Government-issued money is still much more adopted than cryptocurrencies – there’s no doubt about that, but what 2018 has proven is that cryptocurrencies can be just as stable as fiat ones.

Bitcoin’s price performance has been really boring and not volatile, like a currency should be.

Check this out:

In 2017, when the entire world was fascinated with it, so-called experts called it “Digital Gold” or a way to keep funds out of the system. Then, others said it was the cure for 3rd world countries, while many proclaimed it was the perfect inflation hedge.

The truth is neither – as we know, BTC is a digital medium of exchange, whose value proposition is anonymity, low fees, relative scarcity (though I like to remind everyone that there are countless other similar mediums of exchange), speed of transfer, and the most important of them all, you own it outright.

Remember the one thing BTC is not, though, an asset, which generates profits or cash flow.

In other words, if you own cryptocurrencies to make gains, your sole purpose is to buy one of them for less than you’re able to sell them for at a later date. As we all know, any asset has a fair market value, so, as investors, our advantage comes from buying an undervalued or underpriced one, waiting for the price to rise and then selling it to another person.

But, if that’s all we do, then this means we’re not actually using cryptocurrencies for what they’re designed to do – transfer value.

This is the identity crisis these projects are going through right now. Each and every one of them is attempting to narrow down what it is that it does because sooner or later, this game of hot potato will come to an abrupt stop.

That’s part of the reason I sold 87.2% of my cryptocurrency holdings back in Q4 of 2017.

Coming from the world of stock market gains, where world-class returns are 15% annually, making 30 times (3,000%) my money on DASH or 70 times (7,000%) my money on ETH, was seen as absurdly high, so I took profits on both which was over $1,000 per coin.

It’s important to assess reality and accept it. A crypto asset, be it LTC, EOS or a smaller, less liquid one, are essentially digital products. Think long and hard before you decide to own any of them because the fact that there is no middleman in a transaction is certainly an advantage, but only if the transactions you execute are smart, in and of themselves.

In other words, 2017 is in the rearview mirror. What I see in front of me, staring right at me are the blockchain technology’s growing use-cases, while crypto projects take a breather.

When it comes to a systemic collapse of all fiat currencies or the possibility of a hyperinflation of the USD, the odds of this occurring in the immediate future are slim.

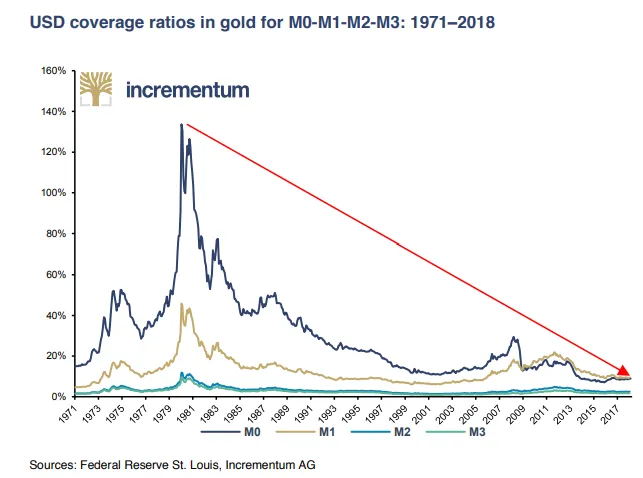

Courtesy: Incrementum AG

As you can see, in all its history as a fiat currency, the USD has never been so intangible, as it is today.

So, the risk of hoarding USD is immense, which is why I’m investing my funds, but putting the majority of it into cryptocurrencies in 2018 could be a serious mistake.

Today, what’s truly in its infancy stage is Artificial Intelligence, especially when married with blockchain tech to create disruptive services that will revolutionize our banking system and make it more transparent and fair.

The future is in tokenization, machine learning, improved database and varied uses of decentralization.

That’s the best way to get the government out of the business of meddling with our lives – becoming more efficient and much wealthier, so they can’t play with us.

For this reason, Pure Blockchain Wealth will make a historic announcement this week about the No.1, top-ranked, highest priority opportunity we’ve ever encountered in the Artificial Intelligence sector.

This is the type of investment, which can change the tune of your lives, once and for all, saying goodbye to financial concerns of any kind.

I’m wrapping up the report tomorrow and will publish it by Tuesday, after speaking with the company’s founder/CEO, who just appeared on Bloomberg.

Best Regards,

President, PureBlockchainWealth.com