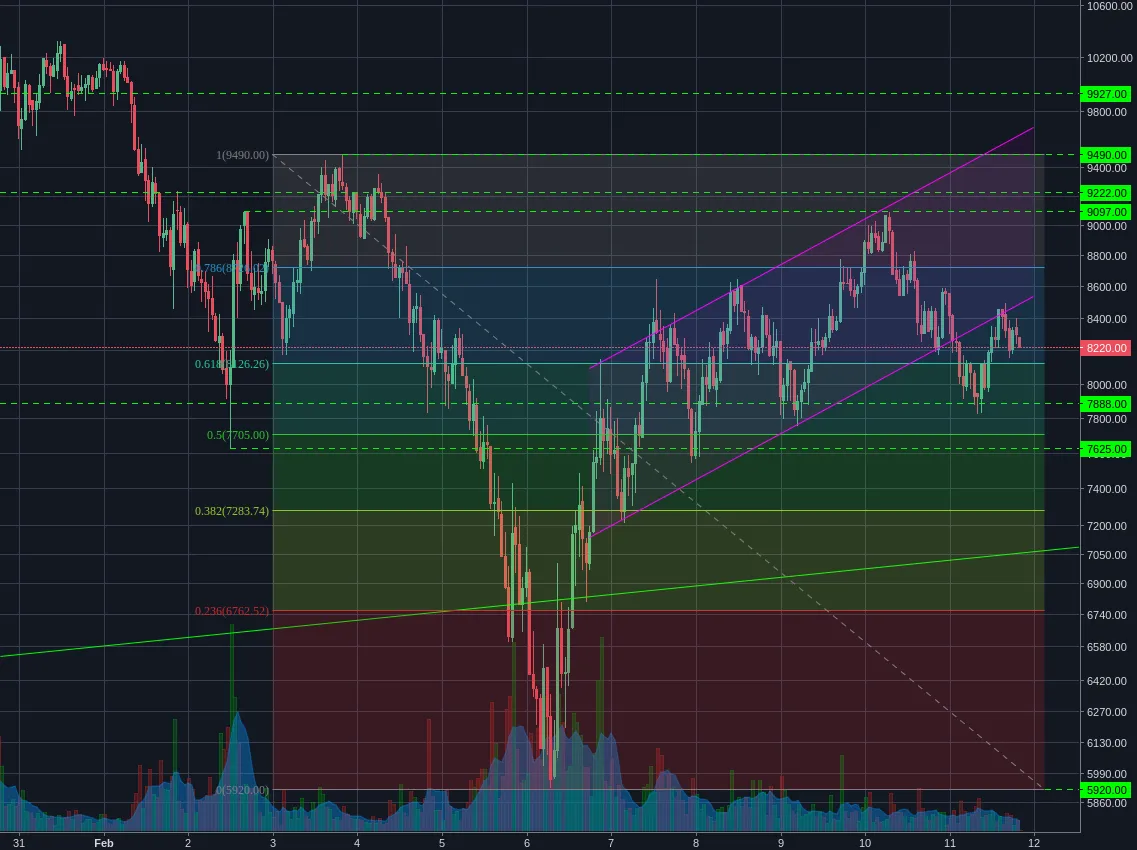

Bitcoin

(Bitstamp:BTCUSD 1h)

Bitcoin broke the support of its ascending channel before bouncing off the $7888 support and retesting the channel boundary. It appears to have rejected the boundary, which is a a sign of a continued bearish breakout. This bearish leg should retest the ascending support of the 2017 channel around $7000 and, if that breaks, $5920.

There is a good chance that this move will form a large double bottom before reaching the $5920 support, so keep an eye out for bullish divergence or sharp rejections of support levels.

The time to buy is once a strong bullish reversal pattern has been established. Until then, the risk of catching a falling knife isn't worth taking on.

If, however, Bitcoin does not form a bullish reversal signal, then we'll definitely be in long term bearish territory.

Ethereum

(Bitstamp:ETHBTC 1h)

On the ratio, Ethereum is still holding firm above the 0.0994 support level. Once Bitcoin has started to pick up speed and volume on its drop will be the true test of this consolidation pattern, but for now it is looking fairly strong.

The volume has been dropping off significantly over the last week, making this a good candidate for a consolidation pattern, but we still need to wait for confirmation.

Bitcoin Cash

(Poloniex:BCHBTC 1h)

Bitcoin Cash has bounced off the 50% support level, suggesting that it has found a bottom on its consolidation. It now looks to be finding support at the 38.2% retracement ready to make a test of the 0.1644 high in the near future.

Volume still remains low, so we are still within a consolidation period. A break upwards should see a spike in volume.

(Poloniex:BCHBTC 4h)

The previous leg up saw a movement of ~0.0412, giving this leg a rough price target of 0.1850. However, there are several historical resistance levels prior to that target, so we may not reach that far, but we'll have to judge how strong the movement is once it breaks out.

NEO

(Binance:NEOBTC 1h)

Neo has seen a good bounce off the 0.012 support level, which coincides with the 61.8% retracement. For a consolidation, volume remains quite high, so I remain a bit sceptical. But, if we can form a strong support level here, then this could form a good bullish reversal signal after this short term dip.

That being said, it would still be wise to hold off on positions for a few days until we have proper confirmation of support.

Cardano

(Bittrex:ADABTC 1h)

We saw a test of the 4730 resistance yesterday followed by a sharp rejection back to the 4320 support, where we now reside. Volume has certainly dropped off during this last dip, suggesting that we finally have proper consolidation after that fake-out. If we can remain around this support level for the next few days with low volatility, then this could make an attractive buying opportunity.

Litecoin

(Poloniex:LTCBTC 1h)

After forming a higher low, Litecoin appears to be nearing the start of its next leg up. The previous leg had a length of 0.0042, giving us a rough target price of 0.0216 for this move. After such a long consolidation period, this looks like a fairly achievable goal, if we can break the resistance levels above our consolidation zone.

Disclaimer

I will do my best to give unbiased, objective analysis, but I can make no promises about my accuracy.

All posts are based on my personal opinions and ideas and do not constitute professional financial investment advice.