Ends up in making you 2378 ETH profit as DegenSpartan on Twitter posts:

- borrow +7500 ETH

- -3518 ETH to buy sUSD from depot at $1

- deposit the sUSD into bzx as collateral

- -900 ETH bid up the value of sUSD through kyber

- borrow +6796 ETH from bzx

- repay -7500 ETH

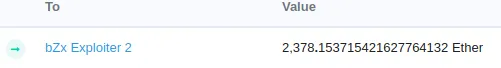

- profit 2378 ETH

Edited for better readability

Proof: https://etherscan.io/address/0x360f85f0b74326cddff33a812b05353bc537747b#internaltx

This is not an exploit or hack though. It's just clever usage of the underlying rules (which seem to be awful at bZx).

Also if you're in for some fun, read the thread on twitter, it has quite some interesting insights...