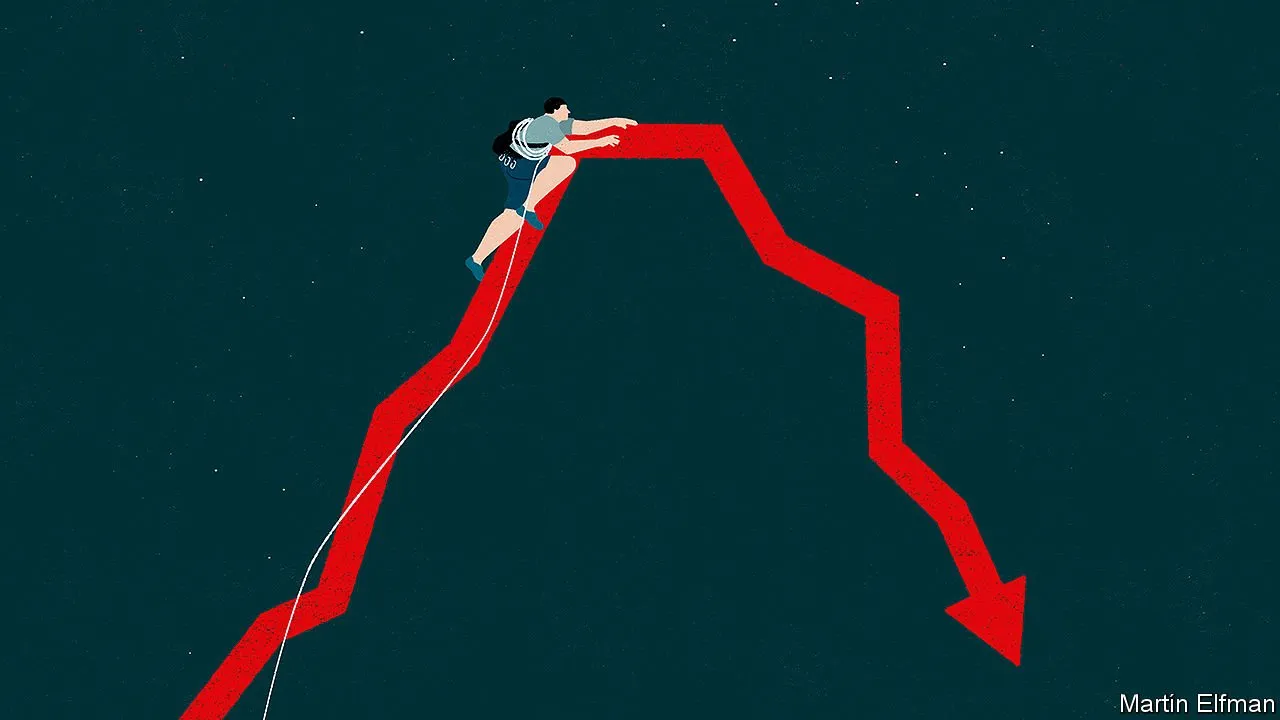

Emerging markets account for 59% of the world’s output (measured by purchasing power), up from 43% just two decades ago, when the Asian financial crisis hit. Their problems could soon wash back onto America’s shores, just as Uncle Sam’s domestic boom starts to peter out. The rest of the world could be in a worse state by then, too, if Italy’s budget difficulties do not abate or China suffers a sharp slowdown.

…the rich world in particular is ill-prepared to deal with even a mild recession. That is partly because the policy arsenal is still depleted from fighting the last downturn. In the past half-century, the Fed has typically cut interest rates by five or so percentage points in a downturn. Today it has less than half that room before it reaches zero; the euro zone and Japan have no room at all.

Policymakers have other options, of course. Central banks could use the now-familiar policy of quantitative easing (QE), the purchase of securities with newly created central-bank reserves. The efficacy of QE is debated, but if that does not work, they could try more radical, untested approaches, such as giving money directly to individuals.

Source of shared Link