A lot of people across the US who use digital currency such as bitcoin for small purchases face a big problem : under current tax rules, any little transaction — like buying a cup of coffee — can be considered a capital gain, and trigger an obligation to the IRS (Internal Revenue Service).

It began on March 2014 while IRS announced that cryptocurrencies like Bitcoin are treated as property, which means gains from sale or exchange are taxed as capital gains rather than ordinary income.

This is in contrast to how foreign currencies are treated, which do enjoy an exemption. Say you buy 100 GBP for $ 130 because you’re spending the week in UK. Before you get to UK, the exchange rate of the Euro rises so that the 100 GBP you bought are now worth $ 140. When you buy a chocolate with your GBP, you experience a gain, but the tax code has a so called de minimis exemption for personal foreign currency transactions, so you don’t have to report this gain on your taxes. You’re good to go and no need to pay tax.

Such an exemption does not exist for non-currency property transactions. This means that every time you buy a cup of coffee, or an MP3 download, or anything else with bitcoin, it counts as a taxable event. If you’ve experience a gain because the price of Bitcoin has appreciated between the time you acquired the bitcoin and the time you used it, you have to report it to the IRS at the end of the year, no matter how small the gain. Obviously this creates a lot of friction and discourages the use of Bitcoin or any cryptocurrency as an everyday payment method.

The taxing of digital currencies has become a big issue because the price of digital currencies has soared so dramatically. Bitcoin, for instance, has soared from $ 1,000 at the start of 2017 to a recent high of $ 8,000 — meaning that anyone who has sold it or exchanged it or goods at retailers is on the hook to declare capital gains and pay the tax.

CryptoCurrency Tax Fairness Act

A solution may be on the way. A new proposal by US lawmakers in the form of CryptoCurrency Tax Fairness Act (CFTA) introduced in the House of Representatives. It propose for Congress to create de minimus exemption for transactions under $ 600. The purpose would be to remove the friction and encourage the development of this innovative technology and its use in payments.

CFTA is currently being debated in the U.S. Congress. If it is passed, it would subject digital currency to a similar tax regime as what currently exists for foreign currency. It would also eliminate a disincentive for people to use bitcoin (and other digital assets) in day to day transactions.

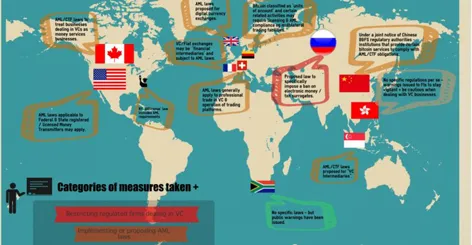

Other Countries Regulation on Cryptocurrency

Most nations make their crypto users submit to one of three fundamental taxation categories: Income tax, Company tax or Capital gains tax.

Income tax, applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income.

Company tax, applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. Think of a cloud-mining company like Genesis Mining, for example.

Capital gains tax, applies to traders who have invested in crypto speculatively with the express purpose of making gains. Most nations split capital gains taxes into short-term gains and long-term gains categories depending on various criteria.

Now, let’s shift to specific national taxation approaches.

Canada: Per a 2013 interpretation letter, the Canadian Revenue Agency (CRA) declared cryptocurrencies are “commodities” under Canadian law—just like silver or natural gas.

This means here your crypto will either be taxed as business income or as a capital gain (or business loss and capital loss, respectively).

Mexico : The Mexican government has a liberalized, open-minded legal attitude toward Bitcoin. Domestic regulatory framework is not yet finalized, but the nation’s legislature is actively designing new measures.

UK : The British government repealed their VAT tax against Bitcoin in 2014. Now, most cryptocurrency transactions are exempt from VAT fees in the nation.

Moreover, the HM Treasury considers BTC and other cryptocurrencies to be “assets,” not legal currencies. This mandates such crypto be taxed either by an income tax or a capital gains depending on the circumstances (if you’re a trader, for example, you’ll pay capital gains).

Mining is hit with company income taxation here.

Germany : Like the UK, Germany doesn’t apply a VAT tax to cryptocurrencies.

If you’re a trader, you have free capital gains up to € 800. Once you breach this amount, you’ll need to pay a 25% flat-rate on your speculative gains.

If you’ve made gains from simply holding your crypto and never moving it, you won’t owe any taxes in Germany.

Like in Britain, large-scale mining operations are hit with company taxes here.

The Netherlands : Holland’s Finance Minister announced that the Dutch government would be considering Bitcoin and the like as “barter items” henceforth.

This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations.

Accordingly, Dutch crypto users’ holdings are taxed according to these users’ respective basic income tax rates.

Switzerland : The Swiss have officially categorized Bitcoin as a “foreign currency.”

Capital gains taxes aren’t applied to the vast majority of individuals in Switzerland, either, so that’s another important dynamic to consider.

Italy : Zero taxation on cryptocurrencies as of Q3 2017.

Russia : Taxation laws as applied to individual users are unset for now. However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation.

China : In Q3 2017, China banned crypto exchanges and Initial Coin Offerings (ICOs) indefinitely in domestic markets, leading many pundits to wonder if the Chinese Communist Party was on the verge of banning crypto ownership altogether.

The reasons for these bans ? Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable.

These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework.

Japan : Japan’s top regulatory watchdog considers Bitcoin to be a “commodity.” The nation’s government also ended the 8% “Consumption tax” that hitherto applied to crypto on July 1st, 2017.

Beyond that, Japanese crypto users contend with all of the normal taxation models: income tax, capital gains tax, and company tax.

South Korea : South Korean regulators are currently exploring a range of taxation options including 1) value-added taxation (VAT), 2) gift taxes, 3) income tax, and 4) capital gains tax.

Australia : The Australian government just ended the infamous “double tax” on crypto in Australia by exempting cryptocurrencies there from facing the goods-and-services tax (GST).

Israel : Israel’s top financial watchdog drafted up new rules at the beginning of 2017 that classified cryptocurrencies as “assets” that must fall under the purview of capital gains taxes in the nation.

Turkey : Cryptocurrencies are taxed just as any other regular financial instruments are here.

Brazil : Brazilian legislators have characterized crypto as an “asset,” not a currency.

As you can see, then, the predominant international trend is to regulate cryptocurrencies like Bitcoin as if they were “property” and “assets.” Most nations have yet to come around to the idea of treat crypto like real currencies in a technical, legal sense.

So back to CryptoCurrency Tax Fairness Act, If CFTA were to get passed, many countries will adopt this revolutionary regulations. Cryptocurrency users would benefit greatly from it, in terms of feeling comfortable with making micro-purchases with their bitcoin. This will trigger many parties such retailers, online & offline shops accept cryptocurrency payment.

It’s not hard to see why this technology is exciting the world of payments. Traditionally we’ve had to rely on intermediaries like credit card operators (visa, mastercard,etc) or paypal to maintain a database of account balances. In cryptocurrency that database is maintained by thousands of nodes in an open network and constantly validated by the work of countless miners. Suddenly you have a new payment option. Since there is no intermediary, cryptocurrency works a lot like cash, but online.

Two decades ago, early Internet developers found themselves in a legal gray area. If old laws were strictly applied to them, they could be held responsible for the content that their users uploaded to their websites. In the 1990s, Congress passed the Communications Decency Act (CDA) and the Digital Millennium Copyright Act (DMCA). The laws protected Internet companies from liability for what their users did. Without these laws, the Internet would probably still exist today, but it would be a very different, and likely less useful, tool.

Regulators should be looking at cryptocurrency in the same way. Cryptocurrency could become critical infrastructure that one day revolutionizes the online economy. Like the open Internet, support from government is key to fostering its growth. Fortunately, there are concrete steps that the U.S. government can take to ensure the country’s competitiveness in this booming sector.

If it is approved, then cryptocurrency would reach another milestone !