@shayne here.

For those who don't know, Coindesk coversthe Flippening nicely:

No stranger to strange milestones, the cryptocurrency sector may soon see a historic first, one that could upend long-held perceptions of its market.

Branded 'The Flippening' by market observers, this new hypothetical is defined loosely as the point at which a competing blockchain network could replace bitcoin as the largest and best capitalized blockchain. Sparked by increasing inflows in cryptographic assets, the concept has already seen a dedicated hashtag and website.

Given that bitcoin invented and popularized blockchain systems, the development could herald a time of new diversity and experimentation for the nascent sector that, until recently, was largely defined in context of bitcoin.

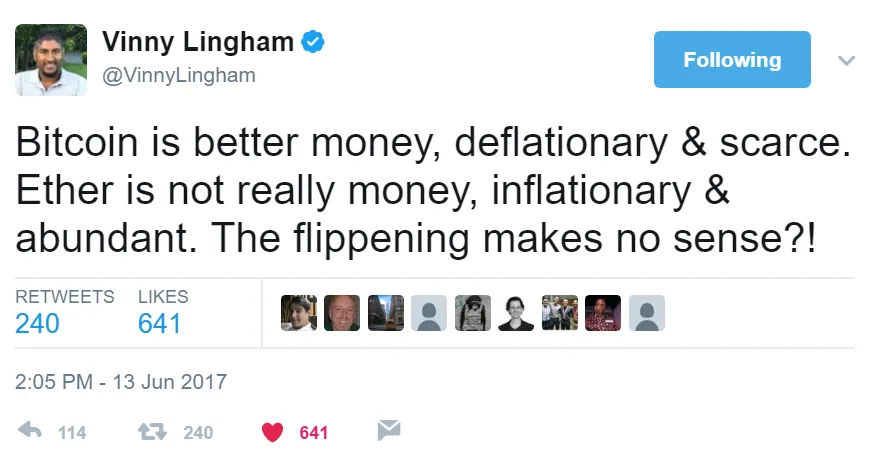

Vinny Lingham

I get his point, here.

Bitcoin has the Aristotelian properties of money, which are:

- It must be durable. Money must stand the test of time and the elements. It must not fade, corrode, or change through time.

- It must be portable. Money hold a high amount of 'worth' relative to its weight and size.

- It must be divisible. Money should be relatively easy to separate and re-combine without affecting its fundamental characteristics.

- It must have intrinsic value. This value of money should be independent of any other object and contained in the money itself.

There is nothing more durable than a decentralized, distributed system. Bitcoin is so portable that you can carry it in your head if your memory is good enough. Bitcoing is about 8 times more divisible than any fiat currency. And I'm convinced by the Bitcoin Wiki's argument for the intrinsic value of Bitcoin:

Each bitcoin gives the holder the ability to embed a large number of short in-transaction messages in a globally distributed and timestamped permanent data store, namely the bitcoin blockchain. There is no other similar datastore which is so widely distributed. There is a tradeoff between the exact number of messages and how quickly they can be embedded. But as of December 2013, it's fair to say that one bitcoin allows around 1000 such messages to be embedded, each within about 10 minutes of being sent, since a fee of 0.001 BTC is enough to get transactions confirmed quickly. This message embedding certainly has intrinsic value since it can be used to prove ownership of a document at a certain time, by including a one-way hash of that document in a transaction. Considering that electronic notarization services charge something like $10/document, this would give an intrinsic value of around $10,000 per bitcoin.

An explanation?

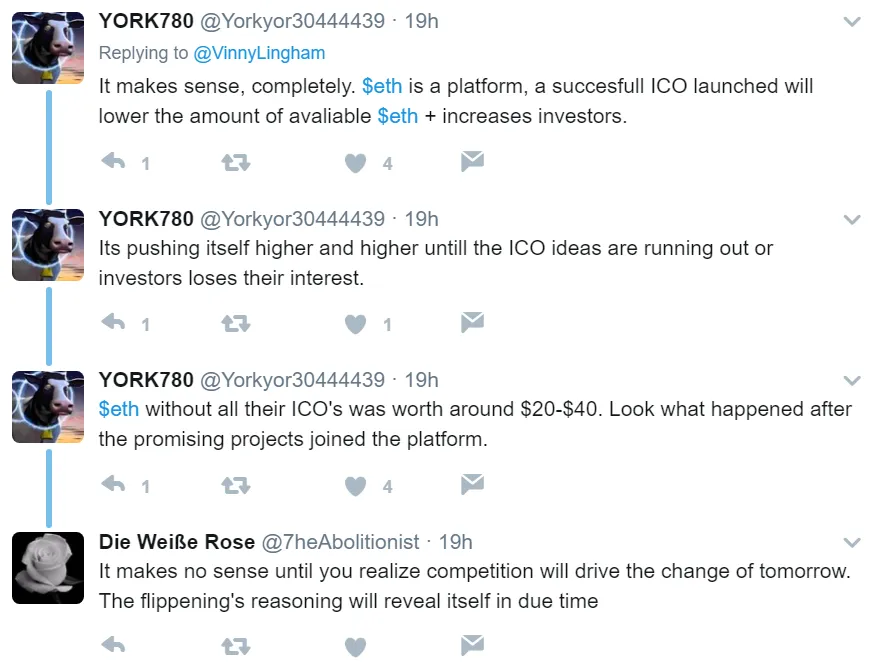

I saw this in the comments of Vinny's tweet and thought it was worth sharing:

What do you think about the Flippening?

I'm sure my buddy @acidyo has a fantastic explanation :D

But I wander what other mortals think, too lol