Some people actually buy useless coins. I’ll give an example below.

Introduction

Back to Basics: a coin vs a token

Some people define crypto coins as means of electronic payment so a bitcoin and Litecoin would be a coin and a token would be anything other than a coin that's used for electronic payments.

However, we’re going to focus specifically on how coins and tokens are defined when it comes to their purposes and mode of operation. A coin is a cryptocurrency which operates independently of any other platform. Examples of coins are bitcoin, bitcoin cash and Ethereum.

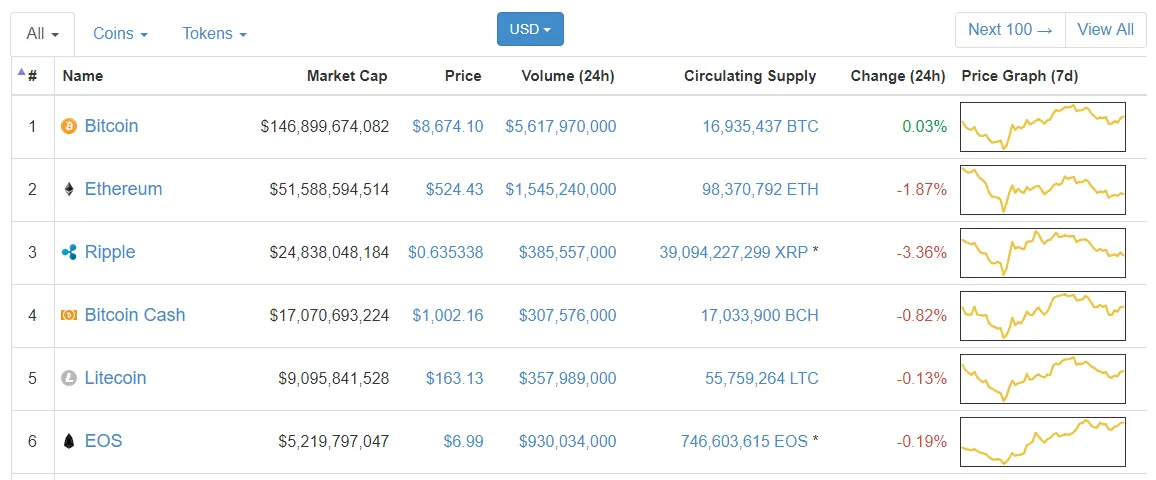

The Coinmarketcap is an example of where the coins and the tokens are listed so you can see how they are clearly separated. On this website, you see that bitcoin, bitcoin cash and Ethereum are coins when it comes to cryptocurrencies.

A token requires another platform like ethereum to exist and operate. Examples of tokens are other augur, omisego and golem. These are tokens that are built on top of ethereum. Now, there are other platforms that you can build tokens upon. There's nxt, there's omni and waves.

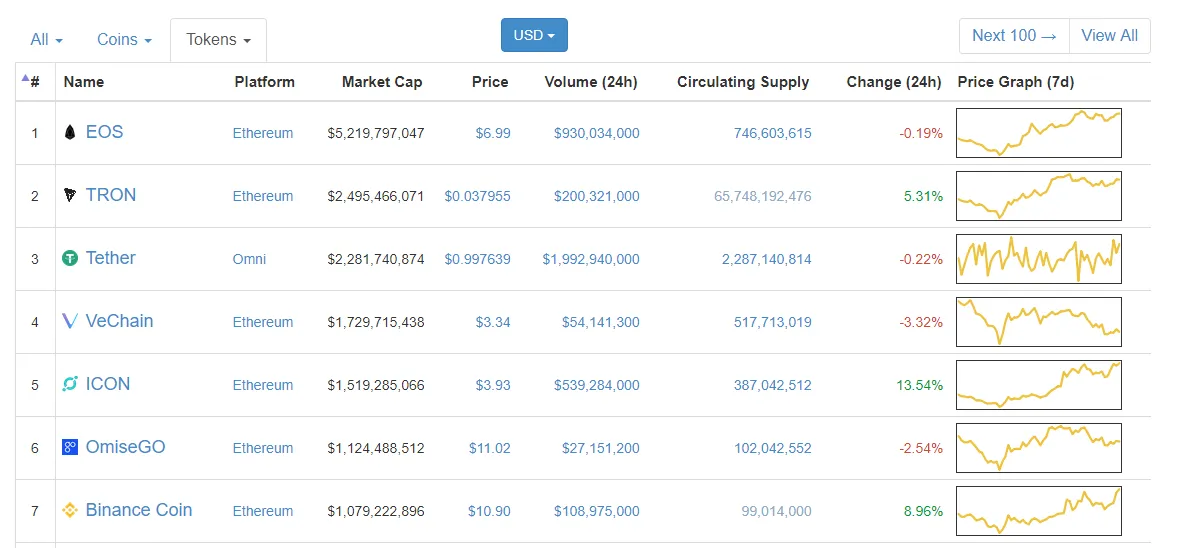

Coinmarketcap actually tracks all cryptocurrencies available and is constantly updated as new cryptocurrencies are made available. You can see the full list under the “All” tab. You'll see the ‘coins’ and ‘tokens’ tabs next to that. Tokens are in a completely different list. There's a ‘platform’ column and what that means is that these tokens that you are seeing here are built upon these platforms.

There are other tokens they're built on different platforms such as Omni and NXT. You see others such as NEO and waves. But the key point in this introduction is: there must be a reason why every cryptocurrency or token is launched. Token utility is an important factor in evaluating tokens and ICOs.

These tokens which can be bought, sold and transferred across the network and on cryptocurrency exchanges, can serve various different functions, from granting owners access to an asset to entitling them to company privileges. Depending on their use, tokens may be classified as security tokens or utility tokens.

Utility Tokens

These are also referred to as user tokens or app coins. They represent access to a product or service in the future. Utility tokens are definitely not designed as investments; if the project is properly structured and executed, this means utility tokens are exempted from federal laws and SEC regulations.

By creating utility tokens, a startup can sell “digital coupons” for the service it is developing, much as electronics retailers accept pre-orders for video games that might not be released for several months. Filecoin, for instance, raised $257 million by selling tokens that will provide users with access to its decentralized cloud storage platform.

Because the term “Initial Coin Offering” came from “Initial Public Offering” (IPO), utility token teams usually refer to them as crowdsales or token generation events (TGEs). Sometimes, crowdfunding or token distribution events (TDEs) to avoid misinterpretation that they are selling securities.

Security Tokens

If a cryptocurrency token's value is determined by an external, tradable asset, it is defined as a security token and must abide by SEC regulations. Failure to comply with these regulations may result in project derailment and delays.

On the other hand, if a startup meets all regulations, security tokens have the potential for so many applications, the most lucrative of which could be the ability to sell tokens that are equivalent to company shares or stocks.

Useless Tokens

Apparently, anything labeled ‘blockchain’ or ‘cryptocurrency’ attract so much attention that it has become a fad. Let’s have a look at a couple of useless tokens.

The Useless Ethereum Token

There’s an actual coin called “The Useless Ethereum token” which is raised 300,000 dollars in a token sale. -This is a joke but it’s not a joke! The ICO was really held though as the name suggests, this new asset serves no purpose and may not appreciate in value. This should not be even listed on any exchange.

This obviously lacks appeal to investors but still, the ICO managed to collect $300,000! This only means that too many people didn’t even pay attention to what this project is all about. This seems surprising but more importantly, it shows or partly represents the people who just throw away money at random investments in hopes of gains.

This is real money. People actually bought the coins and supported an ICO with no product or mission at all. Instead of doing that, just buy and hold bitcoin or ethereum (just my opinion)!

Image Source

Loomia

They presented a very promising and futuristic idea of sewing something like a strip of fabric with electronics, which can track data, into shoes, jackets and other items of clothing. They planned to give tokens as incentives to users who allow them to be ‘tracked’ in terms of their experience with the products. They’ve got a pretty decent roadmap and the prototype looks easy to manufacture so they actually have working units but the thing is, even the ICO administrators admitted via chat that the tokens sold now will not be of use in the future.

They’d better keep the sale private and invite only the people who are really interested in supporting the project. In terms of gains, this is not very promising because of lack of ‘token utility’. It’s very clear that the business can work without the tokens. They can, for example give vouchers or discounts at select brands and outlets for those who agree to share user data. We don’t need a new cryptocurrency or even a new token to make the product or business work.

Please upvote, resteem and follow me. Thank you.