INTRODUCTION

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the Credit market.

The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: 1 USD is worth X CAD, or CHF, or JPY, etc.

The foreign exchange market works through financial institutions, and operates on several levels. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the "interbank market" (although a few insurance companies and other kinds of financial firms are involved). Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Because of the sovereignty issue when involving two currencies, Forex has little (if any) supervisory entity regulating its actions.

The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros, even though its income is in United States dollars. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies.

In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency.

The modern foreign exchange market began forming during the 1970s. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. Countries gradually switched to floating exchange rates from the previous exchange rate regime, which remained fixed per the Bretton Woods system.

The foreign exchange market is unique because of the following characteristics:

its huge trading volume, representing the largest asset class in the world leading to high liquidity;

its geographical dispersion;

its continuous operation: 24 hours a day except weekends, i.e., trading from 22:00 GMT on Sunday (Sydney) until 22:00 GMT Friday (New York);

the variety of factors that affect exchange rates;

the low margins of relative profit compared with other markets of fixed income; and

the use of leverage to enhance profit and loss margins and with respect to account size.

As such, it has been referred to as the market closest to the ideal of perfect competition, notwithstanding currency intervention by central banks.

According to the Bank for International Settlements, the preliminary global results from the 2016 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets Activity show that trading in foreign exchange markets averaged $5.09 trillion per day in April 2016. This is down from $5.4 trillion in April 2013 but up from $4.0 trillion in April 2010. Measured by value, foreign exchange swaps were traded more than any other instrument in April 2016, at $2.4 trillion per day, followed by spot trading at $1.7 trillion.

The $5.09 trillion break-down is as follows:

$1.654 trillion in spot transactions

$700 billion in outright forwards

$2.383 trillion in foreign exchange swaps

$96 billion currency swaps

$254 billion in options and other product

Today, I will be presenting you a particular project called: TIHOSAY

WHAT IS THE MAIN PURPOSE OF TIHOSAY PLATFORM?

TIHOSAY is the most advanced model of accessing and using the cryptocurrencies.

TIHOSAY is leading the cryptocurrency world into the future by solving a major issue for users: converting their cryptocurrencies into spendable capital. Using the TIHOSAY debit cards, consumers are able to seamlessly convert their cryptocurrencies to local fiat and withdraw from ATMs, or they can conveniently use their debit cards in store or online. Along with the ease-of-use associated with the TIHOSAY debit cards, consumers also possess other benefits. This includes an inheritance system that generates a unique code for listed heirs in the unfortunate event of a user’s passing. TIHOSAY has an established network of trusted merchants and affiliates to allow customers to confidently make purchases worldwide. All of these benefits, and many more, are available with industry leading low fees and are available by creating a TIHOSAY account. Join the revolution today and enjoy the monetary flexibility you deserve.

ABOUT TIHOSAY

It is aimed to increase shopping significantly by providing many advantages to merchants together with the general exchange users. You can use all services with a single TIHOSAY account. TIHOSAY EXCHANGE platform allows the conversion of cryptocurrencies to CASH.

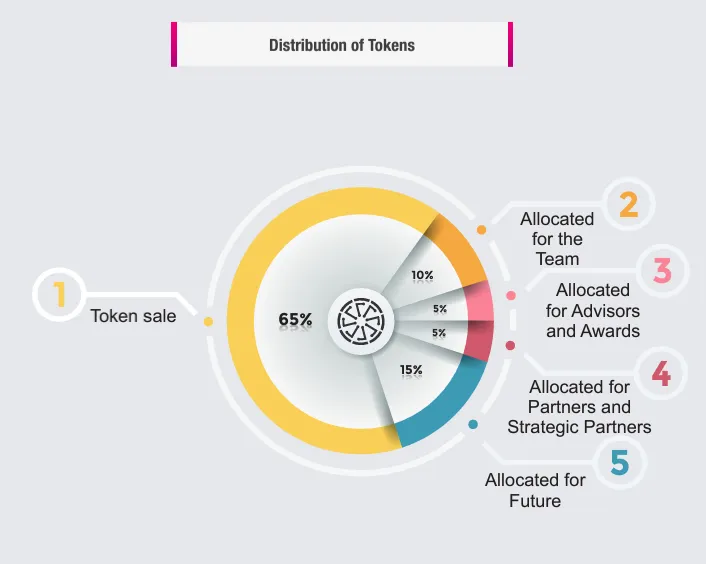

TIHOSAY is a project that creates its exchange marketplace and Visa debit cards. The project gathers all traders and customers together. An exchange chance is going to be given to traders for their digital resources without any kind of commission by giving free everyday exchange rights in TIHOSAY exchange. All the Visa debit card users can convert nine various cryptocurrencies to regional FIAT, to get cash and for purchasing goods. Distribution of tokens goes as follows: 65% goes to token sale; 15% goes to future projects; 10% goes to the team; 5% goes to advisers and awards; 5% goes to partners and strategic partners.

TEAM

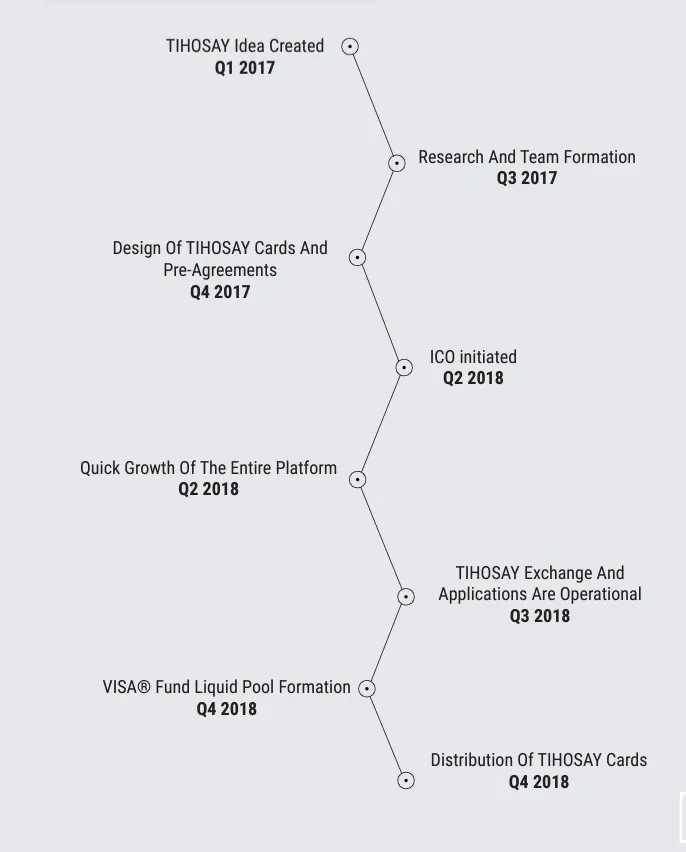

ROADMAP

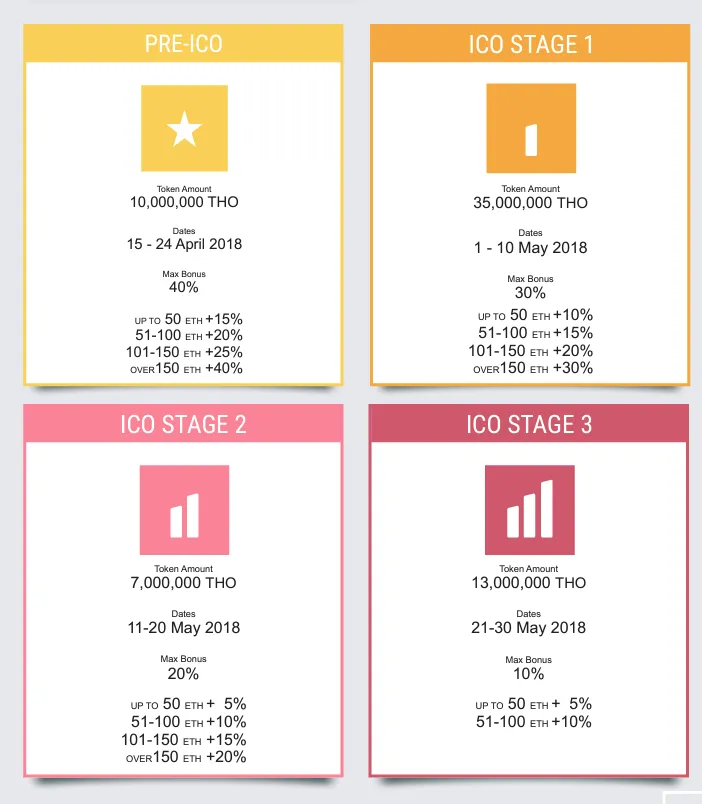

INITIAL COIN OFFERING (ICO)

The ICO is a natural supplementary funding source to further accelerate the development and global adoption of the TIHOSAY PLATFORM

ICO TOKEN ANALYSIS

•Token Name »» TIHOSAY

•Token Symbol: »» THO

•Total Supply: »» 100000000

•Rate: »» ETH 0.0013

For more information about this project, please! follow the links bellow » » »

WEBSITE: https://tihosay.io

WHITEPAPER: https://tihosay.io/assets/blockchain/layer/Tihosay-WP.pdf

BITCOINTALK BOUNTY TREAD: https://bitcointalk.org/index.php?topic=3101808.0

ETH address: 0xB9c38Dc1d4e7CaFe92F75C3a4f67745e5F9Cc401

BITCOINTALK PROFILE LINK: https://bitcointalk.org/index.php?action=profile;u=1907552;sa=summary