An ICO tracker is an online platform where visitors can get information about completed, live, and upcoming crowdsales. Trackers help investors to estimate the prospects of projects and learn about the dates of the ICO. Trackers also provide the crowdfunding companies with an additional promotion tool.

Here you will find information on the particulars of trackers for ICO projects.

The minimum data placed by the company into a tracker includes a logo, an ICO and its date. For example, ICOcountdown is a tracker with the minimum data for every project.

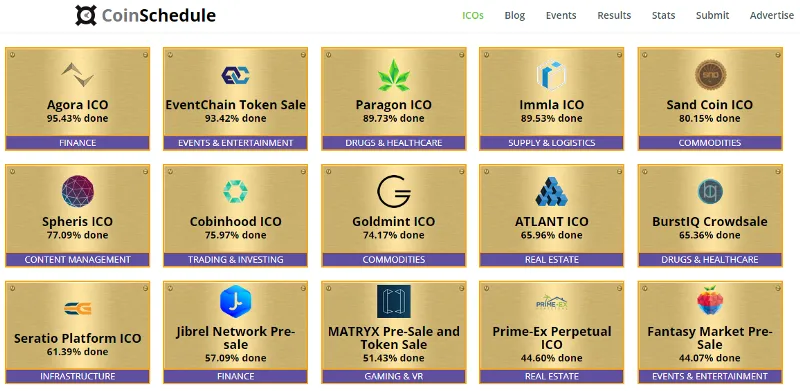

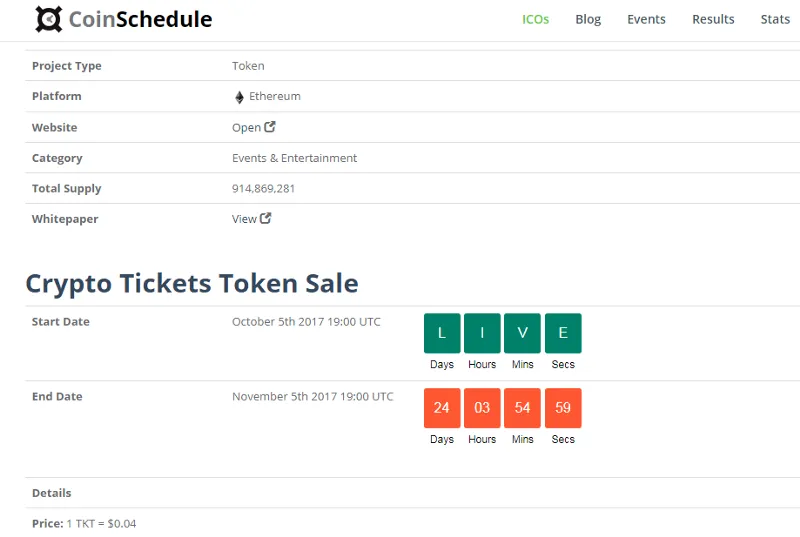

The majority of trackers also publish information about the company, the platform to issue tokens, planned investments, volumes of the raised funds and the crowdsale period. At the same time, every project must place links to the website, white papers, social networks, blogs, forums, and channels in messengers. Coinschedule is an example of a tracker that describes projects in more detail.

List of current ICOs

ICO card

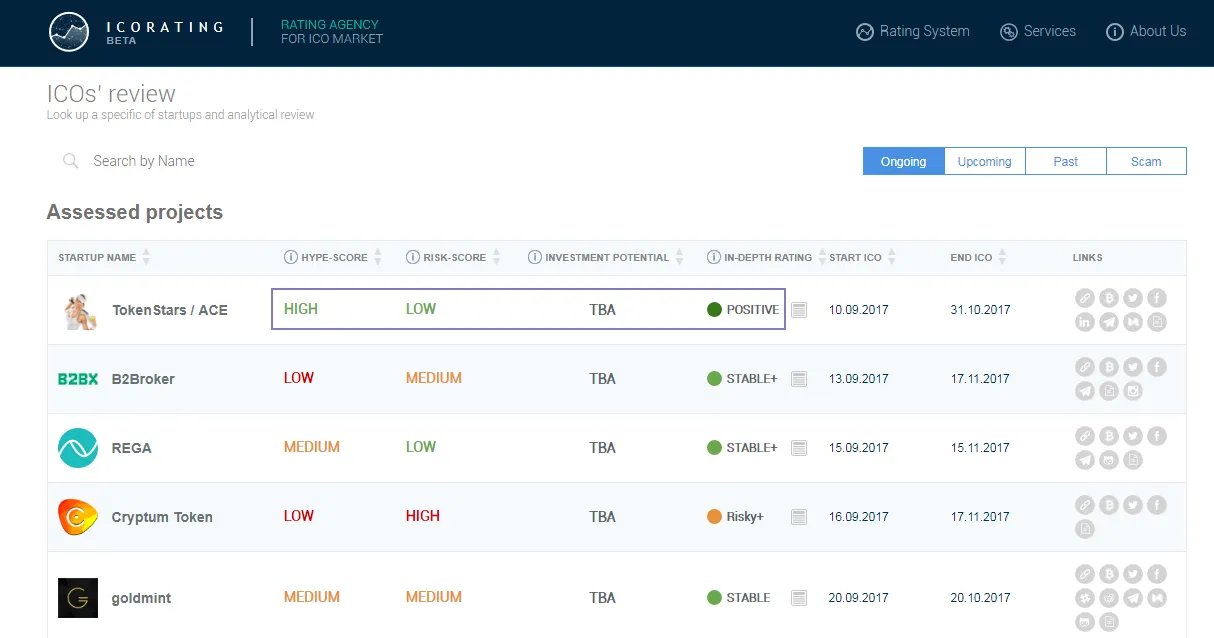

Some trackers like ICOrating take into account special indicators: rating of trust in the project, fraud risk, investment potential for long-term investments and even the hype level.

When placing a project on a tracker, it is necessary to fill out the form where, in addition to the above details, it is necessary to specify:

- Date and country of the legal entity’s registration,

- Minimum and maximum amount of investments from one ICO participant,

- Minimum and maximum amount of investments targeted by the project,

- Functionality, purpose and terms and conditions of tokens sale,

- List of guarantors of investments – escrow,

- Total number of tokens the project plans to issue,

- Number of tokens the project will sell during the ICO,

- Additional issue of tokens if planned,

- List of crypto currencies the project will accept during the ICO,

- Special requirements for investors (for example, the participation of US citizens in the ICO is not allowed),

- KYC and AML procedure when accepting funds from investors,

- Available or planned date of issuing a marginal viable product (MVP),

- Link to the project code on Github,

- License for software, for example, MIT, Apache 2.0, GNU 3.0,

- List of basic competitors, and

- Information about the target audience of the project.

Trackers are divided into free and those requiring a fee. To place info with a fee, it is necessary to pay on average from $200 to $1,000. Some trackers offer a bonus placement in the top positions of the general list of ICO campaigns. Such additional services may reach 1 BTC for the whole ICO period.

The team of Digital Finance has determined 29 trackers. We offer you a list sorted by number of unique users per month (according to SimilarWeb) in descending order:

- CoinGecko — 12,65 mln

- The Cointelegraph — 9,62 mln

- TokenMarket — 1,63 mln

- CoinSchedule — 1,13 mln

- Happy Coin Club — 673 thous.

- ICO Alert — 645 thous.

- ALLCOIN — 460 thous.

- ICO Tracker — 383 thous.

- ICOrating — 382 thous.

- Profitgid — 290 thous.

- Smith + Crown — 274 thous.

- ICObench — 224 thous.

- ICODrops — 181 thous.

- Coinhills — 167 thous.

- ICOcountdown —158 thous.

- Coin Spectator — 156 thous.

- ICO-list —136 thous.

- Token data — 126 thous.

- Cyber.fund — 125 thous.

- ICObazaar — 117 thous.

- Invest It In — 90 thous.

- Crypto Canucks —75 thous.

- Urban Crypto —31 thous.

- ICODaily —28 thous.

- 52ico — 8,3 thous.

- ICOchecker —6,6 thous.

- ICO DB — менее 5 thous.

- The Tokener —менее 5 thous.

- ICOINFO —менее 5 thous.

The Digital Finance team uses trackers when promoting most of the ICOs. The experience of promoting projects allows us to define which trackers are efficient and those that are inefficient. High platform traffic or including additional cost options does not always contribute to attracting members. If you are interested in the experience of Digital Finance in working with ICO trackers, please send us an email to: mail@df.agency

In spite of the opportunities presented by trackers, in order to successfully promote an ICO project, it is not enough to place info only on these platforms. Read about other methods of attracting crowdsale members in our next posts.