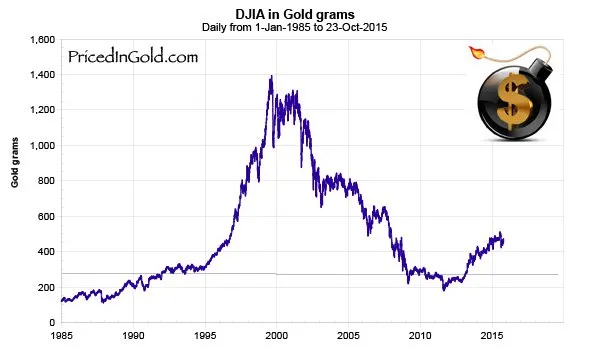

Now let’s take a look at a more sobering graph, this time converting prices from the dollar to gold---historically a more stable currency:

Oh, crap! Suddenly it looks like the economy’s about to implode and it’s time to stockpile storable foods.

This is inflation at work: an insidious force keeping a bloated, lethargic government afloat by robbing our purchasing power while pacifying public outcry.

So while Trump can proclaim himself to be the ultimate jobs president, for whatever that’s worth, the latest numbers expose the hard truth.

“Inflation hits 6-year high, wiping out wage gains for the average American,” reads new headlines, putting a dent in all the hype about America’s “booming” economic future.

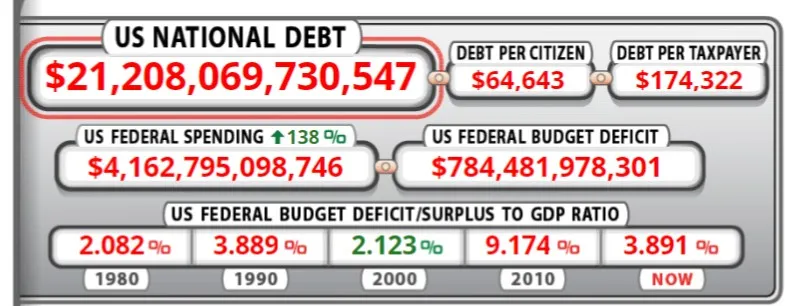

What’s really booming is the national debt.

The figures just released by the US Department of Labor show a 2.9% inflation spike over the last 12 months—a bitter end to the apparent potential wealth hiding in all of those “new jobs.” The worst part is, like all government figures, they’re either complete distortions or outright lies. Inflation is actually far higher than 2.9%.

The costs of basic goods are rising, making the weekly trip to the grocery store a confusing headache for many, as more and more cash is needed to meet daily needs.

In one year, gas prices jumped by over 24% and rent has gone up about 4%.

It seems hyperinflation is still on track to trigger a dollar collapse, likely by the end of this decade as I predicted nearly ten years ago. It won’t be pretty.

Ernest Hemingway, whose books were burned in Berlin in 1933, had this to say about inflation:

Since starting The Dollar Vigilante, I’ve been sounding the alarm bells---to the benefit of our members ( SUBSCRIBE ) who’ve diversified their savings into crypto, gold, and other assets. The insights garnered from TDV’s newsletters have been invaluable for countless people.

After all, knowledge is power, but only if you use it.