INTRODUCTION:

Accelerating digitalization and a decentralized quicker Internet communication speeds, permanent accrual of circulated computing assets, the function of mathematic and cryptographic technologies in the digital epoch: these are the factors to facilitate and guide us to anticipate that in the prospect, we will see an essential public chain based on the features of Blockchain (including but not restricted to: decentralization, honesty, sovereignty, irreversibility, and seclusion fortification). The essential municipal chain will be utilized for circulated credit treatment, liability listing, assets board, and benefit transactions. It will facilitate commerce participants in diverse countries and regions just about the globe to offer monetary services in a great deal extra suitable way. A fresh sort of implicit charity based on blockchain technology—"Distributed Banking"— will surface. A Distributed Bank is not a traditional bank, but rather an incorporated ecology of distributed financial services.

Traditional Credit Businesses:

Description of credit business: a credit commotion in which the proprietor of assured legal tender positions momentarily lends an agreed-upon sum of cash at an agreed-upon concentration velocity to a borrower, who repays the main and concern according to the stipulations and epoch as arranged. As one of the majority vital actions in the monetary market, its methodical management has a gigantic encouraging collision on the advance of society.

Centralized Credit Service:

Enchanting the disinterested party that makes available credit services as examples, lots of credit agencies are stuck in a dreadful catastrophe. Numerous online credit agencies, taking benefit in sequence asymmetry, have turn out to be a federal profiteer industry. Wherever does their enormous income come from? Data tells us that the maximum percentage of their earnings comes from curiosity multiply. The centralized credit mock-up gives such centers monopolistic compensation monopoly. Suitable in sequence asymmetry, the giver and collector misplace straight trading opportunities. Consequently, people are viewed regarding likelihood for credit service devoid of a multiply finished by disinterested party, which would permit lenders, borrowers, risk control models, collection offices, and insurance institutions to participate together. In such service, lenders and borrowers would be able to achieve debit -credit balance based on consensus and for the purpose of service.

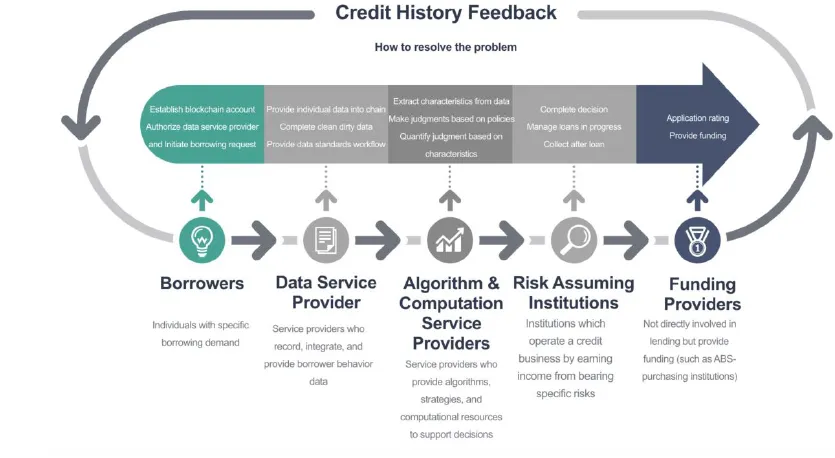

How Distributed Credit Solves the Centralized Credit Problem:

User Account Identification System:

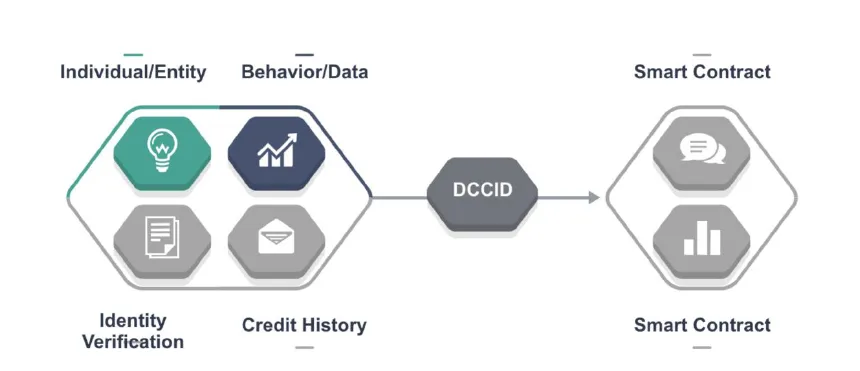

In DCC, every personality or organization has one DCCID generated during Public-Private Key Pair to structure an address. This address stands just like an associate ID in an established Internet system, identifying and associating a variety of real-world attributes (such as real-name verification, bank cards held, number of assets owned) and in sequence on the credit chain—a loan demand, loan, refund, etc .

DCC took the responsibility of providing an unlock basis individual credit data management framework-DCDMF (Distributed Credit Data Management Framework) which is supported by a detailed obscure storage space provider, and developers, are able to fast recreate users' personal credit reporting data using DCDMF based on their APP development needs. Users having a DCCID can exchange data in several APPs which use DCDMF by exporting their wallet addresses.

DCC-Valuation Credentials of Ecosystem:

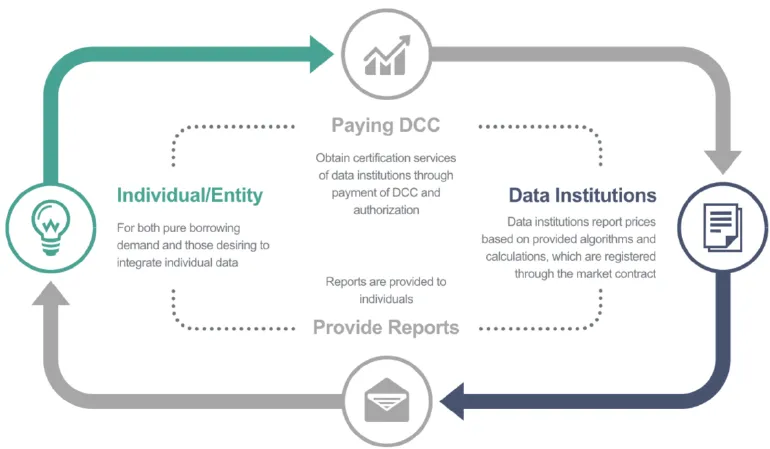

DCC is the documentation used to pay for jobs in the Distributed Credit Chain. Several work in the DCC requirements to be paid for with DCC. DCC balance is managed through DCC token contract to maintain a fixed total amount of DCC. As the financial service system in the DCC grows, more and more distributed business scenarios are embedded and used more frequently, which greatly increases the liquidity.

DCC's payment is handled based on the DCC payment contract, which is responsible for the DCC payment rules for multi-payer participation.

Benefits of Ecosystem Contribution

Use of DCC in Distributed Credit Chain

Reconstructing Credit Cost with DCC

FOR Further Information Visit

Official website - http://dcc.finance

Whitepaper - http://dcc.finance/file/DCCwhitepaper.pdf

Facebook - https://www.facebook.com/DccOfficial2018/

Twitter - https://twitter.com/DccOfficial2018/

Telegram - https://t.me/DccOfficial

Authorized by

Luckyji

https://bitcointalk.org/index.php?action=profile;u=1754163