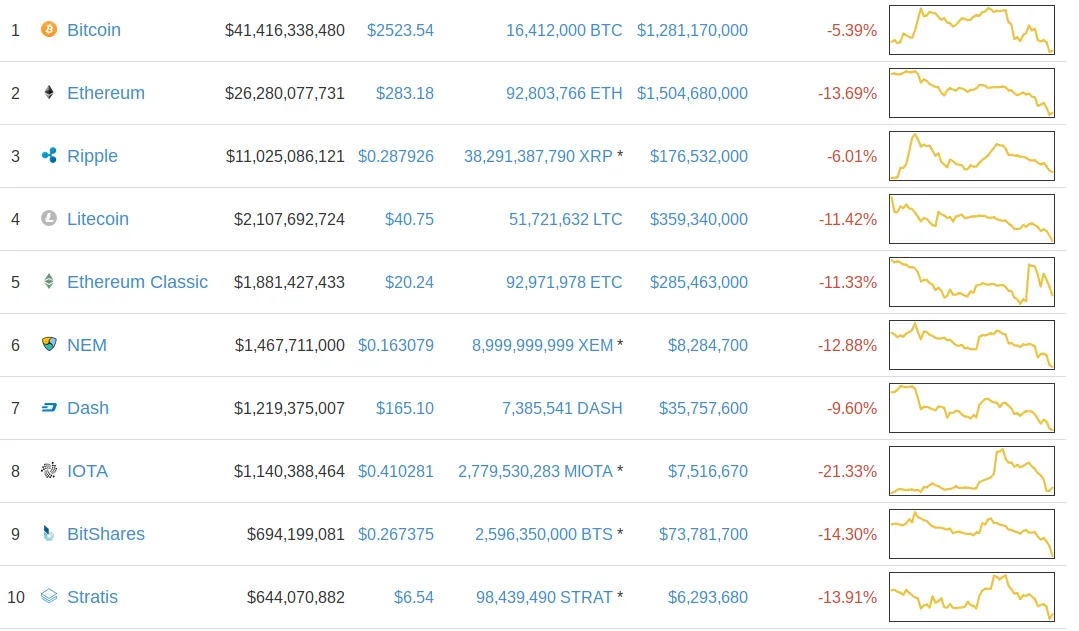

Red candles have painted the sky an ominous shade in the crypto universe over the last few days. Most have watched their portfolios dwindle in value, all by the same eerie candlelight. We often forget how lucky we are to be aware of this space, but in times like this being an investor in crypto can be disheartening. Just take a look at the Top 10 on Coinmarketcap; absolutely nothing is in the green, not even close!

When the tide of the markets turn, our approach to trading also needs to turn. No longer are we striving for increased profits, instead we must strive for decreased losses. If you’ve lost more money than you care to think about over the last few days, then never fear. There’s been a lot of talk recently about a cryptocurrency bubble, and I’ll admit we are likely in one; however, this sea of red isn’t indicative of that bubble fully popping. I read an investment book the other day that discussed the telltale signs of bubbles before they are about to burst. It compared the recent crashes in both the housing market and the dot-com bubble. The main take-away was that right before both of these bubbles burst, EVERYONE was aware of the money that could be made, and ‘dumb’ or ‘unaware’ was pouring in left, right, and centre. For example, in the housing market in the UK, right before the crash, several footballers (*sigh* soccer players) were seen on TV bragging about their property empires. The mainstream was well aware of the profit-potential in these markets, and that hype added to the crash. The good news for us is that whilst we’ve seen some outrageous profits, the general public is still largely unaware! We may be going through a slight bear market, but rest your weary heads, for the bubble has not burst… yet.

Nevertheless, we all want to protect our portfolio during these downward trends. If you’ve seen the value of your portfolio lose more digits than you’d care to think about in recent days, one of the tips below may be of use.

Go Fiat:

I hate to be an advocate of fiat, but it truly is going to be the option that minimises your losses. By doing this, you’re essentially attempting to short the crypto market. This is risky. Time it right and you’ll not only have protected the value of your portfolio, but it will have actually increased when you buy back in. Time it wrong, and well, you could miss out on the rise, and see even more value erased from your portfolio. This method will work best if you are able to constantly check the price, set price alerts, or buy orders to buy back in at the exact right time.

Move Position To A More Stable Coin:

Whilst many downward trends seem to impact the whole market, they do not seem to impact the whole market equally. By moving the majority of your portfolio to a small number of coins that suffer less, you can minimise your losses.

“All coins are equal, but some coins are more equal than others”.

Up until recently I’d have suggested Ethereum being one of these more stable coins, however, this no longer seems to be an option. Your best bet, statistically speaking, would be of course Bitcoin. However, Ripple and Dash have both suffered considerably less than the market average. Other than Bitcoin, my best ‘loss-minimising’ asset was PIVX. Of course, this is a rather defensive investment option, so it may not be ideal for everyone.

Pick A Winner:

Usually, it seems that groups of investors, or possibly single whales, choose a coin to move a large amount of money into during these downturns. This random coin then has its price pushed through the roof and manages to see profits whilst everything around it has failed. For example, today CloakCoin (haven’t heard of it? No surprise there) has risen by almost 30%. The best way to pick these winners? If you don’t have insider knowledge, may I suggest throwing darts at a board or astrology?

Use The CryptFolio Matrix:

The above options are methods that can be adopted once the downward trend has begun, but that isn’t always the best option. By the time you’ve become aware of the trend, transferred coins from your wallet to the exchange and decided on your move, it could be too late. For me, I use my CryptFolio matrix to manage my portfolio to ensure that it is protected against these trends. The matrix can be used to analyse your portfolio to see at a glance whether your assets are skewed towards short-term or long-term, high-risk or low-risk investments.

Following the matrix, my portfolio is currently split roughly 50% in Turtles, 40% in Whale Sharks, 8% in House Flys, and 2% in Snails. As a result, my portfolio is heavily skewed towards long-term, stable assets; each of these has varying degrees of real-life use cases which can be used to guarantee their value to some extent. Once the markets turnaround, a number of these assets will increase drastically as money flows back into the logical investment decisions. Consequently, I feel that I have not only been able to minimise my losses during this downturn, but also positioned my portfolio to increase the most when the market is back.

Portfolio management in the cryptocurrency space is not a long-term situation. A number of assets should be held for the long-term, those classified as Whale Sharks or Turtles, but importantly, the volatility of prices means that portfolios should be actively managed and analysed for optimal profits. I use the CryptFolio matrix as a way to stay on top of my portfolio, both in bear and bull markets.

Let me know what you think of my suggestions in the comments below! I’d also love to hear what tools or methods you use to manage your portfolios and why you have chosen that particular option.

---

This is part of a super regular segment I'll be doing, to make sure you don't miss out click through to my profile and follow me! Let me know in the comments below if you do, I'd appreciate it! Also, got any comments, questions or suggestions fire those at me too!

Disclaimer: For legal reasons, this is not intended as advice, I'm happy playing with fire with my own money, I do not by any means suggest you do the same moves I do. I will, however, be posting them, and the reasons here, and if you choose to follow me, then sweet!