Ripple, a centralized cryptocurrency was the delight of many cryptocurrency investors towards the end of last year. The ROI on it was indeed incredible for most investors as it jumped from less than a dollar to more than $3.

It is in the news again but this time around for the wrong reasons. Many investors are saying its centralization may make it qualify as a security.

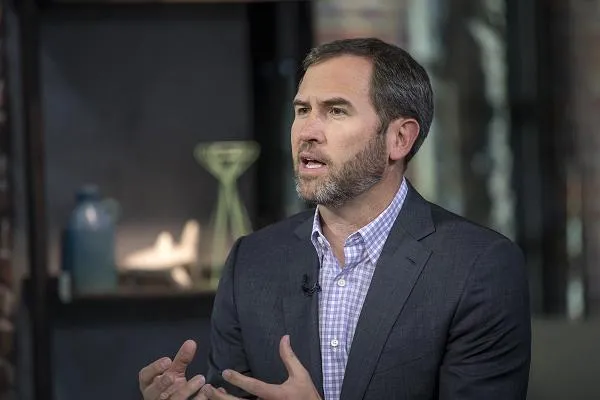

The centralization of Ripple and its gateway exchanges make it possible for the company and its executives to have enough power to either reverse or even freeze transactions. The company at the helms of affairs also owns a great deal of the currency with its CEO, Brad Garlinghouse taking major decisions like it is a quoted company.

Many sceptics believe that buying XRP simple means buying into the shares of Ripple as a company. Now here is the major problem; Exchange companies, although centralized themselves, do not want a centralized currency. We can see what happened recently with Binance delisting Centra from its list of cryptocurrencies. This was immediately after the arrest of the cofounder of the centralized cryptocurrency and an ongoing SEC's investigation into a security fraud. Regulation is what many of these exchanges are trying to avoid at all cost. As we know , security tokens are only allowed to be listed on exchanges that have the necessary licenses to sell them and they can only be sold to accredited investors.

It was in the news that out of desperation, Ripple executives offered coinbase a said amount of $1 Million for the cryptocurrency to be listed on the top exchange but this offer was rejected by coinbase. This is how serious is can get.

Let us know your opinion about how much of a security is Ripple and other centralized tokens. Share your thoughts in the comment section below. Cheers!