Doesn’t it strike you as odd that one of the largest and highly saturated global industries such as banking hasn’t undergone any disruptive innovation over the last couple of decades? At the rate of change we’re currently living in, it sure does raise an eyebrow or two. Ever since the world got the ‘gift’ of credit cards, the typical banking experience has stayed pretty much the same.

In Europe, the situation is about to change radically thanks to the liberation of European banking market also known as Open Banking. It’s the result of long-lasting European Union efforts to create a unified payment area where all local and international non-cash transactions are made as easily as within national borders and at standardized rates.

These efforts evolved into a two-fold legislation by the names of Payment Services Directive 1 (PSD1) and Payment Services Directive 2 (PSD2), latter of which just came into enforcement in January.

In parallel, UK’s authorities have created Open Banking Working Group (OBWG) in September of 2016 to propel the creation of a framework how financial data should be created and transmitted. A couple of months later, OBWG published their work paper The Open Banking Standard which escalated the term in the financial world.

WHAT IS OPEN BANKING?

In essence, Open Banking is a set of rules which allows the user access information from varying financial institutions (banks, payment service providers, insurance companies and etc.) through application programming interfaces (APIs).

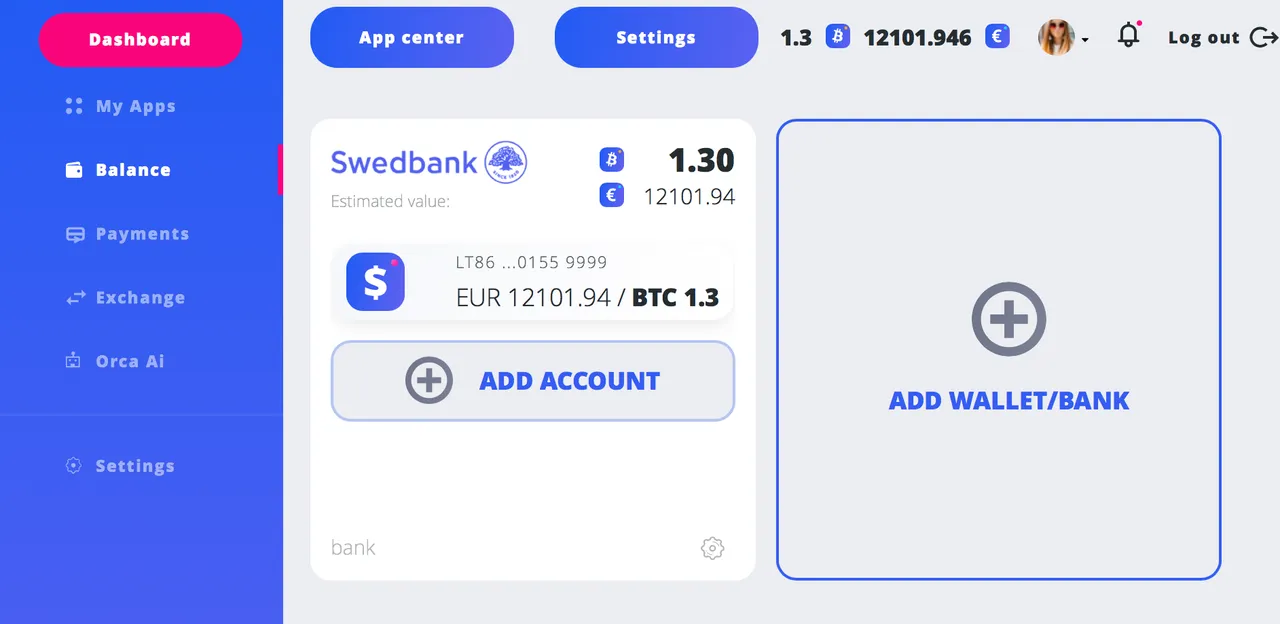

To put it in human terms, no matter how many accounts you have in different banks, you’ll be able to access them all in one place. Even more convenient is the fact that switching from one provider to another, opening/closing of accounts, payment initiation will be as easy as winking. Customers will be able to make informed choices from publicly available market data.

On the business side, adaptable start-ups will get access to client data and start offering banking services. The trick is, these lean start-ups will not have to put up with heavy legal regulation or capital requirements typically compulsory for the banks. And that’s a real game-changer moving from a closed system in the direction of “bank as a platform” model.

Instead of relying heavily upon the centralized data storage of separate banks, Open Banking is shifting the load on API networks and will kick off a wide array of business opportunities. Clients will be able to get insights into their spending habits and get personalized suggestions how to improve. And that’s only breadcrumbs of what’s to come.

Instead of relying heavily upon the centralized data storage of separate banks, Open Banking is shifting the load on API networks and will kick off a wide array of business opportunities. Clients will be able to get insights into their spending habits and get personalized suggestions how to improve. And that’s only breadcrumbs of what’s to come.

"The money revolution nobody knows about" - Independent.co.uk

ARE WE READY?

No surprise that the banks are not overly keen to jump on the bandwagon. According to PwC report published in H2 2017, 70% of 39 interviewed bank representatives reported that PSD2 is going to affect all bank functions.

On the other hand, only 9% of banks were in API protocol implementation phase at the time of interviews. Interviews were conducted during the period of April — July 2017.

Open Banking train is leaving in Europe and sooner or later, everyone will have to play ball.

“Open Banking is the biggest change to the system since the invention of the checkbook” — A. Lockhart head of Open Banking and Fintech Solutions at RBS.

WHY ORCA?

ORCA is creating an Open Banking platform to be at the forefront of disruption. To make a good deal even better, ORCA is building the first Open Banking platform designed for cryptocurrency users. All your financial data — savings, deposits, insurance, car or equipment leases, mortgages, loans and crypto holdings are going to be within a hand’s reach.

No more waiting in hopeless uncertainty to convert from traditional currencies to crypto. No more managing gazillion of different logins and passwords. No more unfair conversion fees. No more frustration searching for the most efficient and reliable service providers.

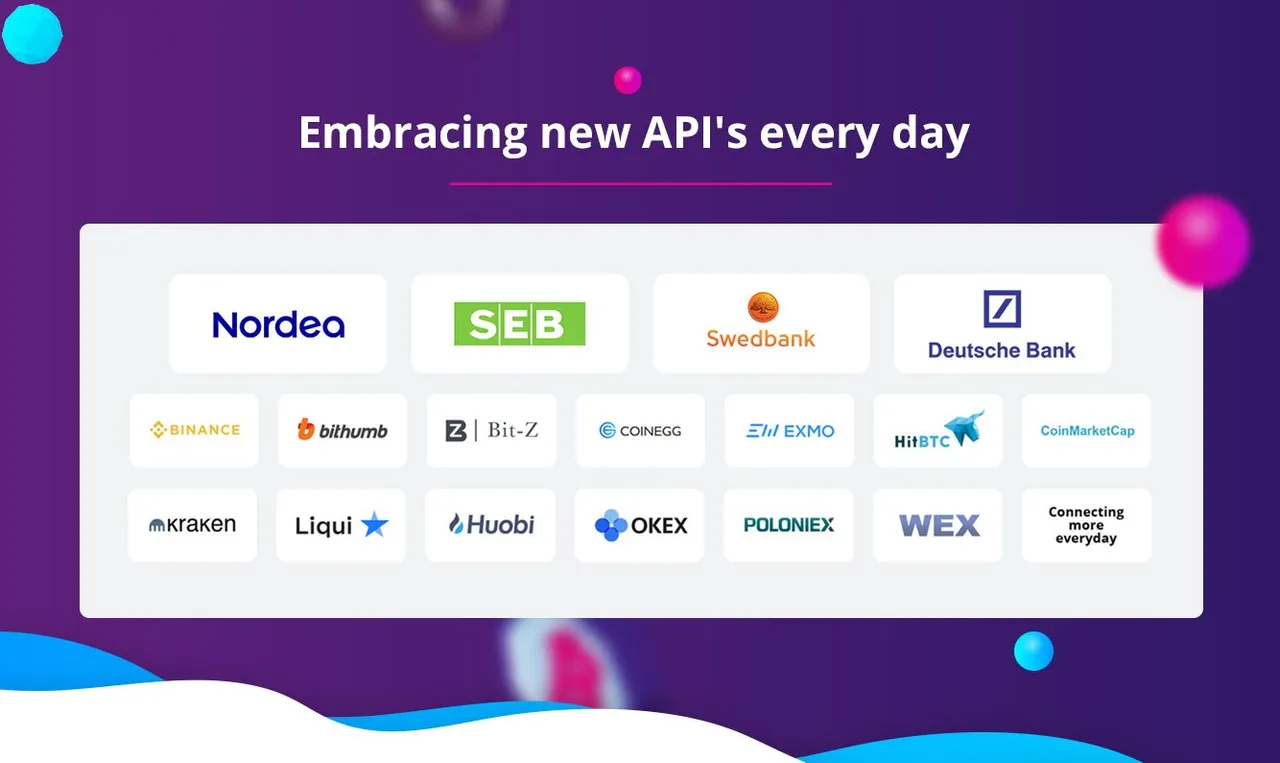

ORCA’s Open Banking platform is putting all of the aforementioned problems behind you. We already have a DEMO version available for inspection. Our developer team is working non-stop and have established working API connections with 4 commercial banks and 12 largest crypto exchanges.

Moreover, ORCA is being backed by 2 investment funds which offer monetary and strategic support for the project. Open Banking is not a dream anymore, it’s a reality. Come and join the revolution.

ORCA Alliance public token sale starts on April 16th. Visit our official website to reserve your seat on the ORCA journey.

At ORCA we are operating in the private presale phase. Any interested parties are welcome to contact our investor relations team at vb@orcaalliance.eu | laurent@orcaalliance.eu.

Do not fail to follow ORCA on social media and join our rapidly growing community in Telegram.

Website | Twitter || Facebook | LinkedIn |