Fake News: Read the original on Brave New Blockchain

Still, what can we assume Jordan Peterson thinks about cryptocurrency?

The main tenets of Jordan Peterson's books and lectures boil down to: Take responsibility for yourself and stop being pathetic. His 12 Rules for Life are:

Rule 1 Stand up straight with your shoulders back

Rule 2 Treat yourself like you would someone you are responsible for helping

Rule 3 Make friends with people who want the best for you

Rule 4 Compare yourself with who you were yesterday, not with who someone else is today

Rule 5 Do not let your children do anything that makes you dislike them

Rule 6 Set your house in perfect order before you criticise the world

Rule 7 Pursue what is meaningful (not what is expedient)

Rule 8 Tell the truth – or, at least, don’t lie***** (Take note, Coinfirm)

Rule 9 Assume that the person you are listening to might know something you don’t

Rule 10 Be precise in your speech

Rule 11 Do not bother children when they are skate-boarding

Rule 12 Pet a cat when you encounter one on the street

None of them seem to give us any eye-opening insight into what he might think about cryptocurrency, except, perhaps Rule 7: "Purse what is meaningful, not what is expedient." I searched through that chapter to find something that might relate to the adoption of crypto:

"Consider then that the alleviation of unnecessary pain and suffering is a good. Make that an axiom: to the best of my ability I will act in a manner that leads to the alleviation of unnecessary pain and suffering. You have now placed at the pinnacle of your moral hierarchy a set of presuppositions and actions aimed at the betterment of Being. Why? Because we know the alternative. The alternative was the twentieth century. The alternative was so close to Hell that the difference is not worth discussing. And the opposite of Hell is Heaven. To place the alleviation of unnecessary pain and suffering at the pinnacle of your hierarchy of value is to work to bring about the Kingdom of God on Earth. That's a state, and a state of mind, at the same time."

In the above passage, if you replace "the twentieth century" with "the 2008 financial crisis," I think you can see how Jordan Peterson is likely in support of a system where massive banking fraud is nigh-impossible, as long as you personally believe that a world without Wall Street is one that minimizes suffering and benefits you and your loved ones.

But if you're one of those people who's just in crypto for the money (and there's a new trend on r/bitcoin and r/cryptocurrency that it's "impossible" to not be in crypto for the money, even though -- as far as I remember -- that trend didn't exist until the most recent boom), reconsider crypto's position in your personal dominance hierarchy.

Here's Why

I'm in the realm of thought that no debt is good debt. Honestly, I don't even trust mortgage debt (as unavoidable as it is). My reasoning is simple: It's impossible to spend money that you don't have. On the surface, that doesn't seem to make a whole lot of sense. Money, at its most basic, isn't anything other than a social contract ("I own this and this is as good as my word"); and credit is nothing other than an extended social contract ("my word is just as valuable as this; so take my word that I will give you this in the future"). The problem is that huge financial systems take advantage of the disparity between a person's self-perception of their word and the actual value of their word. Much like how people are actually less attractive than they think, people are also much worse at generating income and paying back debt than they think. That's the only reason credit card companies are profitable; they make you think you're boring for not spending money for a backstage pass to an Alicia Keys concert, and then they penalize you for spending too much. In short, easy money will eventually lead to widespread financial collapse, just like it did in 2008.

A more complicated and more reasonable rationale would include these main talking points:

- Every modern government's economic policy is convoluted to the point of incomprehensibility, even by the most intelligent and skilled experts.

- Zimbabwe and Venezuela have suffered from such high rates of inflation that their governments don't even release economic data anymore. This puts any citizen of those governments in the strangle-holds of their corrupt leaders, through no fault of their own.

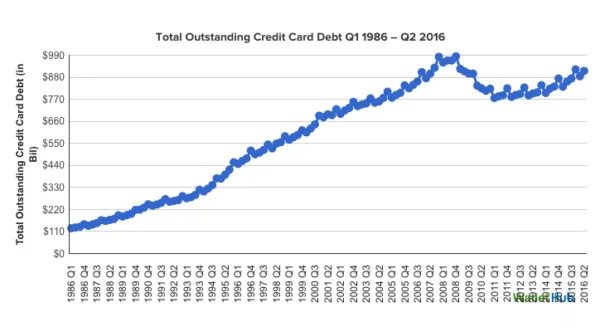

- As I mentioned, capitalist nations -- America in particular -- is/are full of "temporarily embarrassed millionaires," a self-delusion that's infinitely exacerbated by the universality of credit card use. A minority of people, when it comes to personal finance, are the walking, talking epitome of the Dunning-Kruger Effect. Take this chart made from WalletHub data as an example:

- Furthermore, to expand on that Dunning-Kruger claim, the type of person who's perpetually in debt is really just a freeloader. When you buy something with credit, you're essentially saying, "I don't have the means to buy this now, but I'm going to buy it anyway." And, when you're always in debt, society is saying (harshly, given 25% interest rates on a lot of credit cards), "you don't have the means to buy this at all; in fact, you don't even have the means to continue your current lifestyle. We're going to penalize you until you stop." (This sounds arrogant, so I should note: Not everyone who's in debt is in debt because of consumer spending. I'd wager that it's oftentimes the result of a loved one's medical bills, but the point unfortunately still stands. Society, if it isn't already obvious, doesn't really give a shit that your grandpa has lung cancer.) In today's financial world, freeloaders -- even the well-intentioned kind -- are given too much influence. They will eventually cause the whole system to topple.

*That's only talking about private debt, which pales in comparison to the US government's national debt, now at $20.8 trillion and climbing.

*Governments can't go on printing money indefinitely to get rid of their ever-expanding debt load. It doesn't make financial sense and it doesn't make practical sense.

When the system collapses, just like it did in 2008, the corporate bigwigs and government bureaucrats won't lose their houses. They won't miss a meal. Their extended family won't have to move in with them. They won't be eating peanut butter out of a jar with a plastic spoon. They won't be washing themselves with handsoap in public bathrooms to get ready for a minimum-wage job interview.

They'll funnel money from their off-shore accounts. They'll tax the common man even more to pay for their private jet flights to the country club. They'll bump down from a five-star to a four-star restaurant; they'll even make a couple trips to Olive Garden. They'll sell a couple houses as the market collapses just to free up some liquid capital to buy more expensive ones.

I'll never live like that, but when shit hits the fan I want the option of opting-out of the system that I know is designed to fuck me. That's why crypto is so important, and that's why you should recognize its importance.