A lot of people in this space throw around the word centralized/decentralized like they know what they are talking about.

That's not decentralized!

That's centralized!

blah blah blah

Decentralization is such a relatively new concept it is often misinterpreted.

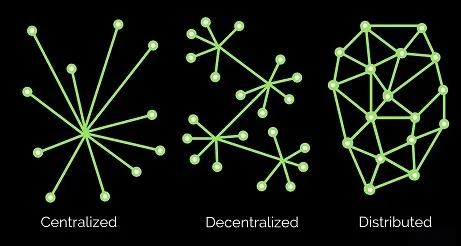

There is no such thing as centralized, and there is no such thing as decentralized.

These are just concepts that exist on a non-binary spectrum.

If the world was centralized, one person would be in control of everything. Not only is this not the case, it is an impossibility.

There was always a certain level of decentralization in the world,

long before crypto ever existed.

Look at the light spectrum above.

Can you imagine showing the color orange to someone and being told:

That's not blue! That's red!

---with such conviction

You'd think they'd lost their damn minds!

Yet this exactly what is happening when it comes to this issue.

Everyone seems to be "color" blind.

A better example might be showing many different colors to someone and having them tell you whether they are black or white.

These are not binary true/false type questions.

This issue is a very big problem with idealists.

As you can imagine, an idealist is looking for the ideal solution. Show them anything that isn't 100% decentralized and they are going to claim it's centralized garbage.

The problem with this ideology is that Bitcoin was never meant to be a good solution; it was only intended to be good enough to satisfy Byzantine fault tolerance. The Byzantine General's problem was published in 1982 and wasn't solved until 2009; no one was expecting the perfect answer to such a difficult problem.

In fact, if something was perfectly decentralized, you wouldn't even call it decentralized.

The word you'd be looking for is "distributed".

Example #1:

Mining Pools Are The Solution; Not The Problem

POW mining pools are a perfect example of what I'm talking about. Many idealist claim that mining pools have vastly centralized Bitcoin hashpower, and thus pose a threat to network security.

False

Decentralization has many drawbacks. Imagine you had enough mining equipment to generate $20,000 worth of income every year. That's a lot of mining equipment, and a good chunk of overhead cost for an individual hobbyist. Unfortunately, when we do the math, we see that if this person was trying to mine without help it would take them like three years on average to mine even a single block! This is absolutely unacceptable. Very few individuals would be willing to play in this lottery.

Mining pools solve this problem. By pooling all that hash power together everyone gets a much more consistent income. Does it centralize some hash power? Yes. However, that centralization is a good thing. It allows anyone to safely and consistently mine Bitcoin anytime they want. This consistency brings more miners into the network, increasing Bitcoin's overall hashpower and securing the network even more than it would have otherwise. What is seen by many as a threat to the network is actually securing it further. #irony

Worst case scenario

One of the mining pools acquires a majority share of hashpower (unlikely) and they start attacking the network with temporary forks and double spends (even more unlikely). This Web 3.0 crime is transparent and isn't going to go unnoticed by the network. The mining pool in question will lose all credibility and be immediately wiped off the face of the map.

The only ones left using that pool would be the ones trying to attack the network. This would not be nearly enough hashpower to attack the network again. So many other things would happen in the wake of this event.

The Bitcoin network knows how to defend itself. If that much isn't clear after being under constant attack for the last 11 years, I don't know what to say.

In the wake of a Bitcoin attack via mining pool.

The value of Bitcoin would go down, and the entire network would be pissed. Many miners would stop renting hash power. Many new mining pools would pop up as their demand would skyrocket. Many miners would be willing to sacrifice some (not all) of their income consistency in order to support the network. This is the push and pull of the spectrum.

That's what idealist don't get: We aren't even looking for a fully decentralized distributed solution. We are looking for the good-enough solution in the middle-ground that capitalizes on the best of both words.

What am I playing World of Warcraft again?

What about Chinese farmers?

Many people out there claim the security of Bitcoin is centralized to China or any big corporations that produce mining equipment. This is also false. Sure, any big breakthrough in mining is going to see that company capitalize and use it to generate income themselves before going public, but it doesn't matter.

Most of the energy lost from mining is heat, and I am on record multiple times stating I can't believe people haven't figured this out yet. The optimal solution to Bitcoin mining is to repurpose the heat being generated.

Do you remember all those times we were told that Bitcoin wasn't profitable to mine because the energy required to do so exceeded the reward? Yeah, well that's only true if all that free heat is being wasted.

It should boggle the mind that a hobbyist in say Canada could create a more efficient mining strategy than a full-fledged corporation. This would be unheard of in any other industry. However, all they have to do is use the excess heat to offset the cost of traditional heating. We are literally destroying energy on purpose to heat our homes with high-resistance coils rather than mining Bitcoin for-profit. Truly, we are still at the very beginning of this movement.

Example of how mining warehouses are doomed:

Because the demand for heat is decentralized this dynamic will allow for POW mining to also become far more decentralized via piggybacking. A person running a mining rig during cold weather will become far more efficient than any mining warehouse could ever hope to be. Because it is always cold somewhere in the world in many habitable locations, this implies that eventually these huge centralized operations will simply not be able to compete with the decentralized demand for cheap heat sources.

Hashpower will continue to rise as the common folk continue to offset their heating bill, while huge mining operations will be squeezed out forever. The only option left for corporations will be to sell mining equipment that also doubles as a heat source byproduct by design. This will likely allow power supplies to be lower quality and cheaper because users don't really care if it is that efficient or not. It will also allow miners to upgrade their equipment far less often, because again, they don't have to worry about efficiency nearly as much. They were going to use that heat regardless. Remember, traditional heating wastes 100% of the electricity and creates zero Bitcoin, leaving a lot of wiggle room for this economy to emerge.

POW VS DPOS

The more I think about it, the more I realize that DPOS consensus actually has a lot in common with POW consensus. Witnesses are the mining pools. They are the centralized link that give the network many advantages at the cost of sacrificing decentralization.

Just like we have to trust that mining pools will not become too powerful and attack the network, so to do we have to trust that witnesses will not become too powerful and attack the network. However, as we see with both mining pools and witnesses, this is not something to worry about, as those who attack the network are immediately crucified and cast out.

Advantages and Disadvantages

The biggest advantage of DPOS is that we only have to allocate 10% of our inflation to securing the network, unlike POW which uses 100% of that same inflation for similar security. However, this is a tough comparison to make considering the halving event and the fact that witnesses are voted in directly with stake.

Another huge advantage of DPOS is obviously scaling. Three second blocks, free transaction, blah blah blah. As with any of these trade-offs, the cost is usually security. Bitcoin has the ultimate security, and no other project is even attempting to compete.

Another reason why Bitcoin has the ultimate security besides dominating hashpower is the fact that it is so simple boring. The more complex and interesting a network becomes, the more attack vectors become available to bad actors.

However, we can view DPOS just like we can view mining pools themselves: this is all an attempt to find the middle-ground between centralization and decentralization in order to capitalize on the best of both worlds.

Biggest disadvantage of decentralization:

The ultimately biggest challenge faced by those in this space is a complete and utter lack of leadership and direction. Everyone is running in every direction at once. No one is working together. We saw this first hand during the #steemhostiletakeover. JSun's side stood on a united front while the Steem community was quite divided (but surprisingly not as much as you would think).

This is yet another advantage of DPOS. When the exchanges and the ninjamine attacked Steem, what did we do? We tried to fix the problem without forking time and time again, but we ultimately did fork, and when we did, we scooped the vast majority of the community. Other more decentralized chains would not have been able to accomplish this. Either they would have been slower to act or the community split would have been much more devastating.

Conclusion

Decentralization is a goal never to be reached. Truth be told, it is never a goal we want to reach. The only reason why cryptocurrency exists is a complete lack of trust in the world. The more trust we have, the less we need decentralization in the first place and the more efficiency and scaling we can gain from a lack thereof.

The world's need for decentralization will always be in constant flux depending on the demand of trust due to lack of supply. Decentralization exists on a spectrum and should never be something we strive to achieve no matter the cost. Often the cost is not worth the gain. Don't let anyone tell you otherwise.