Neo Approaches Record High But Centralization Concerns Persist

The Neo Kid on the Blockchain

Also Read : Review: Indians See Brighter Crypto Future than Americans

Also Read : Review: Indians See Brighter Crypto Future than Americans

On the off chance that 2017's crowdsales were about Ethereum, 2018 is turning out to be the time of Neo. The Asian brilliant contract stage has some approach before it can coordinate the exchange volume, showcase top, or number of ICOs as Ethereum. However, in the event that buildup is any mediator of things to come, Neo is on course to possess 2018. The greatest token age occasions this month have all been on the Neo blockchain, with tokens offering out in record time.

The Key brought $22 million up in minutes, and undertakings, for example, Aphelion – a Neo P2P DEX – and Deepbrain – an AI stage – have additionally announced record take-up. Despite everything others to come incorporate Zeepin, Narrative, and Apex, the last bragging one of the biggest crypto Telegram gatherings and ensured to hit its $25m top. At first glance, everything is going easily, yet underneath the waters the great ship Neo is cruising on, inconvenience might blend.

Who Controls Neo?

Da Hongfei, Neo's CEO, is a man of few words and even less tweets. Binance CEO Changpeng Zhao is chatty, affable, and congenial; Hongfei, then again, is a puzzle. The whole Neo group aren't known for their informative abilities, liking to give their group a chance to do the talking. One explanation behind this might be the unverifiable administrative condition in China. Like other crypto organizations that started in the nation, Neo is obliged to keep government authorities onside, as it strolls a sensitive tightrope, adjusting its objectives with its lawful commitments. The center group has since moved, however Neo holds close ties with its nation of birthplace.

One of the greatest concerns with respect to Neo, and in fact numerous other digital currency ventures, is the level of centralization. Ethereum, in spite of its "solid pioneer" incapacitate, is in any event decentralized regarding the hubs that safe the system, as a current report has appeared. With the dominant part of Neo hubs controlled by the venture's inward circle, the blockchain is helpless to impedance, either straightforwardly or at the say-so of government authorities. Its Github likewise just has one branch.

Heaps of Nodes (Just Not for Neo)

In its December month to month report, the Neo board talked about plans to decentralize the system, clarifying: "We need to have no less than 3 hubs keep running by outside gatherings… The underlying period of decentralization is arranged as takes after: 2 hubs will be controlled by City of Zion. 1 hub will be controlled by the group and will be group financed (autonomous of CoZ). 2 hubs will be controlled by institutional revenue driven organizations with blockchain intrigue. 2 hubs will be controlled by the NEO Council."

In the same way as other blockchains, Neo is by all accounts attempting to a "future decentralization" demonstrate: get things up and running first and afterward, once the getting teeth issues have been resolved, decentralize. Awesome on the off chance that it works, however as history appears, control, once picked up, is difficult to give up. Bitcoin and Ethereum have more than 30,000 all inclusive conveyed hubs between them; the quantity of authority Neo hubs is under 10. The Neo blockchain is quick and has high throughput, yet speed is of little advantage on the off chance that it comes to the detriment of security. Talking about security…

Security or Utility?

One of the best difficulties Neo may look in 2018 stems from a land past its achieve: the USA. The Chinese blockchain needn't bother with America's favoring to work, yet with the US commanding the crypto advertise, Neo's nonattendance would be a noteworthy hit to Da Hongfei's gets ready for worldwide control. With Bitfinex having shut its ways to US occupants, the quantity of authorized trades where US dealers can purchase Neo is as of now constrained. The token is at present accessible on Bittrex, yet gossipy tidbits recommend the US trade might be ready to delist Neo.

Stores and withdrawals of Neo have been inaccessible at Bittrex for a month, and the trade as of late delisted another token, Mysterium, for no obvious reason. With the Securities and Exchange commission taking a gander at tokens that may constitute securities, it is suspected that Bittrex might evacuate security-like tokens to take off a SEC clampdown.

Neo token holders are paid Gas as a profit, and keeping in mind that the vast majority wouldn't see this as a benefit share, the SEC may see things in an unexpected way. The way things are, Bittrex doesn't pay out Gas to token holders therefore, while Binance does. Regardless of whether Neo can disregard issues on outside soil, it is a prime focus for direction should China or South Korea come employing the hatchet. Delisting from Upbit or Okex would be a noteworthy blow.

Written falsification and Fake Goods

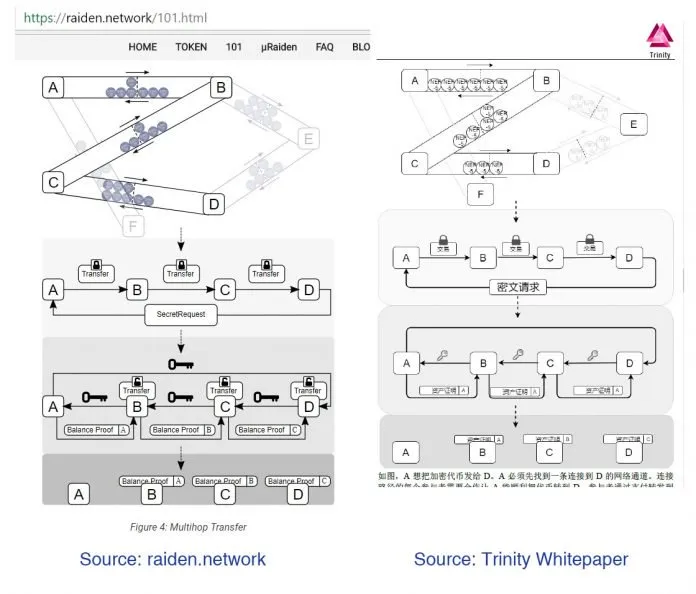

The worldwide forging economy is esteemed at a large portion of a trillion dollars every year, with the main part of those phony products originating from China. The blockchain space isn't safe from allegations of duplicating either, with China representing what's coming to its of imitators. There's Tron for instance, drove by Justin Sun, which was appeared to have replicated whole pieces of its white paper. At that point there's Trinity, an undertaking working on the Neo blockchain, which has replicated its state channel outlines specifically from Raiden. This plagiary isn't the doing of Neo – nor is it constrained to Asia – yet it indicates that the crypto activities to rise up out of this piece of the world merit investigation.

In the event that Neo can beat its centralization issues, and the ICOs it dispatches can include esteem and not vaporware, there is each probability that the venture will prosper. Numerous financial specialists however observe potential obstacles, from the US to China, at each bend and turn. As the coin keeps on ascending in esteem, one of the greatest impediments it might confront is a calculated one.

Not at all like different cryptographic forms of money, neo is indissoluble. You can purchase a small amount of a neo on a trade yet you can just send entire units between wallets. Should the token ever achieve an indistinguishable kind of valuation from ethereum, this could introduce a noteworthy issue. Hodlers with a large portion of a neo on a trade would then be looked with a situation: offer it or spend another $500 just to have the capacity to pull back.

How would you rate the Neo stage? Do you believe it's excessively brought together? Tell us in the remarks segment beneath.

Source

All in all, what do you consider this? Just offer your perspectives and considerations in the remark area beneath.

Upvote For More Details >>> @wahabali