There is much debate about whether, or not, XRP fits the definition of a security according to the Howey Test and what the implications would be if it did. Some argue that it does fit the Howey Test definition of a security, whilst others, including Ripple, argue that it doesn't and Ripple is also arguing that XRP isn't a security in the broader sense: Ripple is a company founded by venture capital, rather than an ICO; XRP is open-souced, decentralized technology that was premined and given to Ripple; XRP exists independently of Ripple, as only one part of the Ripple ecosystem.

In the US, securities are generally considered to be stocks or bonds. If XRP were to be deemed a security in the up and coming Coffey vs Ripple Labs court case, then the legal framework governing securities would mean that Ripple would have to comply with fiduciary obligations to their "shareholders", who would have indirect control in the decisions made by the company, in addition to being able to elect or deselect directors of the company. Most significantly, a security classification would be a disaster for Ripple, as hodling XRP would come with an entitlement to ownership, income, dividends, interest etc, as per the US SEC security laws. XRP would then be unlikely to fulfil its actual purpose of a bridge-asset for cross border liquidity, since all the hodlers of XRP and all the banks utilizing xRapid would have been handed the legal right to a share of ownership in Ripple Labs Inc.

Some commentators, such as Suzy Crew, are of the opinion that all cryptocurrencies are securities and it would be a good outcome for XRP to be classified as a security, as institutional money could then invest in it, but it's difficult to see what they would have left to invest in and Ripple's impressive legal advisors obviously disagree that a security classification for XRP would be a good outcome. Besides, institutional investors can already invest in XRP via the Winklevoss twin's Gemini trading platform and now that Ripple has a BitLicense, institutions and financial investors can buy XRP directly from Ripple and custody XRP with them.

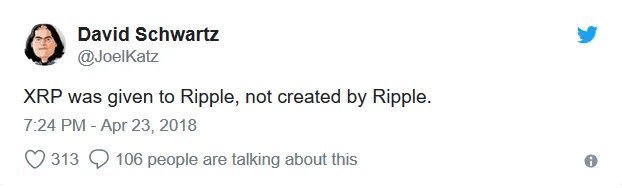

In April this year, former CFTC Chairman, Gary Gensler, claimed that XRP may be an unregistered security, because it was created and issued by Ripple Inc as a speculative investment.

In response to this claim, David Schwartz posted the following tweet;

Schwartz is correct in stating that XRP was given to Ripple and here we need to look at the way this came about. XRP was first created and developed in 2004, by Ryan Fugger, who had built a decentralized digital monetary system called RipplePay.com. In 2011, Jed McCaleb and Chris Larsen developed a consensus blockchain and in 2012 they approached Ryan Fugger and the RipplePay community seeking a partnership, but after discussions, Ryan Fugger and the community handed-over RipplePay to Jed McCaleb and Chris Larsen, who both co-founded a company called OpenCoin, financed by angel-funding. After further development of the the RipplePay protocol, OpenCoin was rebranded to RippleLabs in 2013 and XRP was issued to run on the RipplePay protocol first created by Ryan Fugger.

But who is the issuer of XRP, is it Ripple? Well, who is the issuing party in the case of Bitcoin? Is it Satoshi, does it exist only because the rules of the system determine its existence, or is it the miners? If it's the miners, then gold would be a security, because there are gold mines. As Schwartz contends, surely the issuer is the one who created XRP in the first place and then decides how it is to be distributed? In the case of XRP, that would be Ryan Fugger, not Ripple.

If the Ripple company went out of existence tomorrow, then the XRP digital asset would continue to exist, since it functions as a separate entity from the company and could continue to increase in value without any entrepreneurial efforts on the part of Ripple. Who would be the issuer then?

Aside from ICOs, XRP and other cryptocurrencies that have been functioning for some time and have become more decentralized escape the traditional legal definition of a security, as set-out by the SEC. The SEC's ruling that Ethereum is not a security has brought clarity to this point.

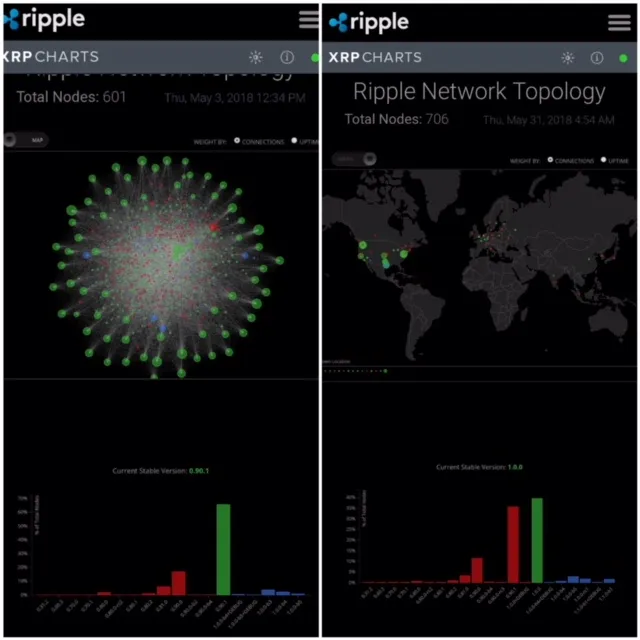

Since Ripple was fined $450k by FinCEN in 2015 for failing to register as a money services business (MSB), Ripple has been in communication with regulators to insure future compliance and, perhaps with an eye on this, one of Ripple's stated aims this year was to become more decentralized. Since the introduction of Rippled 1.0.0, this has begun to gather pace and now Ripple removes one of its own validators for every two non-Ripple validators added to the network.

Indeed, if we look at the XRP nodes, it is becoming more difficult to point at any decentralization;

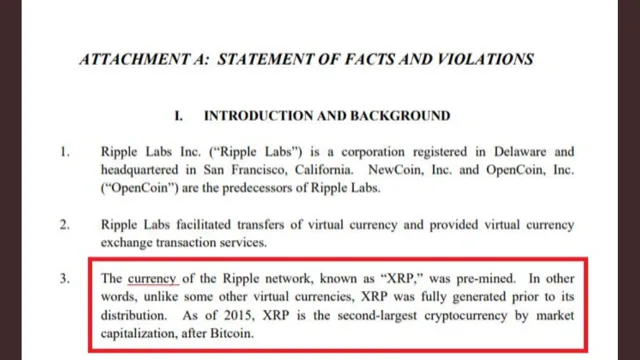

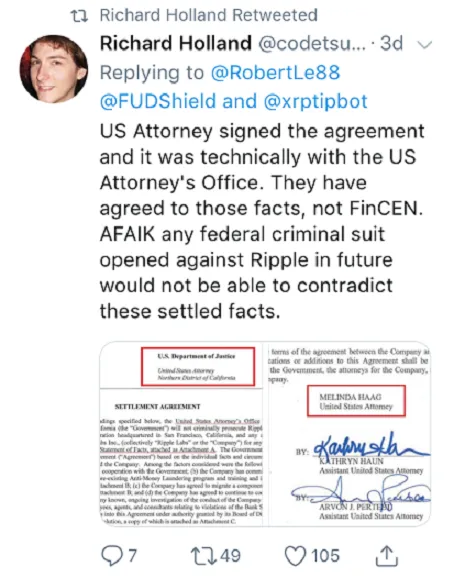

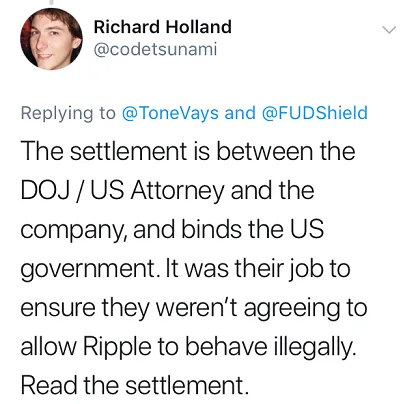

It is noteworthy that after fining Ripple in 2015, FinCEN ruled that Ripple XRP is a currency and therefore they did not regard XRP as a security, which will help in the Coffey v Ripple Labs court case, as demonstrated by the Richard Holland tweets this week;

Lastly, the granting of a NYDFS BitLicense to Ripple provides further testimony to XRP not being classified as a security, a timely shot in the arm for Ripple, just before the Coffey v Ripple Labs court case. Applicants will only receive a BitLicense as long as they are not deemed to be "controlling, administering, [and/]or issuing a Virtual Currency", and the token is not deemed to be a security based on the Howey Test.

In conclusion, Brad Garlinghouse has been careful to define XRP as a digital asset, rather than a coin. Whatever happens in the Coffey v Ripple Labs court case, it will be the SEC that ultimately decides whether, or not, XRP is a security. The old definition of a security is difficult to apply to the new asset class of functioning, decentralized cryptocurrencies, as the ruling on Ethereum clearly demonstrates.

It seems likely that cryptocurrencies will be classified and regulated in a new and different way. In Russia, cryptocurrencies are being classified as digital assets and if XRP were to be classified as a digital commodity, similar to oil, wheat, or gold, it would be regulated and governed by the CTFC, rather than the SEC, which only regulates ownership and debt. XRP could then fulfil its purpose as a bridge asset for cross border transactions, which would not entail ownership etc of Ripple Labs by XRP retail investors, or by the banks and corporations utilizing xRapid.

https://www.ccn.com/ethereumeth-and-ripplexrp-are-noncompliant-securities-says-fmr-cftc-chairman/

https://toshitimes.com/xrp-should-not-be-considered-a-security-according-to-an-uncovered-document/

https://www.coindesk.com/contortions-compliance-life-new-yorks-bitlicense/