Anyone investing in the Altcoin space has been incredibly concerned over the past few weeks due to the profound shocks we're feeling as the valuation of a number of currencies has dropped anywhere from 10%-80% from their ATH (All Time High) early in June. And yes, for those of us who started investing during the rise in June are seeing our holdings drop in value. Nothing has been spared except for Litecoin and Dash which have been setting new ATHs recently.

With that said, let's at least try to understand what's been going on and if this is a sign of gloom and doom, or just another crazy month in the Cryptocurrency space by looking at some historical and current information.

(2013-2014) The First Altcoin Boom saw 20x Gains

Using history to understand what CAN happen (not what will happen) let's see what happened doing the 2013 Boom. The Altcoin sector was just at $100M in total market cap at the time. Considering how many coins we have today sitting over $100M in market cap each, it's crazy to think the entire space was at that level not long ago.

As we can see from the chart, the entire Altcoin space experienced a 20x growth within a matter of 1 month, which then went on a violent ride until finally settling down at $500M in total market cap value 1 year later.

Those who purchased at the top saw their holdings drop by at least 75%. Consider Litecoin. It recently reached over $50 setting a new ATH... but it had actually hit $50 way back in November 2013 before dropping to near obscurity and gradually moving back up to around $4 until the beginning of 2017.

BUT! From the beginning of the boom until the end of the bust a year later the altcoin space actually grew 5X from $100M to $500M. And, that's part of the lesson we have to take away from every major cycle in a growth market. It lands back down, yes, but at higher levels than it was before the boom upwards.

(2013-2016) Altcoins Capped under $2B for 3 Years

Between 2013 and 2016 the Altcoin space (excluding Bitcoin) was largely capped under USD $2B. That's nearly 3 years of consolidation, simmering and waiting patiently for the moment to break out again. That's an eternity if you consider the life of the Cryptospace in its entirety is roughly 8 years.

One thing we have learned is in growth markets, the longer a coin/sector simmers for, the larger the break out can be. And that moves us to 2017.

(2017) +2900% Growth in Altcoins Space

The Altcoin space grew from a mere USD $2.5B market cap to USD $72.5B within a span of 5 months! That's a growth of 29x from out of nowhere. Comparing this growth spurt to that in 2013, it dwarfs that boom entirely, in both absolute $ terms and in percentage growth.

For those who had invested before the boom in their respective coins, they're sitting pretty today for sure. It doesn't matter if the market tumbles 50%, if they're holding, they're still way in the profit. However, for the rest of us who may have started investing in May or June, we're definitely feeling the pinch right now. For us, the baseline is MUCH higher than those who invested in the space through 2016. And that is where the concern is coming from.

As in any market, the later an investor comes in, the more risk they are taking on themselves. Irrespective, we all come into this market because we believe in the long term (I'm hoping at least)

2013 vs 2017: Bitcoin vs Altcoins

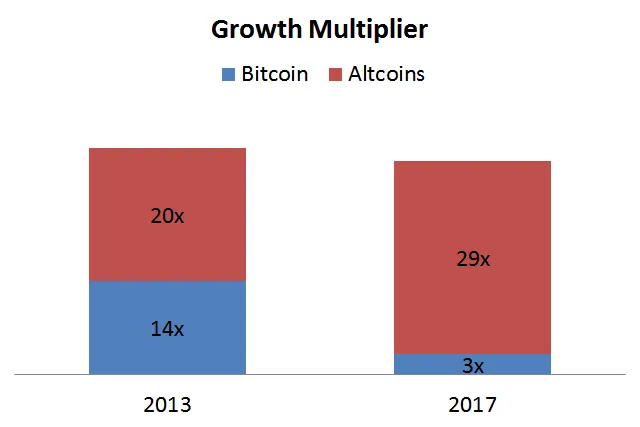

There is a major difference between the boom in 2013 and in 2017. The growth multiplier in 2013 was shared between Bitcoin and the Altcoins with Bitcoin growing 14x and Altcoins 20x. Comparatively in 2017, Bitcoin grew "only" 3x, whereas the altcoin space grew 29x! Altcoins performed well (percentage wise) in both time frames, but in 2017 they have been the true stars of cryptospace's growth story.

However, looking at multipliers in an isolated manner can be deceiving of course, so let's look at the overall marketcap landscape in 2013 and 2017 below

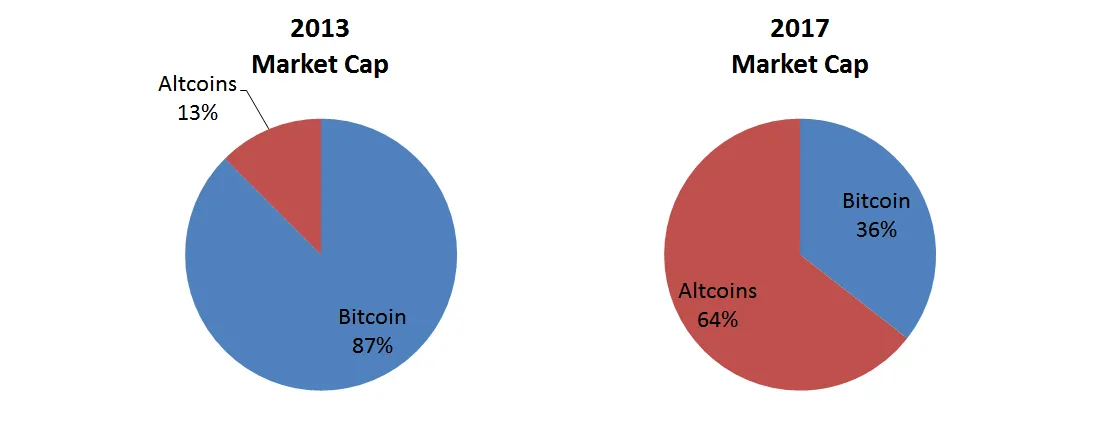

A striking difference, Bitcoin jumped from around $1B in total Marketcap to $14B within a month during the 2013-2014 boom, where Bitcoin represented 87% of the overall marketcap at its peak valuation.

Fast forward to 2017 and Bitcoin's growth was completely dwarfed by the altcoin space, pushing Bitcoin down from around 80% in total marketcap to well under 40% through early June.

(July 2017) Current Altcoin State

From our $72.5B high, we're down about 35%, hovering at around $50B in total Altcoin marketcap. And as we can see the $50B floor has established itself as our strongest support base since the end of May. We have already bounced off of it twice now, with every bounce carrying less momentum back upwards, marked by the declining red line.

We're at a stage where we'll know shortly whether we're going to continue in a downward trend for a longer period of time or if we're going to start moving up towards recovery.

Yes, Ok, But Up or Down though?

I get this A LOT! And the thing is, No, I don't have an answer on the direction we are going to move in, just that we're at a cross roads. Anyone who claims they do have foresight is either flipping a coin, lying or delusional. We can use technical analysis to give us signals, but there is no fortune teller to give us any truth.

It's a scary moment for sure for many investors who came in a bit late. But, never lose sight of the fact that everything moves in cycles. And in an overall bullish market like crypto is in today, we have to assume we're still moving in the right long term trajectory.

2017 is the Year of the Altcoin and Blockchain Technology at Large

Make no mistake about it, 2017 has really marked a milestone for the Altcoin space. And that is something we should all take away from this irrespective of where the market takes us this year.

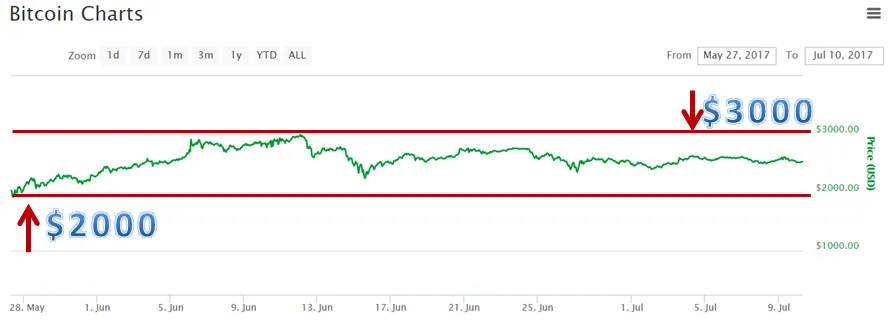

With that said, if we remove the Altcoin picture from Bitcoin, we'll notice that Bitcoin has largely been trading sideways between $2000 and $3000 since May. It may swing 20-30% up or down, but it has largely been stable.

Since the Altcoin space is what is facing the blunt end of the stick right now, this is where all of our collective eyes are. Yes, Bitcoin is going through a potential fork on August 1st, and that can impact both Bitcoin's and the Altcoin's valuation for sure. We will likely see further turbulence when that does happen too... or perhaps the turbulence we're feeling is already baked in and partly due to August 1st anyway.

But, the bigger picture is that Bitcoin is simply not the exclusive solution to disrupting currency anymore and is certainly not the solution to disrupting other industries that need it. Blockchain's potential is being identified as something that can solve problems beyond just currency, and the manifestation of that value is going into the Altcoin space for those coins that are looking to do just that.

Always remember that we're in a high risk space, with tremendous volatility. However, if you believe in it, and believe it is a disruptive force for the betterment of human kind (and our wallets) then we have to ride these downturns. If we believe there is a future in Crypto then the tides will turn again and we'll move back up, so there is nothing to worry about, since we're all in it for the long haul.