[reposting from Medium - https://medium.com/@starscapecapital/arbitrage-opportunity-brief-salt-lending-e30accd05d18]

Jan. 8 update — in the community Telegram channel, one of SALT’s employees posted the following clarification to the loan conditions. While SALT can be used to repay principal and interest, early repayment is not possible, which limits the profitability of the arbitrage trade. Tomorrow, we will publish a retrospective on the events of the past couple weeks and what the arbitrage opportunity is like with this additional information.

“There has been a lot of questions regarding the use of SALT to repay principal and interest. When we announced this option it was always stated with the clear message that there would be limitations and conditions, and terms of each would be finalized at the origination of each loan. At this time, one of those limitations is the early repayment of a loan. This means that you can repay 100% of your loan’s monthly payments of principal and interest with SALT. This is subject to change, but we intend to keep this going into perpetuity. The ability to repay ANY portion of the principal is something that was announced for the first time when we launched, and we are glad to be able to add this use for SALT for our community.”

— end update. Original article below:

Three days ago, Salt Lending launched their loan platform, through which members can post cryptocurrencies (currently BTC or ETH) as collateral to receive a loan in USD. The release announcement contained an unexpected note, shown below, that caused the SALT coin’s price to spike, also shown below.

The good news

The market reaction

Since early on in the Salt Lending project, the team had made clear its intention to allow SALT tokens to be redeemable at a fixed price (adjustable and above market price) to pay back loan interest. With the news that SALT could also repay principal, the tokens instantly gained massive value on the open market (approximately $10 prior to the announcement) relative to their current $27.50 redemption price. Whereas an interest-only token would still require the loan recipient to pay back principal over time with fiat, thus only slightly benefiting from SALT’s exchange price vs redemption price, suddenly the entire loan could be repaid at a substantial discount, and the interest rate would also be minimized by early repayment depending on loan terms.

Thus, off to the races — or so one might think.

The aftermath

What happened? After spiking to around $18 immediately following the announcement, SALT has steadily declined to its current value of ~$12. Understandably, many people have been confused by the failure of the market to respond to this arbitrage opportunity, and some have gone as far as to accuse the Salt Lending team of market manipulation or outright scamming investors.

Starscape Capital strongly believes that there is no foul play, and this event is a great illustration of the market appropriately responding to the true circumstances of SALT arbitrage. We are confident that SALT’s market price will move towards its $27.50 peg, and likely in the near future. Here’s why —

This may be the exchange price before too long

To put it very simply, loan arbitrage with SALT requires the following:

A loan to repay

SALT to repay the loan with

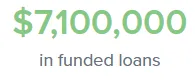

The market has 2. in spades, but precious little of 1. Possibly even none at the moment. The loan platform went live on December 27, and loan approval began right away to the tune of ~$2m in the first 24 hours, with over $7m as of this writing.

Roughly $100k in loans per hour!

However, loan approval is not the same as actually being able to repay the loans. The exact terms are only known to the loan recipients, but receipt of loan funds, which are sent via ACH, may be necessary prior to repayment. If funds were disbursed starting the 28th for the first approved loans, they should start to be received later this week following bank holidays, and the SALT market should begin to move in response.

It’s also possible that receipt of loan funds does not gate paying back the funds. In either case, another major limiting factor is the small sum of outstanding loans relative to trading volume, as loan recipients acquiring SALT would currently represent a small portion of the roughly $35m daily trading volume.

So the opportunity is real, but there aren’t yet sufficient real loan repayments with SALT occurring to overcome the market’s suspicion following the initial euphoria. As reports begin to surface of real repayments with SALT and loan volume grows, the sentiment should very quickly change and SALT could potentially experience a rapid correction closer to the $27.50 peg. Timeframe? Hard to say, as it depends on how quickly the SALT team can process loans, but at the current rate of ~$100k in loans approved hourly it would be surprising if things didn’t start moving by next week.

Hope this was helpful for those trying to decide on whether to hold or enter a position in SALT. Starscape holds no SALT at the moment due to the indeterminate time horizon, but we believe it to be a safe trade and are monitoring the market to establish a position at an opportune time.

Interested in reading more about crypto arbitrage? Check out our primer at https://medium.com/@starscapecapital/part-one-introduction-to-crypto-arbitrage-4b3d3458e2cb

About Starscape Capital: We seek to exploit pricing inefficiencies through arbitrage. The upcoming Arbitrage Flagship Fund will raise capital for this purpose.

About the ICO: Opens Jan 19. Ends after 1 week or when 3,000 ETH has been raised. Tokens are used to receive profits and reclaim invested ETH. Tokenholders will also be able to contribute to future funds ahead of the public.