Bitcoin

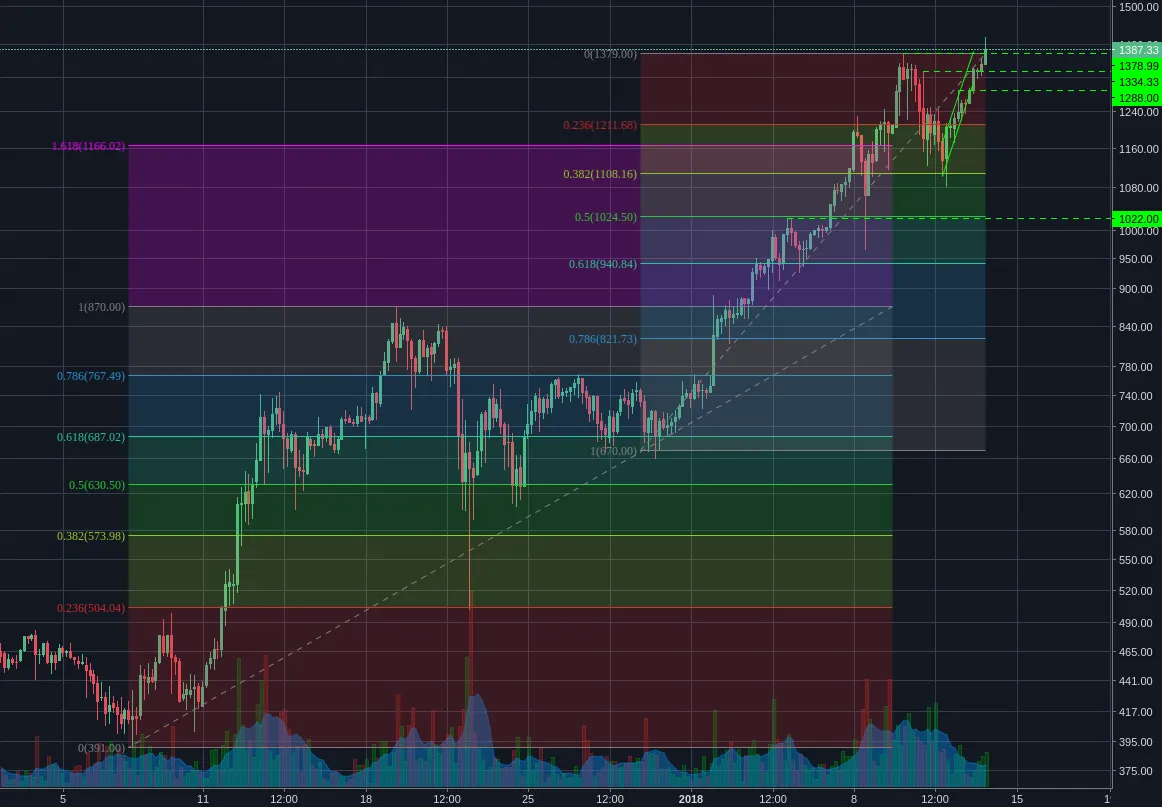

(Bitstamp:BTCUSD 4h)

There was a small break upwards from the flat channel I identified yesterday, followed by a swift rejection of resistance and a dip back into the channel. Unless we see a sustained break above the channel, this is looking bearish. The failed break is looking like a lower high, which would also confirm the bearish view. Volume on that short term rise was also dropping, suggesting that the market is not comfortable looking for a reversal at the moment.

I'm expecting Bitcoin to retest the major support line soon and the reaction to this will likely be the deciding factor in the short - medium term market direction.

Ethereum

(Bitstamp:ETHUSD 4h)

Surprisingly, Ethereum is currently in the process of testing new highs rather than continuing its consolidation. While this might look like the start of a new bull run based on price movement, the volume seems to tell a different story. While volume has been raising consecutively for the last 5 bars it still remains relatively low. If volume continues to rise then there is a possibility that this will form a new bull run, but it doesn't look very strong to me.

A shallow pullback and a small consolidation region would also be a valid option to confirm this as a new trend, but until we see a more concrete confirmation I remain sceptical of this move.

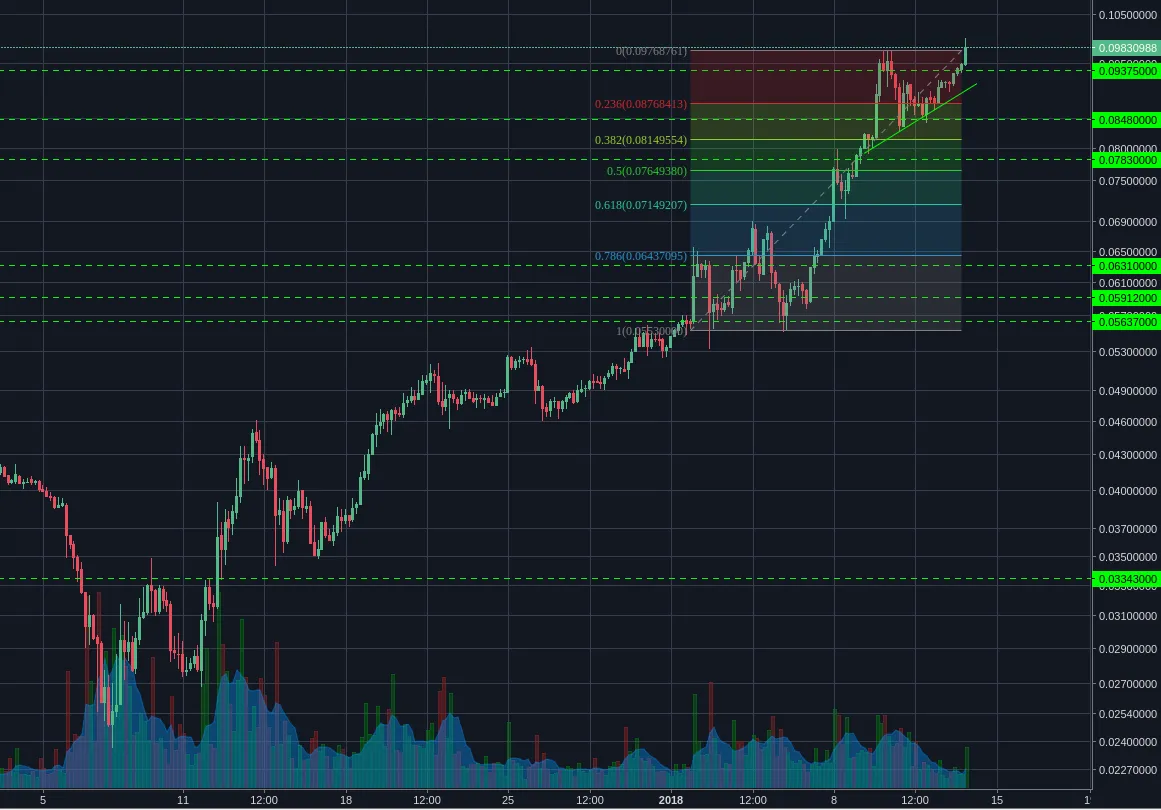

(Poloniex:ETHBTC 4h)

The Bitcoin ratio is showing a similar pattern but this breakout is certainly looking stronger than the USD pair. We saw a solid support line and volume consolidation with volume only spiking considerably on the breakout bar - which fits the expected consolidation pattern much better.

We will probably still see some more sideways movement here before the bulk of the new bull run (which would make me more confident in the move) but ,if volume picks up sufficiently, its not a given.

Bitcoin Cash

(Bitfinex:BCHUSD 4h)

Once again Bitcoin Cash is facing the resistance zone, although this time with much weaker pullback. At the moment its just a waiting game until volume picks up enough for us to break upwards. Overall, I see no bearish signs and this is still looking like a decent place to be building up positions.

(Poloniex:BCHBTC 4h)

BCHBTC is also in a short term consolidation zone and also looking to retest highs in the near future. A break below 0.181 seems unlikely, so this is once again a matter of waiting and watching for the next leg of the bull run. Once we break upwards there will likely be strong resistance first at 0.2138 followed by the retest of the high at 0.2570. As I always advise - keep an eye on these levels, because any weakness will most likely be reflected strongest in these areas.

Monero

(Bitfinex:XMRUSD Daily)

Monero saw a huge increase during its last bull run of 480%, before retracing and finding support around 50% fib level. We can also see a good ascending support line has been formed during the consolidation. Up until recently, Monero has been following Bitcoin's bull run (pink line) fairly closely, before decoupling during the corrective phase. While monero's correction has certainly been shallower than Bitcoin's, the volume doesn't seem to have properly consolidated, meaning there is still room for more sideways action. A retest of support would make a good place to start opening positions, but until we see a stronger bullish structure I would remain cautious.

Disclaimer

I will do my best to give unbiased, objective analysis, but I can make no promises about my accuracy.

All posts are based on my personal opinions and ideas and do not constitute professional financial investment advice.