INTRODUCTION

Millions of new investors began trading cryptocurrencies. Of course, as with any investment vehicle, there are many different trading strategies, so it’s important to identify which one suits you best.

To be successful in the world of cryptocurrency trading you must know the market very well, but above all, you must know yourself. Perhaps this is even more important than knowing the market, and your future in the world of crypto may depend on this level of self-honesty.

In general, there are four types of cryptocurrency traders based on the time they take between the opening and the closing of an operation (between buying and selling or vice-versa). You can combine two or more strategies, but the important thing is to know how to distinguish them and the differences in each one. From shorter to longer times, the types of trading are:

- Scalping:

Scalping is a type of cryptocurrency trading which is based on buying and selling almost instantly. It is perfect for those looking for a fast trading style. The scalper does not take his eyes off the screen, seeing the variations in real time. These trades typically don’t last more than 5 minutes.

Scalping is a type of cryptocurrency trading which is based on buying and selling almost instantly. It is perfect for those looking for a fast trading style. The scalper does not take his eyes off the screen, seeing the variations in real time. These trades typically don’t last more than 5 minutes.

This type of trading requires a lot of leverage to obtain considerable profits, and it involves opening and closing many operations on the same day. The idea is to bet a lot of money to get very little profit but in a brief time.

The analysis of trends is not very important in this type of trading because short-term predictions are less accurate. If you are a scalper, you must know how to make quick decisions. You cannot “get attached” with a coin, and you must be very strict with your limits of Take-Profit and Stop-Loss.

- Day Trading:

Day trading is a short-term trading strategy that consists of opening a few positions at the beginning of the day and closing them at the end. This way, there is a greater range of action and a quieter period of operation, controlling the risks of leaving a trade open for a few days and suffering a change of trends by an unexpected event. i.e., if you live in the United States and leave a position open, bad news from Asian governments may cause a fall while you sleep. In the same way, some good news may generate an increase, but at the end of the day, what matters to the Day Trader is having control over the information.

Day trading is a short-term trading strategy that consists of opening a few positions at the beginning of the day and closing them at the end. This way, there is a greater range of action and a quieter period of operation, controlling the risks of leaving a trade open for a few days and suffering a change of trends by an unexpected event. i.e., if you live in the United States and leave a position open, bad news from Asian governments may cause a fall while you sleep. In the same way, some good news may generate an increase, but at the end of the day, what matters to the Day Trader is having control over the information.

The most common candles daytraders operate with are candles from 15 to 30 minutes. Sometimes they observe 4-hour behaviors to see if their trading is part of a trend.

They use indicators and technical analysis. The most recommended ones are the MACD and the RSI.

- Swing Trading:

This is the most common type of trading in the cryptomarket. Generally, because of the significant volatility of altcoins, traders buy a currency and then change it to USD, BTC or ETH only to buy another altcoin and thus maintain their wave of profit (most altcoins are quoted mainly against Bitcoin).

This is the most common type of trading in the cryptomarket. Generally, because of the significant volatility of altcoins, traders buy a currency and then change it to USD, BTC or ETH only to buy another altcoin and thus maintain their wave of profit (most altcoins are quoted mainly against Bitcoin).

Swing trading cryptocurrencies consists of opening trade and leaving it for a reasonable period of time, from hours to several days. They generally use candles from 12 hours onwards with other essential indicators. One that is not usually missing is the volume of the market. The use of technical analysis is of great importance.

The most common indicators are the MACD, RSI, Stochastics, however many prefer to use other signs that provide a more general view of market behavior: Fibonacci Regressions, Gann forks, Bollinger, EMAs, etc.

- Position Trading:

Position trading is a trading strategy that is more “investment” than “trading.” It consists of opening positions and leaving them for several weeks to years. It requires extensive knowledge of aspects beyond the technical ones. Long-term investors are willing to take a significant amount of risk in favor of the possibility of making a considerable amount of profit.

Position trading is a trading strategy that is more “investment” than “trading.” It consists of opening positions and leaving them for several weeks to years. It requires extensive knowledge of aspects beyond the technical ones. Long-term investors are willing to take a significant amount of risk in favor of the possibility of making a considerable amount of profit.

An in-depth study is necessary to know the reliability of each move that is made, for this reason beyond the technical analysis, traders must continuously apply fundamental analysis studies.

The most common candles studied go from 1 day to 1 month depending on how willing investors are to maintain their position.

But above all, as serious as the trading world may be, make sure you enjoy your trip.

Today, I will be presenting you a particular project called: XTRD

WHAT IS THE MAIN PURPOSE OF "XTRD" PLATFORM?

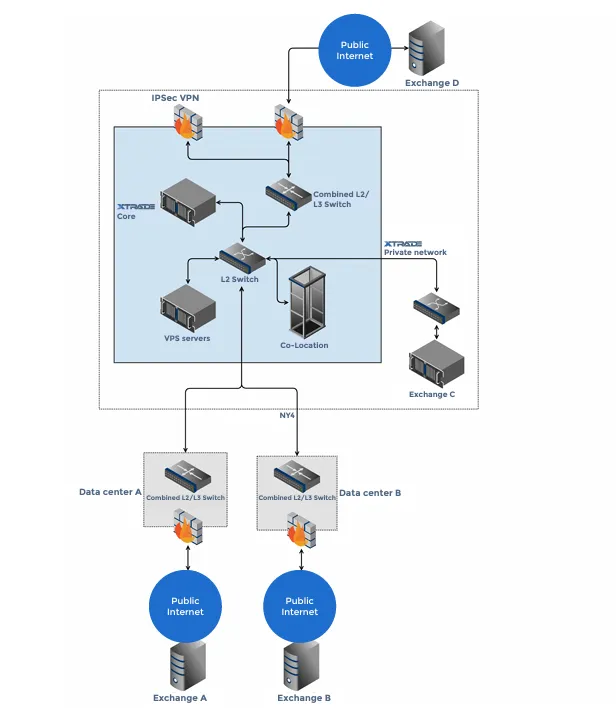

XTRD is a technology company that are introducing a new infrastructure that would allow banks, hedge funds, and large institutional traders to easily access cryptocurrency markets.

XTRD is comprised of a team of veteran Wall Street trading specialists with a mission to unify the cryptocurrency exchanges. This mission has manifested in four products that are all interconnected. These products are a unified FIX API similar to ones already used for high volume trading, a Single Point of Access (SPA) for cryptocurrency exchanges to increase liquidity, a downloadable trading platform to called XTRD Pro, and a centralized Dark Pool for turning crypto into fiat. With a more secure and concrete infrastructure, entities such as banks, hedge funds, and large institutional traders can easily access cryptocurrency markets.

ABOUT XTRD

As of January 2018, there are over 120 standalone cryptocurrency exchanges, facilitating trading in more than 1000 individual markets. Daily trading volume for cryptocurrencies is now equivalent to 20 billion USD, with a total market cap of over $700 billion. The majority of the trading is concentrated among the top 20 exchanges, denominated in multiple currencies ranging from crypto ones including Bitcoin and Ethereum to sovereign ones such as USD, GBP, JPY, CNY, and KRW, among others. Predictions point to growth toward a $1-2 trillion market capitalization in 2018, and a corresponding 3% average daily trading volume of $50 billion or more.

Asset managers are beginning to see increased demand for cryptocurrency exposure in their portfolios, over 500 active funds are being created to enter the market in 2018, and the regulatory climate is warming. However, the market is nascent, and large spreads are common between exchanges on the same crypto pairs, allowing for ample arbitrage opportunities that don’t exist in more efficient markets.

The inefficiency is a product of cryptocurrency trading markets being highly fractured in terms of execution, account setup, automated access, liquidity, execution speed, pricing, and security.

XTRD was created by finance and trading professionals to solve those problems by both improving on and consolidating current trading practices.

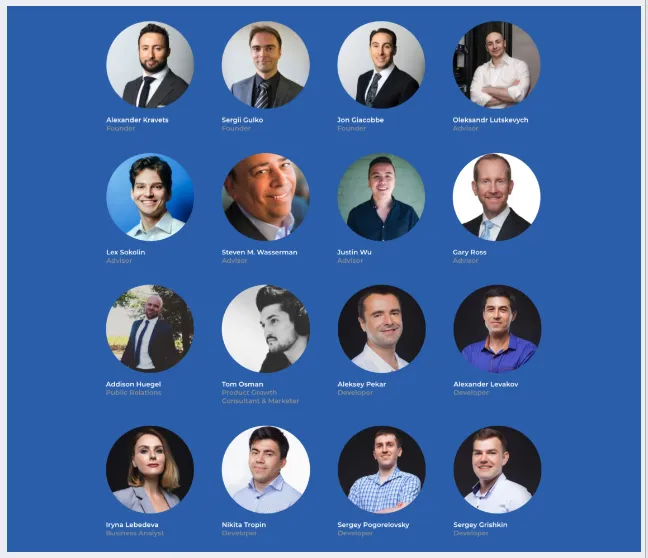

X TRADE (XTRD) TEAM

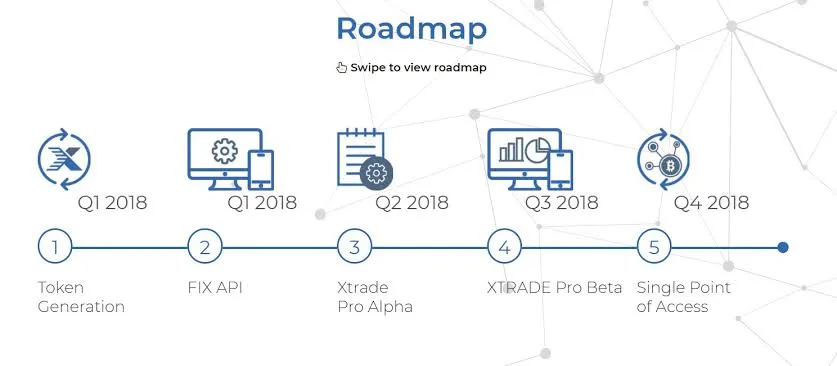

X TRADE (XTRD) ROADMAP

X TRADE INITIAL COIN OFFERING (ICO)

The ICO is a natural supplementary funding source to further accelerate the development and global adoption of the XTRD PLATFORM

TOKEN ANALYSIS

XTRD is an ERC-20 utility token used to access a crypto trading platform. This platform has been adapted from APIs used in traditional fintech markets. Xtrade aims to modernise the way we trade cryptocurrencies and open up the market to institutional investors.

•Token Symbol »» XTRD

•Price in ICO »» 1 XTRD = 0.1 USD

•Country »» Cayman Islands

•Whitelist/KYC »» KYC & Whitelist

For more information about this project, please! follow the links bellow » » »

⚡ XTRD Links:

★◽ White Paper: https://xtrd.io/xtrd_whitepaper.pdf

★◽ Twitter: https://twitter.com/xtradeio

★◽ Facebook: https://www.facebook.com/xtradeio/

★◽ LinkedIn: https://www.linkedin.com/company/18273025

★◽ Telegram Community: https://t.me/xtradecommunity

★◽ Telegram Announcements: https://t.me/xtradeannoucements

★◽ Bounty chat: https://t.me/Bounty_XTRADEIO

★◽ Medium: https://medium.com/@community.xtrd

★◽ Reddit: https://www.reddit.com/r/XtradeIO

★◽ YouTube: https://bit.ly/2sDQjfI

Website: http://xtrd.io/

BITCOINTALK PROFILE LINK: https://bitcointalk.org/index.php?action=profile;u=1907552;sa=summary