There's something I noticed in pretty much all my trades, and something that's actually common to most people who trade, namely that it always seems like the price will drop almost immediately after you've just bought in! I'm here to tell you that's perfectly fine.

VOLATILITY

You hear it a lot, crypto is volatile. And it really is! Overall the trend is definitely up but before getting there, all crypto markets suffer from terrible (or profitable?) swings. One thing I noticed is that whenever I make a trade into an altcoin, it often isn't timed precisely right. I almost never buy in at exactly the right time for the price to go up, and when it does go up, 9 out of 10 times it will drop down in the days after, bringing me to an initial loss.At first when I traded, this annoyed me a lot and I felt like I had just made a loss. These days, however, these drops don't phase me. I have gotten accustomed to the idea that whenever I buy into something, I should be ready to take as much as a 50% hit on it and still feel fine. As long as in the future things are up, I will be fine. I have learned to be stubborn, and simply refuse to sell anything at a loss.

THE RIGHT PROJECTS

The trick is to choose the right projects that have an actual long term chance of adoption and thus increasing in price. Maybe the massive rises of some cryptocurrencies look enticing, but in many cases these are artificial pumps that do not last. Small projects can provide massive gains, but these markets are easy to crash as well, taking away any profits that you had.When I invest I try to look at the long term potential and the fundamentals of the blockchain. I read the whitepaper, and try to imagine how big a project could be. Are there any partnerships? Any famous or impressive advisors to the team? Is there a product yet? Is there an existing customer base? Who will actually use this? How will adoption spread?

I tend to focus on platform crypto's, because I feel they have the widest reach. Other projects can be built on top, and perhaps a killer-app will be among them, which will be beneficial to the platform it is built on as well obviously. I feel this increases my odds at having a winner in my portfolio.

When I do invest in smaller market cap coins, it's usually for the shorter timespan and I am actually looking for a 'quick' flip to increase my investments in the other more established and promising coins I have like BTC and ETH (and NEO and OMG and XMR). I see the risk for smaller coins to be too big to leave a lot of value in it for a longer time. I do sometimes take my initial investment out, and leave my profits in the smallcap to ride it out and see where it goes. Inevitably, though, I always cash out into something else.

JUST HODL IT

Once you've identified a project (or a couple) which you're pretty confident will be succesful in a year or two from now, you're ready to buy in, or perhaps you've already done so. Of course, now the price drops and FUD strikes you, but not to worry this time: Your chosen project is solid if you've done your research well.

I've taken massive hits on most of my investments over time, and massive gains as well which totally offset the losses I have had. However, I do not think I have invested many times where I didn't have to go through the dips first in order to reach the highs. I'm proud of my portfolio, because it consists almost entirely of coins which I have complete faith in. I can walk away and not pay attention and know I will be fine on the long term.

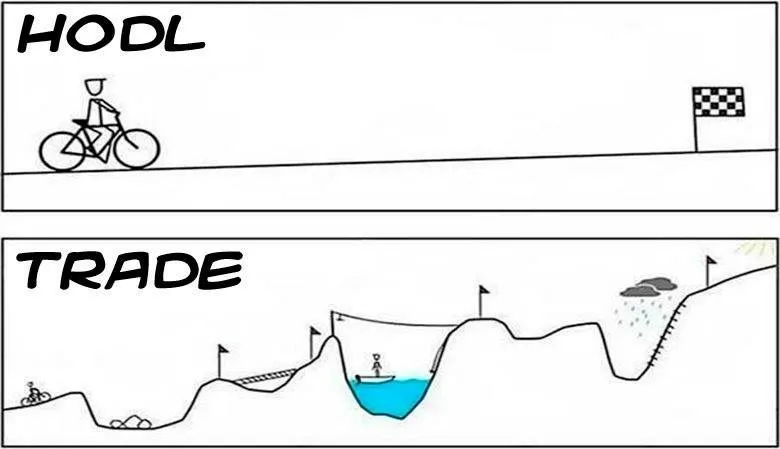

You need this kind of attitude in order to succeed. I have found that as a small fish, you don't make your money by trading every day trying to make 10% daily. Instead, you just pick some proper ones, preferrably when they are low, and just wait it out. Instead of trading every week, just trade every few weeks or even months. I suppose it's more investing than trading, or somewhere in the middle.

I know it seems like it is a lot slower, but your overall gains will be a lot higher in general as well as giving you far less stress. It's also the only way to truly beat the whales, who are really on control of what the charts say (and thus how the market reacts). If you trade on a longer timespan you're not looking at daily 10% fluctuations, but instead waiting for the time when it goes 2x or higher before considering selling some of your position. This almost never happens when you trade on a daily basis - you'll be the one missing the train over and over and selling too soon or too late every time. The road of a hodler is much smoother.

WHEN YOU READ IT, EVERYBODY ELSE IS TOO

It's impossible to time the market, they say. And it's indeed super hard. But one thing to remember is that whenever you come across a coin, perhaps through some post or perhaps because it has shown up on coinmarketcap, everybody else is finding out about it also. I believe this is the real reason why buying at the wrong time is common - it's very hard to be truly ahead of the herd when everybody is trying to do the exact same. By the time you think you're in something on time, it may actually be the moment when a lot of others are there already.And they are ready to take some profits from people like yourself who just bought in and made the price increase. This too is why you'll often see drops. Many people are contend with taking 5% or 10% profits, daytraders usually, causing these fluctuations. It's a matter of simply waiting until the fluctuations lessen and less profits are to be had for them, causing an eventual consolidation line which tends to go up in a bull market. I always simply ride it out and wait for the situation to resolve itself: my confidence in my picks is enough to know that in the future I'll be up, so who cares about the present? All I know is, I can't risk trading for 5% profit and risking losing my entire position because I timed it wrong - I may never be able to buy back in at the same price.

So in summary, my advice is to research your coin picks properly and pick the ones which you feel are guaranteed to be around in a couple of years. These may be big established coins in many cases. Don't put most of your portfolio in the small picks, instead put perhaps at most 20-25% in those for trading and put the rest in top 30 ones that feel legitimate and just ride it out.

You know you've got the right portfolio when you've gotten to the point where I am, where you can choose to step back for weeks and not worry, and you have full faith that in the future it will be worth a lot more. If you're feeling the need to ask others: "Should I sell??", then you may have chosen the wrong coin to invest in. If the price drops 30%, and you feel fine, then you know you've picked a likely winner.