During the last issue, we discussed both how to trade during a price correction for profit, and how to use Bollinger Bands to identify entry and exit points. https://steemit.com/cryptocurrency/@vanessav/from-normie-to-competent-crypto-scalper-scalping-a-downtrend Any feedback or has anyone added that to their indicators?

Today, we can get into how to use the STOCHASTIC Relative Support Index to assess whether prices are going up or coming down. We can also use Stoch RSI setups that should lead to some good scalping.

In short, this support oscillator was invented in the 50s, and I use it to assess whether a coin is undersold, overbought and everywhere in between.......and which way it is headed. "Stochastics measures the momentum of price. If you visualize a rocket going up in the air – before it can turn down, it must slow down. Momentum always changes direction before price." Here is a little more info you can check out now or afterwards as you learn more before putting it to the test:

- Babypips intro and strategy - https://www.babypips.com/learn/forex/stochastic

- Stochastic Divergence with Daytrader Rockstar (http://www.daytradingradio.com/) video tutorial

- You know how I love my New Yorkers and this guy makes it look easy.

- You know how I love my New Yorkers and this guy makes it look easy.

Here is an hourly chart for ETC without the STOCH RSI indicator. Hindsight is 20/20 but here are a few typical thoughts watching that and wondering where to buy in and when to sell.

Now, if we add STOCH RSI, we can see that the price generally follows the ups and downs of the STOCH wave and gets distorted a bit when the volume goes nuts. But there are setups. The best ones are the Divergences. Here is the same ETC chart with a couple more general divergences that could have reduced losses in the dip, and maximized profit in the pump.

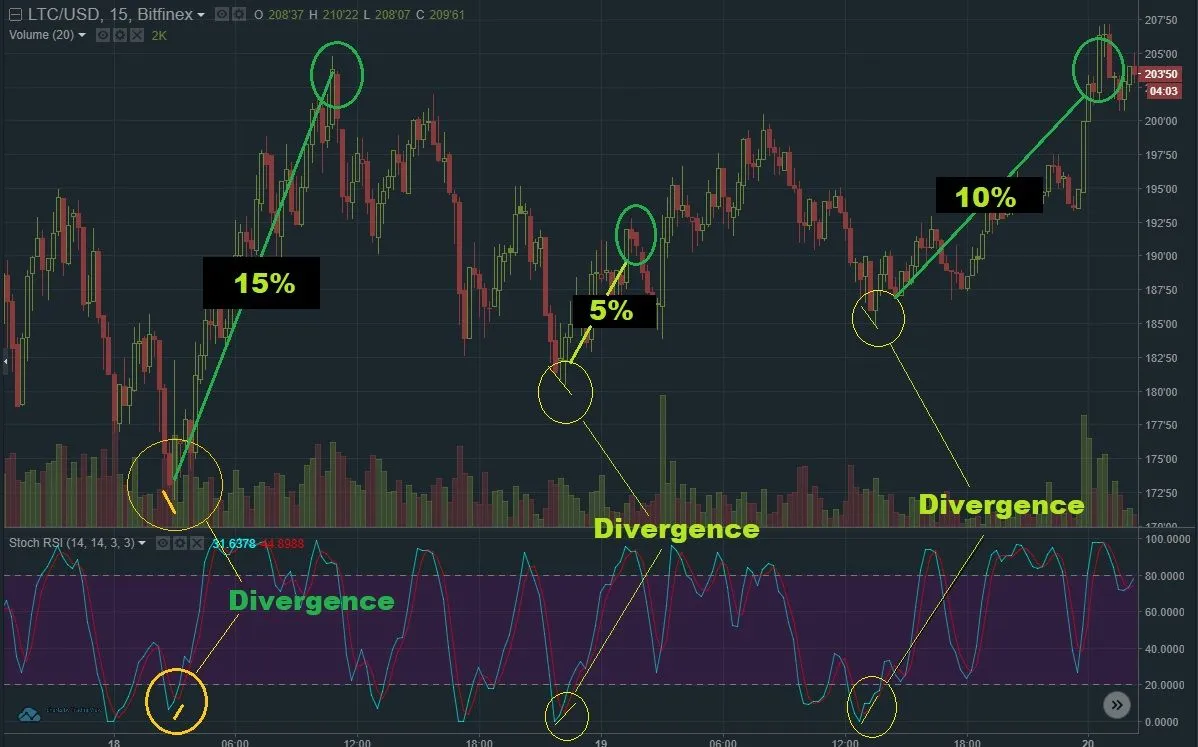

I like to use Stoch RSI (ESPECIALLY when things are going sideways or consolidating) to more accurately and tactically pick the bottom of the 15 minute charts for my quick scalps. With a more tactical use of a bullish divergence, you can buy the bottom of a STOCH dip when you the candle clicks from one 15-minute period to another, the low price on the 2 candles are even or dropping, and the buy line on the STOCH line is rising. Here are 3 Divergences during a ~3 day period for good scalping of LTC when it was trying to decide where it was trying to go.

You will notice that there were a few more very good scalps to be made in that period but that is hindsight and just picking one STOCH divergence a day to stay conservative, you could make your day with the one trade. (I consider 5% a day very good over the long term)

A couple of my personal observations specifically on STOCH Divergence:

- You will miss a lot of good trades, but will save some not-so good trades, and be more confident

- Some of the biggest pumps are when the STOCH is railed at 100% on the top when it is overbought....and you have sold into profit.

- Some of the largestprice drops happen at the bottom of the STOCH when it is insanely under-bought so it is good to wait for a divergence to make sure you avoid a red knife.

- You should be looking at the STOCH on 5 and 15 minute charts to determine the best entry point

- You should also be looking at the the STOCH 1-hour, and daily charts to know if you are scalping a downward/upward channel and trend.

**Feel free to comment, resteem, criticize, and help fill in the holes I may have left as I experiment with this, I learn to effectively relay what I have learned, and I strive to avoid slipping into TL:DR territory.

What I would love most is a reply with a picture of a STOCH scalp you were able to make and I upvote well! ;)**