I want to take a look back at this post as ETH skyrockets past 60USD in the wake of the 300 Million USD Gnosis crowdsale.

I am going to blatantly open with a central assertion: we are in a bubble. There is a lot of new money pouring into crypto right now; the magnitude of investment in digital assets is much larger than that of the actual understanding of the technology - or that of its functionality for that matter. This imbalance is eventually going educate the investors. When they lose their money they will mature fast. The problem today is they aren't losing their money, projects with little to no innovation are carving out multi-million dollar markets and nieve investors are making outrageous returns.

There is a fund it first, build it later mantra that is completely unsustainable especially with these ICOs or initial coin offerings. There are so many startups in this space funding themselves with this format, the ones with actual value are few and far between. I am not going to bless any project specifically but I will say that there will be a clear-out. This will be a very healthy thing for this industry. When the investment drys up and investors become much more conservative, that is where the strongest projects will endure.

Looking back at the fundamental concepts of decentralization this space is built atop, those in it for the long run need to look past the get-rich-quick-schemes and focus on ensuring the decentralizations and freedoms we all were looking for in the first place remain.

Gnosis ICO

I mention the recent initial coin offering of the Gnosis project GNO token because it represents exactly one of the issues with uneducated investors. In short, without a product to show, the Gnosis team's ICO format combined with uneducated investors resulted in an extremely inflated initial valuation. Even worse, this resulted in only 5% of the GNO tokens being distributed to the community - the other 95% went to the developers (they have time locked the funds for a year). You can read more about the ICO and the issues here.

The Gnosis project may very well be worth 300 million dollars, but the current investors are not educated enough for accurate valuations. Investors continue to be swayed by a strong fear of missing out.

**10 days ago: **

Cryptocurrencies are exploding; as the market caps of these new assets rise, it is important to keep in mind the fundamentals that created this space in the first place

If you are just reading up Bitcoin today, you would be overwhelmed by vocal disagreement on the two conflicting subreddits, personal attacks on twitter by prominent members of the community and the slow... freaking... blocktimes...

consensus freedom

This chaos may seem very concerning, especially given Bitcoin's position as a store of value. It is important at this time to see through some of the tweet-storms and disingenuous blogposts and remember the resilience and freedom cryptocurrency is able to provide. There is a reason that despite the many issues, Bitcoin is still Bitcoin. Hypothetical attack vectors aside, a cryptocurrency is by definition, at the mercy of its user's consensus -- if someone stole every Bitcoin in existence in a single transaction, it could be inferred that the consensus of the users would be to return their funds; if all the users come to consensus, the thief doesn't matter -- this scenario seeks to demonstrate the user's control when it comes to cryptocurrency and how little someone else can influence the protocol.

If you are new to cryptocurrency, don't let this fighting and rhetoric scare you, it is that which the blockchain is resilient against. Although the math and code certainly protect us users, it will be important to resolve issues with more maturity if we would like to remain agile with progress. The following quote from Vitalik does this point justice:

One of the worst aspects of crypto culture is the idea that because math and code are supposedly apolitical, we do not have to be polite.

-Vitalik Buterin

beware of the shitcoins

There are lots of scams in the cryptocurrency space. With all the new money flowing into the current crypto bubble, now more than ever it is important to beware of the shitcoins.

If you are a newcomer to this space, looking at a "CoinMarketcap" list of every random coin and their 500% returns is a very tainting window to the real innovation happening. There are hundreds of bitcoin-like tokens that can be traded and speculated on, maybe a dozen or two are projects with real prospects and development. You might be easily dazzled by #Burstnation posts or the Mooncoin runup, but these projects don't represent the same innovation or market penetrability that made Bitcoin a success.

There is a reason you see here on Steemit, frequent posts by the same individuals promoting an obscure altcoin: they are trying to keep a market around to legitimize this token they own. Except that token is a copy paste of the open-source Bitcoin code where you can only mine with hard drives or something ridiculous. These are pure scams. The developers make a small change to Bitcoin and then start their own blockchain, they do most of the mining at the beginning while they promote the heck out of it. Once momentum dies down, they have hopefully sold a bunch of useless tokens to idiots who buy them thinking it will be the next Bitcoin. /scam

The most important thing that you can do is weather some of the fighting and research the project you want to invest in. Who are the lead developers? Do you agree with their mission? Did the coin emission look fair? Do the developers hold a significant portion of the supply (see Dash)? These are some of the questions you should be confident in the answer to before investing in any of the projects you read about.

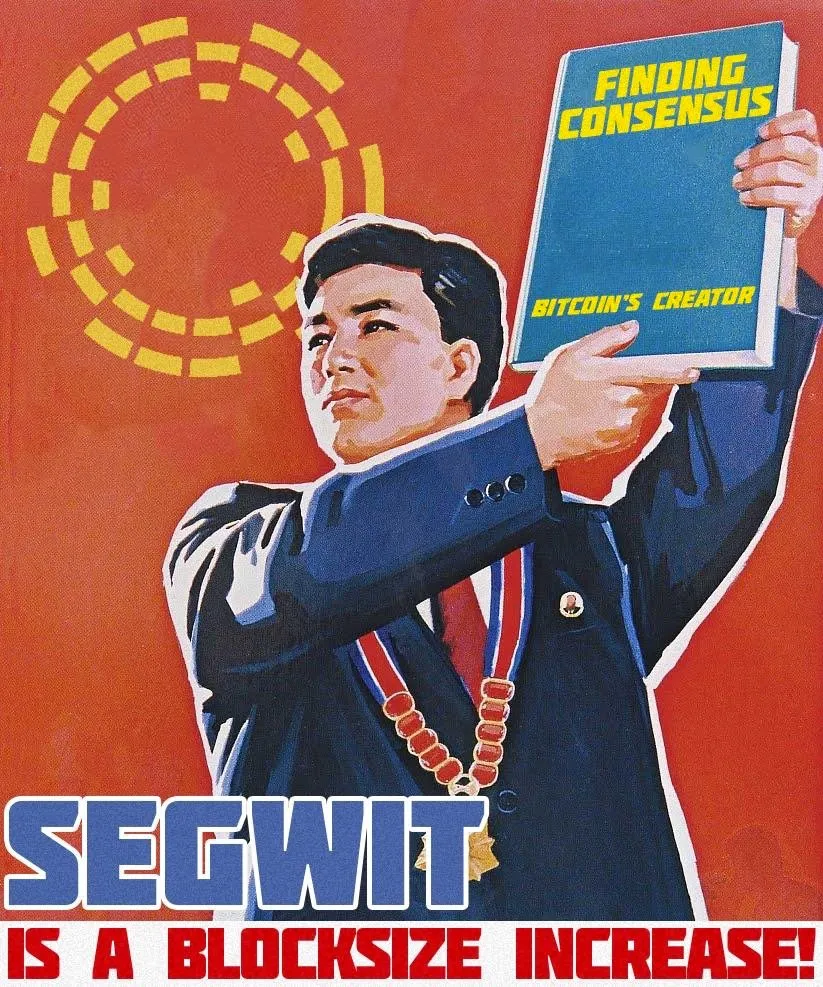

Beware of the propaganda

Stay decentralized,

Kyle