INTRODUCTION

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the Credit market.

The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: 1 USD is worth X CAD, or CHF, or JPY, etc.

The foreign exchange market works through financial institutions, and operates on several levels. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the "interbank market" (although a few insurance companies and other kinds of financial firms are involved). Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Because of the sovereignty issue when involving two currencies, Forex has little (if any) supervisory entity regulating its actions.

The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros, even though its income is in United States dollars. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies.

In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency.

The modern foreign exchange market began forming during the 1970s. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. Countries gradually switched to floating exchange rates from the previous exchange rate regime, which remained fixed per the Bretton Woods system.

The foreign exchange market is unique because of the following characteristics:

its huge trading volume, representing the largest asset class in the world leading to high liquidity;

its geographical dispersion;

its continuous operation: 24 hours a day except weekends, i.e., trading from 22:00 GMT on Sunday (Sydney) until 22:00 GMT Friday (New York);

the variety of factors that affect exchange rates;

the low margins of relative profit compared with other markets of fixed income; and

the use of leverage to enhance profit and loss margins and with respect to account size.

As such, it has been referred to as the market closest to the ideal of perfect competition, notwithstanding currency intervention by central banks.

According to the Bank for International Settlements, the preliminary global results from the 2016 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets Activity show that trading in foreign exchange markets averaged $5.09 trillion per day in April 2016. This is down from $5.4 trillion in April 2013 but up from $4.0 trillion in April 2010. Measured by value, foreign exchange swaps were traded more than any other instrument in April 2016, at $2.4 trillion per day, followed by spot trading at $1.7 trillion.

The $5.09 trillion break-down is as follows:

$1.654 trillion in spot transactions

$700 billion in outright forwards

$2.383 trillion in foreign exchange swaps

$96 billion currency swaps

$254 billion in options and other product

Today, I will be presenting you a particular undisputed project called: BITBOSE

WHAT IS BITBOSE?

Bitbose is the world’s first ever smartest crypto currency exchange which offers incredible opportunities for its investors in form of smart portfolio management, mining & trading solutions, fastest p2p transactions, ingenious fiat & smart crypto loans and emerging out be the first crypto smart bank in future.

Powered by Artificial Intelligence and Machine learning over a fully KYC/AML compliant Blockchain platform using advanced consensus protocol (DPOS), Bitbose is all set to create a benchmark in the history of crypto industry.

Backed with an ardent team of well known entrepreneurs and seasoned professionals, the credibility, reliability and trust comes by default. Our platform is designed in such a way that it promises excellent returns over time.

ABOUT BITBOSE

Bitbose completely understand the insecurities related to financial investments in the current market scenario. Heavy transaction fees, third party interference, low interest rates, poor liquidity and over dominance by banks & other financial institutions, are to name a few. The current market scenario is prone to fluctuations and hence, unpredictable.

The lack of modern technologies and obsolete approach towards all fiat-currency investment solutions is further leading to more dissatisfaction and lack of trust by the common man.

FEATURES

Crypto Bank

BitBose Platform mission is to create the decentralized complete bank solutions which will not just disrupt normal banking structure but also provide several investment opportunities based upon blockchain technologies.Portfolio Funds

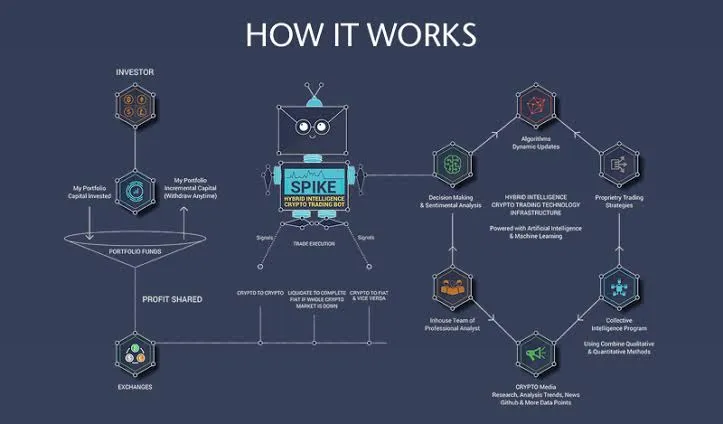

We are building a revolutionary Portfolio Funds Manager for all investors or traditional online traders that can make an easy leap into blockchain and crypto investors can utilize all their finanaces on the single platform & get their investment grow without worrying about market conditions. It is like a modern investment ecosystem which is backed by a Hybrid Intelligence Trading Bot known as PADDY.Crypto/Fiat Finance

BitBose's Crypto loans program offers users to be able to funds denominated in crypto/fiat by depositing their crypto assets to our secured platform for as a guarantee of good faith.PADDY - The Hybrid Intelligent Trading BoT

BitBose's Crypto Loans program offers users to be able to funds denominated in crypto/fiat by depositing their crypto assets to our secured platform for as a guarantee of good faith.

TEAM

ADVISORS

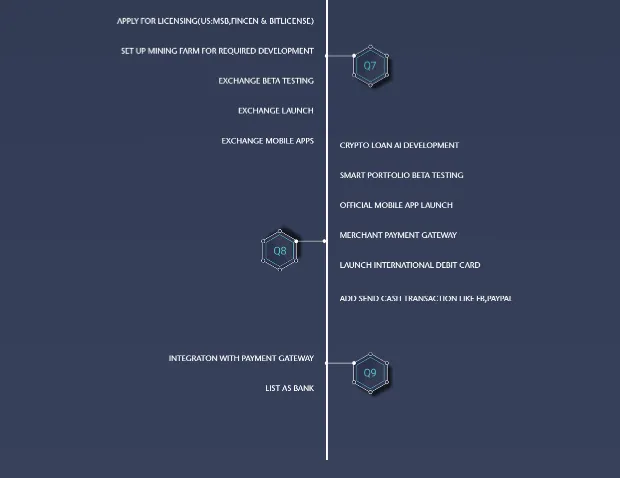

ROADMAP

The ICO is a natural supplementary funding source to further accelerate the development and global adoption of the BITBOSE PLATFORM

ICO ANALYSIS

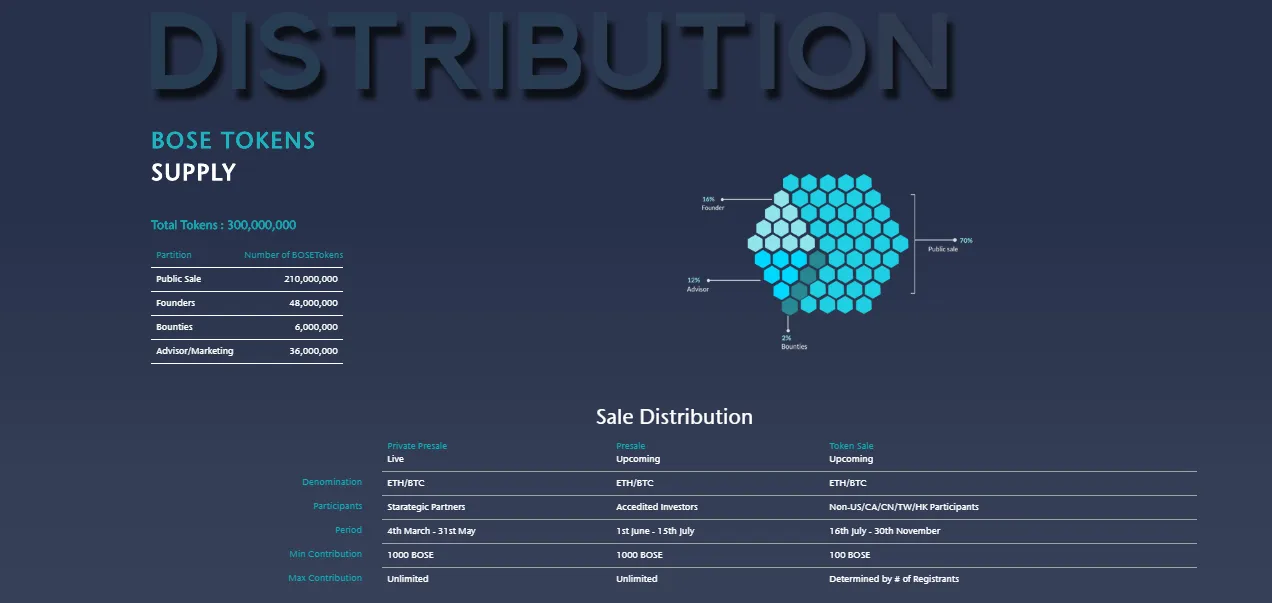

Pre-ICO

Start Date: 1st June, 2018

End Date: 15th July, 2018

ICO

Start Date: 16th July, 2018

End Date: 30th November, 2018

Total token supply: 300,000,000

Project Protocol: Ethereum

Total token supply: 300000000

Public Sale: 210,000,000

Founders: 48,000,000

Bounties: 6,000,000

Advisor/Marketing: 36,000,000

TOKEN ANALYSIS

•Token Symbol »» BOSE

•PreICO Price »» 1 BOSE = 0.25 USD

•Price 1BOSE »» 0.25 USD

•Bonus »» Available

•Platform »» Ethereum

•Accepting »» BTC, ETH

•Minimum investment »» 100 BOSE

•Soft cap »» 5,000,000 USD

•Hard cap »» 45,000,000 USD

•Country »» UK

•Whitelist/KYC »» KYC & Whitelist

For more information about this project, please! follow the link bellow » » »

WEBSITE: https://www.bitbose.com

Enjoyed the article? Please let me know by giving your vote or send a recommendation to a friend. Thank you!