Hi Lydians 🦁

The launch date is approaching ⏰

Before the launch, we would like to explain some features that differentiate us from other similar platforms.

Lydia Finance is a customized fork of SushiSwap/PancakeSwap for Avalanche with some key differences.

Token production

We think block-based token production is not a good approach on Avalanche. Because it can work too fast. Block times may go under a second. Maybe less. And this may cause too much emission in a short while.

That's why we produce tokens based on timestamps. No matter the block number, 10 LYD tokens are produced per second.

Wait! Is it safe to rely on block timestamps?

On Ethereum no, On Avalanche YES!

Since miners can manipulate block timestamps, the usual way of measuring time in Solidity contracts on Ethereum is to use block height. See vulnerability details here.

On Avalanche, timestamps are guaranteed to be accurate to within 30s of the real-time and guaranteed to be increasing. This blog post explains the details.

Avalanche's guaranteed timestamps allow us more predictable token production and offer more accurate APY rates.

Configurable emission rate

updateEmissionRate function we added in our Croesus contract (aka MasterChef) allows us to update the emission rate.

We are starting as 10 LYD/sec and we are able to slow down token production in the future in case we need it.

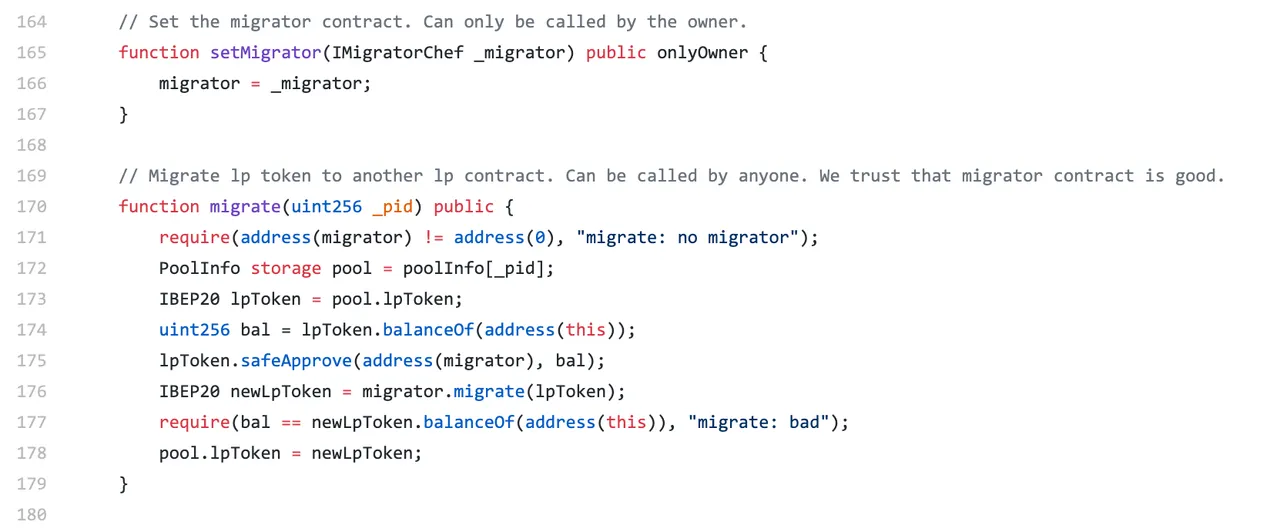

Deleted the rugpull migrator code

The code allowed SushiSwap/PancakeSwap to take all of your money within 6 hours of it being deposited in a vault.

We removed this code and our Croesus contract does not contain the 6-hour migrator function.

We are launching very soon. Don't forget to follow us on Twitter and stay up to date.

Join the discussion in our Telegram group.