NEO up ~40% - does she have more in her

NEO:BTC

daily

NEO formerly ANS had gone for quite the run, from $5 to $53 upon rebranding and marketing of the ability to use NEO to run nodes to collect GAS - Jargon translated - it pays a dividend and so there is reason to keep this one on your watchlist.

On the daily time frame, upon hitting the $53 mark, price in both USD and BTC, NEO formed a HEAD & SHOULDERS pattern, too classic to ignore and while this triggered a downtrend, recent news that rattled the entire crypto market saw it take a steep dive into the low $20's

Not the RSI didn't quite reach oversold before spiking on some volume as the stochastic RSI on the daily time frame has resolved into the downtrend area. We are watching for more volume to come in and push this through the downtrendline for more upside.

4 hour

On the 4 hour time frame we see the NEO:BTC low was exactly pivot support 2 where dip buyers came in and have triggered a steep rise in the stochastic RSI as well as the price. This is very condusive price action. However, NEO has found resistance off of a downtrend line that extends off the previous highs, and while the 4 hour looks like it has more room to run, we are going to look for breakout confirmation and/or a dip to buy.

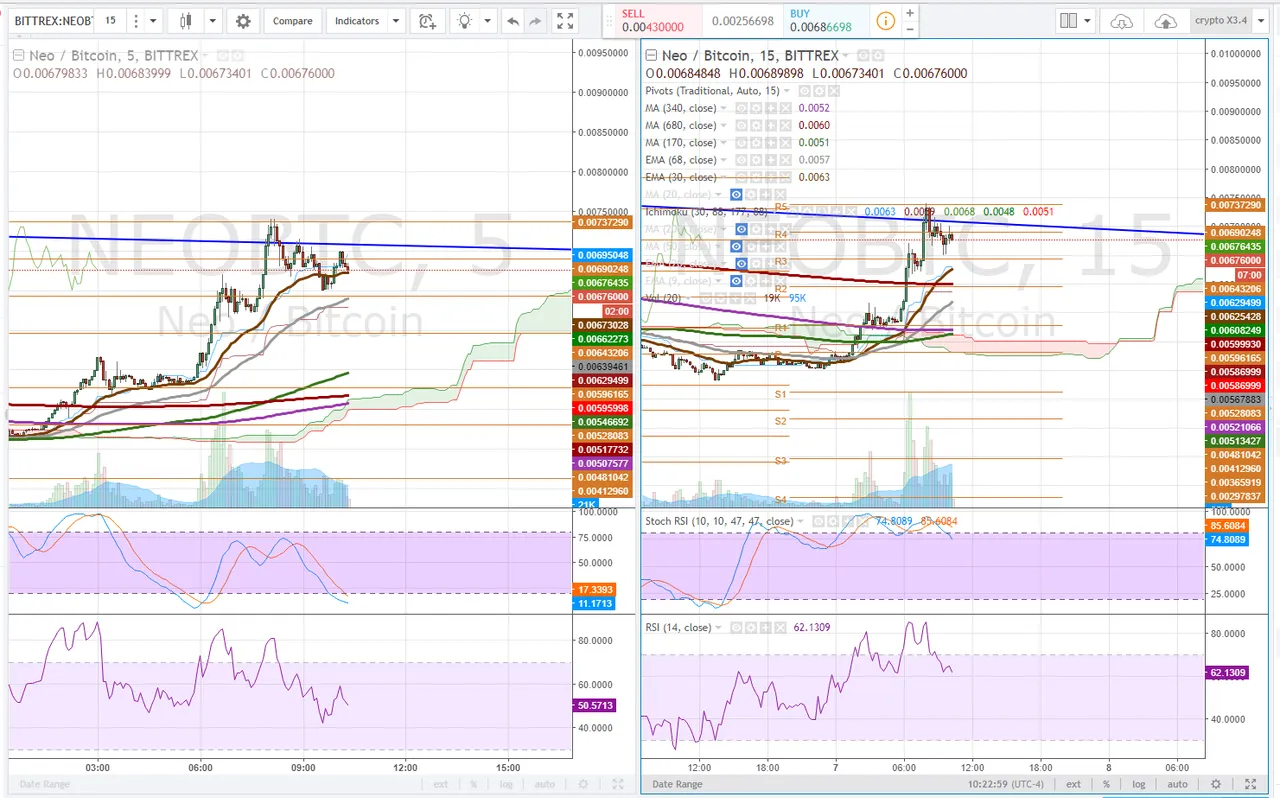

5 min/15min

On the 5 minute chart we see that NEO:BTC is consolidating in a bit of a bullflag pattern on low volume and holding the 30ema. This is very good and what we are looking for. When we look to the 15min, however, we make note of the extended stochastic RSI. I will be looking for a pullback or continued consolidation. Patience will pay here or prevent you from taking a loss. The ideal after consolidation is a break above that trendline on heavy volume. Converseley a dip to buy, if the price falls drastically we will be looking for an oversold RSI to make out entry for a trade.

TRADE: take position at the 68ema, set stoploss 1-2% below

ALTERNATIVE: Wait for breakout confirmation above the blue trendline, and ride it for a scalp

RISK TRADE: Enter here, add lower. Set loose stop loss as i expect volatility.

Previous Articles:

Trading Vs. Investing

Bitcoin

Weekly Overview

ETHUSD

bullish setups

Follow at your own risk, Not a financial adviser, understand the risks associated with trading and investing. Manage your own Risk - in other words you could lose it all and I could give a fuck.