As we are in a bear market, I'm currently in the process of consolidating my investments into a few key areas within the crypto space. 85% of my investments are in Platforms (i.e. Protocols) and not in the Coins built on top of the Platforms. Let's go over why I prefer this method of investment.

Note: This is not investment advice, simply my view of how I am investing.

What is a Platform?

Let's quickly get the definitions out of the way. A Platform is one that allows other coins to be built on top of them. As an example, Ethereum is a Platform (or Protocol) that allows other coins, like Golem and Augur to be built on them. As such, Golem and Augur cannot function unless the Ethereum network is functioning.

Seeking 50x multiples or 1000x?

The question for today's investor is if they looking for the 50x multiple or a possible 1000x multiple years down the road? The answer is likely self evident.

However, this space is so risky it may all just go to Zero within the next few years. And if it survives and thrives then a majority of the coins we see today will likely drop down to near $0 in value when all is said and done with. That's just how these burgeoning markets pan out when they mature.

So we do have to be very picky with where we invest. And what I want is the chance to get that 1000x return.

Differences between a 50x coin and a 1000x coin.

Think about the recent success stories in the Big Boy space and we have Bitcoin and Ethereum sitting at the top. But, Ethereum wasn't exactly nipping at the feet of Bitcoin until a month ago. What happened and why does it matter to our discussion here?

The simple reason is as you likely surmised by reading the title of this post and earlier paragraphs, Ethereum is a Platform.

Ethereum: A Current Success Story

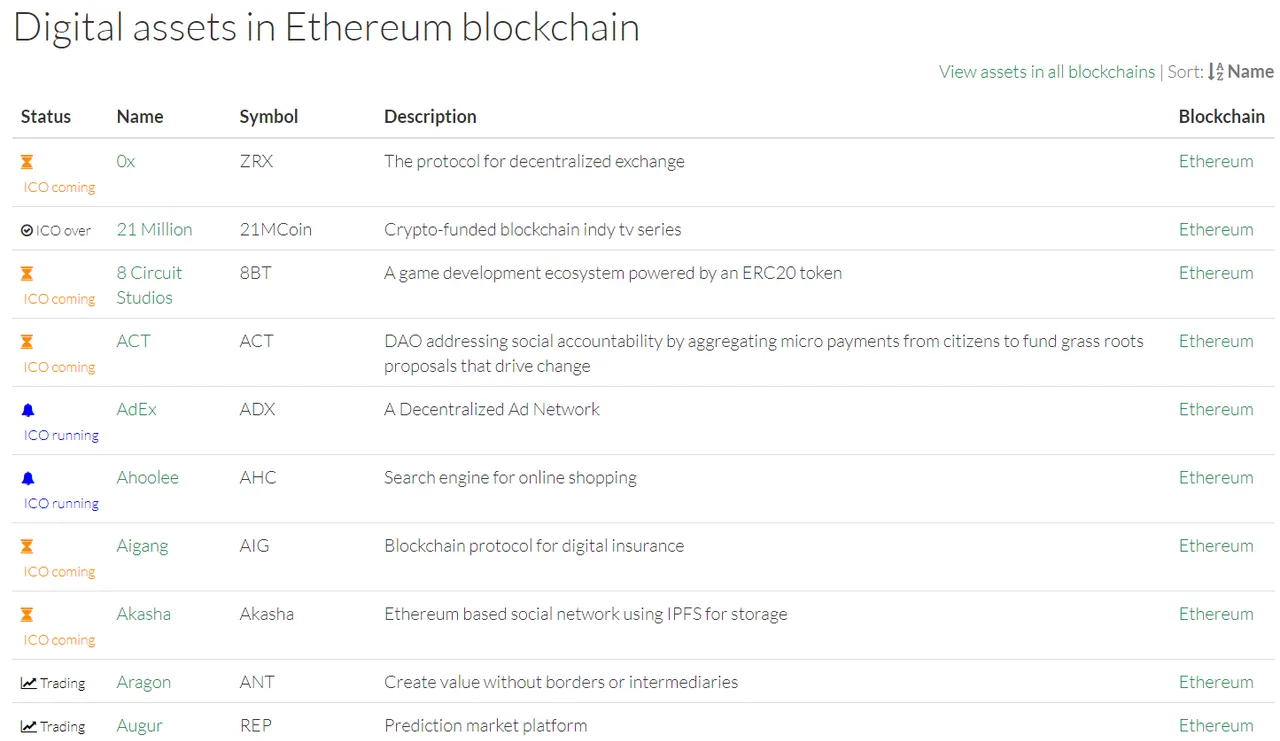

Look at the image above. It's a very small list of coins out of a much larger list. What do all these coins have in common?

They're ALL built on the Ethereum platform.

These coins are basing their success on Ethereum's success because if Ethereum fails, they all fail. That's a lot of faith isn't it?

The Ethereum platform is what is generating value for the coins on it. And these same coins receiving millions of Dollars of investment are then reinforcing the value of the Ethereum platform, making it that much more valuable.

Sure the coins built on Ethereum could do well, but they can't do well unless Ethereum does well first.

So if coins on Ethereum are generating millions to billions of dollars worth of value, Ethereum is getting some of that value back for itself too.

Platforms are Core Generators of Value

If we look over the crypto space there are a few names that are brought up time and time again: Ethereum, Stratis, Lisk, Omni, Antshares, etc., as well as new entries EOS & Tezos.

Why all the excitement? Why are larger investors publicly supporting Ethereum, EOS & Tezos? Because the larger term bets are in (you guessed it) Platforms.

Yes, I love me some Gridcoin, Augur, Dash, and Litecoin. They have single purposes in mind and can disrupt their specific spaces. However, the upside to disrupt any one space is limited, even if focused on perfectly.

As a result an individual coin's long term valuation will also be limited to the value of its intended industries. That limitation is not the same for a Platform

Platforms Powering Multiple Coins are More Valuable than any Single Coin on the Platform

Since the backbone of a coin (based on a Platform) is the Platform, a chunk of its valuation is given to the Platform powering it. So if a specific coin performs incredibly well, it validates and adds value to the Platform it is hosted on.

And, since Platforms are the backbone to a spectrum of industries that its coins are built to disrupt, the Platform's value is also diversified across these industries.

Even if one coin isn't able to create the disruption intended in a specific industry, another coin built on the same Platform might, or even if not, ideally there are enough coins disrupting other industries to continue to bring back value to the Platform.

So, investing in a Platform is investing on the aggregate success of the coins on it.

Coins Built on Platforms have Two Critical Failure Points

By investing in a coin built on a Platform we're making two key assumptions on Risk:

(1) The Coin built on the platform will perform as projected

(2) The Platform will perform as projected.

So, if the Platform breaks, then it doesn't matter how amazing the coin is sitting on top of it, its value will take a nose dive unless there is a contingency plan put in place successfully.

Now, imagine investing in multiple coins built on top of a single Platform. If that Platform caves in, ALL investments in those coins will also come crumbling down.

Platforms DO Carry Risks if a key Coin fails: TheDAO

The article's purpose is not to say that investing in a Platform has low risk. It's important to note that if a Coin fails it CAN bring the valuation of a Platform down too.

Consider TheDao in 2016, the highest performing ICO in history during its time. TheDAO was built on top of the Ethereum Network. TheDAO was supposed to be an amazing new way to fund great projects. Governance was intended to be decentralized and the positive vibes coming out of it for the community were uplifting.

However, TheDAO was hacked. Millions of USD worth of TheDAO tokens were stolen. The issue was in the way the smart contract had been created which allowed it to be hacked. Even though the hack wasn't due to any fault with the Ethereum platform, it was given the blame anyway.

Ethereum's price dropped, losing over half its value within a short span of time. The price of Ether was suppressed and it took almost 6 months for Ethereum to recover and for prices to start rising up again.

In Ethereum's case, as it stands, if/when one of the existing key ICOs built on top of it fails miserably, we're going to see Ether's price drop again. Considering how many key coins are built on top of it today the likelihood of another situation like TheDAO is almost inevitable.

However, as recent history has shown us, solid platforms can rise back up again, stronger than ever.

Conclusion

Investing in crypto is super high risk so I'm looking for the highest of returns possible knowing the potential downsides ahead of time.

Platforms logically have the highest growth potential because they are enablers for other coins. Platforms simply create value from the beginning.

This is not to say Platforms can't lose out. They can and they will. But, a few will survive. And those that do, will be incredibly successful and drive valuations through the roof. That's the bet and it's why I look at Platforms.

What do you think about investing in Platform?