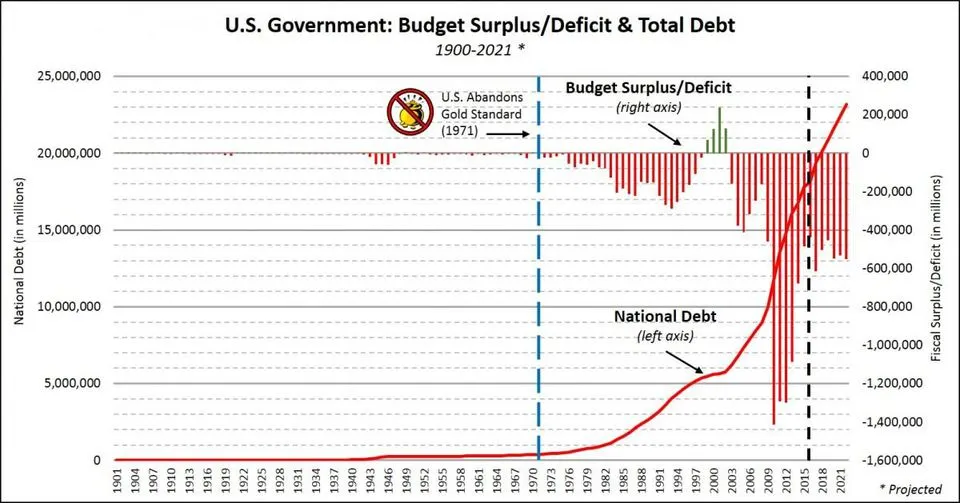

The national debt at the end of the last business day of the 2018 fiscal year, which ended on September 30, 2018 now sits at $21.5 trillion (this is the debt the government admits to). The national debt at the end of fiscal year 2017 was an estimated $20.25 trillion, yielding an increase of over $1.2 Trillion dollars in just one year.

That's an increase of almost $38,000 per second of money printing or about $8,200 per US worker (based on an estimate of 155MM people with jobs in the US).

Over the fiscal year, the gross national debt increased by 6.3% and now amounts to 105.4% of current-dollar GDP.

All of this is enabled by abandoning a hard money standard and printing money at will. Its no coincidence the timing of the exponential increase in debt all started when the US de-pegged the dollar from the last remnants of a Gold Standard in 1971.

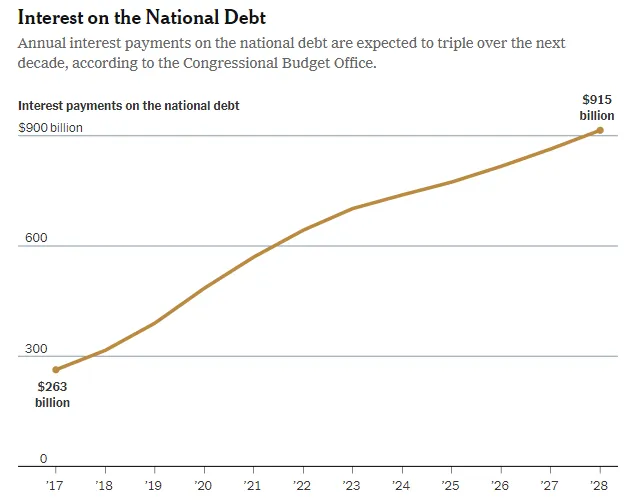

Remember, these are supposedly "Boom Times" for America and the world economy and they have lasted for 10 years. What is going to happen to when a real recession hits? I can tell you it is not going to be good. Spending is going to increase and tax receipts are going to drop rapidly.

...and these Interest payment estimates are going to come up short..."Biggly".

Meanwhile the stock market is making new highs and the Dow just hit a new intra-day record...nothing to see here, move along.

Get your financial insurance now while you can on the cheap and eliminate as much of your debt as you can. Plan for the worse and hope for the best.

To invest in Mene24k Gold Jewerly click Here

To open your own BitShares account, click Here

To open your own Binance account, click Here