Hello Friend,

Its been a while since I wrote something on Steemit . Today I am going to write about ETF as there are news around about ETF with BTC.

Before we go into deep ,lets understand these terms in easy way.

Exchange -

You must have seen local food markets right ? if no you must have visited vegetable markets, seafood market, Chicken market ..etc . So my point is these markets are some specific place where people come and buy things also there are people who sell their products ...sometime you see growth in price of a thing lets say price of chicken and sometime price of chicken also fall down based on season, availability ..etc similarly in economics Exchange is a place where people buy and sell financial instruments.. confused ? I don't think so apart from what is financial instrument. You can understand it with comparison of our local market .

Financial instrument in economics is similar to chicken, rice, potato ,grains, vegetables from local food markets.. in other words anything which is traded in exchange we call it financial instruments. for example - shares ,stocks ,futures, Mutual funds, securities ..etc

Trade -

There is no need to explain this term but in simple words its a trustful mechanism/ecosystem by which a thing lets say stock/share/security etc buy or sell by people .

For example if I am buying 1 share of Apple worth $190.00 at the time of writing this post ,it means I am trading ( I am giving $190 and getting 1 apple share) .I am hoping its clear enough now.

Fund -

Its a simple term and we all know about it but because I am explaining everything with basics, Fund is just a collection of money.

You must have understood what is E(Exchange)T(Traded)F(Fund) separately however concept of ETF still must not be clear enough by now.

Lets go back to Fund again . There might be some questions in your mind but keep them aside for some time ....

Exchange traded funds are the funds those are traded on exchanges. Confused ? ? don't worry keep moving...

For time being just understand ETF is nothing but at highest level collection of money(fund) from people. Now to manage/monitor/trade this Fund there are companies who take care of this and we call them as Asset Management company (AMC). These AMC appoints Fund manager for specific fund.

Now fund manager uses fund(collection of money from people) and allocate that money to stock market based on goals of that fund and on timely basis profit of that fund( scheme) shared with investors ( people who initially provided money to the fund)

I am hoping above theory is not confusing and you must have understood all the basics.

Coming back to ETF , Can you buy Nifty ,Sensex, NASDAQ or New York Stock exchange ?? Simple answer to this question is NO , you can not buy them because they are not stock/share/commodities/any type of financial instrument. these are just exchanges or indices where companies shares got listed and the price of these shares got monitored in trustable manner. On these exchanges people do trading. You buy vegetables from food market right ?? you don't buy food market place . :)

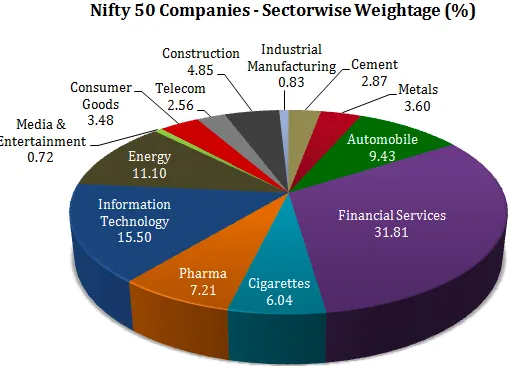

Lets take example of Indian exchange/index Nifty 50 - Nifty 50 is a exchange/index where Top 50 Indian companies are listed from different sectors like IT , Pharma, Infra...etc. So Niffty shows performance of these 50 companies. that's why Nifty gives us idea about overall market ( because it covers almost all sectors companies) . Entire fund in nifty consist of money from different sectors . For example -

Financial services - 31%

Auto- 9.4%

Energy -11.1%

IT -15.5%

.

.

.

and so on.

Now what is ETF fund of Nifty 50 ?? Hang tight you are getting closer to the concept . In above example I took Nifty ,lets continue with this only. Assume there is a ETF of Nifty called Nifty-ETF (just an example) and you put $100 on it .(again this is an example for simplicity)

So now your $100 will be invested on Nifty ETF ( $31 on finance companies + $20 on infra companies + $11.1 on energy companies +$9.4 on Auto mobile companies +$15.1 on IT companies ....and so on)

So thing to understand here is ETF of Nifty is completely mirror image of Nifty , its a replica of original index. It means if the performance of Nifty go down , the performance of Nifty ETF will go down and if performance of Nifty go up then performance of Nifty's ETF will go up. Sometimes returns of ETF may not exactly match with indices/exchange.

I am hoping by now you would have understood now what is ETF.

Recently Chicago Board option exchange (CBOE) situated at United states submitted an license application to operate BTC as ETF. So if this happens then BTC will become part of CBOE as a ETF ( there are still dispute if its teated as securities or commodities ). This can result in price hike of BTC. Petition still with SEC( Securities and exchange commission) and they asked for comments from industry experts. Its is important to know that CBOE is one of the highly reputed exchange in Chicago.

What will happen if it get approved ?

If this happens then BTC will become available on market easily , in other words it will be easy to buy. It will mostly result price hike as more and more fund will come to BTC , brand value of BTC will increase ,people will be more aware about BTC ,It will increase demand of BTC as well. I have been reading articles on web and few are claiming that BTC prices may reach to 40k,60,80k... upto 100k ( too optimistic haha)