Some may know him as the childhood actor that stared in the hit movie The Mighty Ducks, others may know him as an early Bitcoin adopter and cryptocurrency pioneer. But what many don't know is that he's been caught up in a Hollywood pedophile ring scandal, has been known to rub shoulders with convicted pedophile Jeffery Epstein, and is an active member of the Clinton Global Initiative. He's also received Millions of dollars of investments from the likes of Goldman Sachs and Oak Investments. Oh, and he's also the founder of Tether.

Tech Figure In Dot-Com Child Sex Scandal Was A Clinton Global Initiative Member Disobedient Media - 01/27/2017

Brock Pierce is a controversial figure who has received surprisingly little attention despite connections to the Clinton Foundation, digital currency Bitcoin and involvement in a notorious scandal involving a child abuse ring. Pierce’s involvement with a child abuse ring, Digital Entertainment Network and The Clinton Global initiative were first highlighted in the documentary An Open Secret, Directed by Amy Berg.

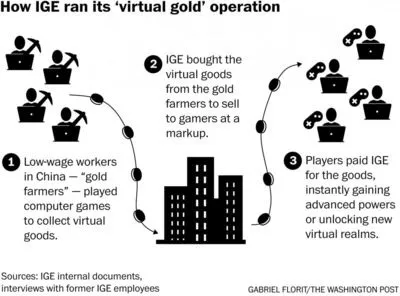

Before the advent of Bitcoin, Brock Piece made vast amounts of money buying and selling virtual assets in the gaming world. In 2001 he set up a company called IME that bought gaming credits from people playing games like World of Warcraft and Everquest, which by 2006 was turning over $8.5 million a month. The business model was built around buying virtual assets from gamers in places like China and the far east where people had plenty of time but not much money, and selling them to western players that had less time to play but more money to spend. In the end Pierce was eventually replaced as CEO by ex-Trump advisor, Steve Bannon.

As an 18 year old, before his rise to fame in the crypto world, Pierce found himself caught up in a high profile child abuse scandal whilst he was vice-president of DEN (Digital Entertainment Network), an online video streaming platform. In 2000, along with 2 other DEN founders, Chad Shackley and Marc Collins-Rector, a lawsuit filed against Pierce by 3 young actors claiming they had been sexually abused by the 3 men in the late 90's. Further lawsuits were filed against Collins-Rector, Shackley, and Pierce in various states in the early 2000s by boys/men claiming to have been sexually abused as teenagers.

Mystery Man At Center Of Alleged Hollywood Sex Ring Has Vanished | Buzzfeed - 04/24/2014

One suit filed in Los Angeles Superior Court in July 2000 listed the plaintiffs as Egan, Alexander Burton, who played Pyro in the first X-Men film, and Mark Ryan. All three were DEN employees, according to court documents. An attorney for the plaintiffs, Jacob Arash Shahbaz, told BuzzFeed the case was over alleged sexual abuse. Collins-Rector did not respond to the suit, and the plaintiffs were awarded a multimillion-dollar default judgement, according to court records and the Associated Press.

With Brock Pierce and Chad Shackley eventually settling out of court, Marc Collins-Rector was the only one out of the 3 to ever be charged. Since Rector's arrest, he has been in and out of prison, changed his name, and is now a broke, disabled recluse living a life of anonymity in tiny little flat in the port town of Antwerp.

Found: The Elusive Man At The Heart Of The Hollywood Sex Abuse Scandal | Buzzfeed - 06/26/2014

Digital pioneer Marc Collins-Rector lost millions before he vanished, believing that movie mogul David Geffen wanted to destroy him. Now he's broke and alone — but the sex scandal he left behind continues to consume Hollywood.

In the early 2000's whilst in Spain, Rector, Shackley, and Pierce, had built up an extremely profitable business buying and selling virtual world gaming assets. By February 2006 Goldman Sachs, together with a consortium of private funds, invested $60 million into Pierce's (and Rectors) company. Netting Pierce $20 million whilst still retaining controlling interest in the company. The odd thing about this investment deal was that even before the Goldman Sachs deal was done, profits in IGE were falling, and by January 2007, the company was losing more than $500,000 a month. Although Pierce claimed Rector was never officially on the IGE payroll, an ex employee in a lawsuit, and Rector himself, claim otherwise.

TETHER

There has been a lot of controversy surrounding Tether and the Bitfinex exchange over the last year. Since it was revealed in March that Wells Fargo had blocked all international bank transactions with Tether, people have been speculating that Tether is no longer backed by USD. This has lead some people to believe that Tether Limited have been issuing millions of USDT coins a week and funneling them through their parent company, Bitfinex, to other exchanges, eventually trading them for Bitcoin.

In April 2017, we announced that Tether’s primary banks in Taiwan were being blocked by U.S. correspondent banks, including Wells Fargo. We are among a number of innovative companies in the digital token space experiencing such banking roadblocks. - Source

Although Tether is technically a cryptographic currency it isn't actually mined like conventional coins. Instead it is issued, it seems, when ever they feel like it. Much of how, why, and when Tethers are generated still remain a mystery, even though they claim in all there promotional material that they are a transparent company. Up until recently Tether stated in their legal documentation that there is "no contractual right or other right or legal claim against us to redeem or exchange your Tethers for money." This has since been updated.

For a company that advertises that every Tether is backed by 1 US dollar this legal statement seems rather conflicting. Here's a great blog post by someone on Seeking Alpha that has examined the movement of Tether and Bitcoin funds between exchanges, and how they were possibly used to manipulate the recent rise in the price of Bitcoin.

Regulators Must Investigate Bitcoin And Tether | Seeking Alpha - 12/11/2017

I examined the flow of funds originating from Tether Limited and determined that Tethers are being funneled to other exchanges through Bitfinex

Tether is a cryptocurrency issued by Tether Limited that is supposed to be backed by USD reserves, hence allowing traders to have a portable version of the dollar. Numerous indications of fraud (failure to produce an audit, opaque banking relationships, strong correlation between Tether’s supply, and the price of Bitcoin, among other things) led me to believe that Tether Limited was issuing fraudulent Tethers (i.e not backed by USD) and funneling them into other exchanges through Bitfinex to buy Bitcoin, rapidly increasing its price in the process.

The correlation between the recent price rise of Bitcoin, and the amount of Tethers being issued, has lead some people to believe that tether has been helping to pump up the price of bitcoin. We can see that Tether started off 2017 with a little under 15,000,000 coins, but now has more than 1.6 billion. This means they have issued well over a billion coins just in 2017 alone. Much of these was issued whilst Tether did not even have an offical bank account.

So if they had no bank account to back the Tethers, yet were still issuing them, how were they backed? To me, there can only be 2 possible reasons. Either they were/are lying about backing Tether with dollars, or they received more than a billion dollars investment from an unknown backer. Tethers odd business practices, and cozy relationship with Bitfinex has even made it to the pages of Bloomberg news.

There’s an $814 Million Mystery Near the Heart of the Biggest Bitcoin Exchange | Bloomberg - 12/ 05/2017

Among the many mysteries at the heart of the cryptocurrency market are these: Does $814 million of a digital token known as tether really exist? And what is tether’s connection to Bitfinex, the world’s biggest bitcoin exchange?

Some wonder whether tether has helped pump up the price of bitcoin, which recently surpassed $11,000 after beginning the year below $1,000.

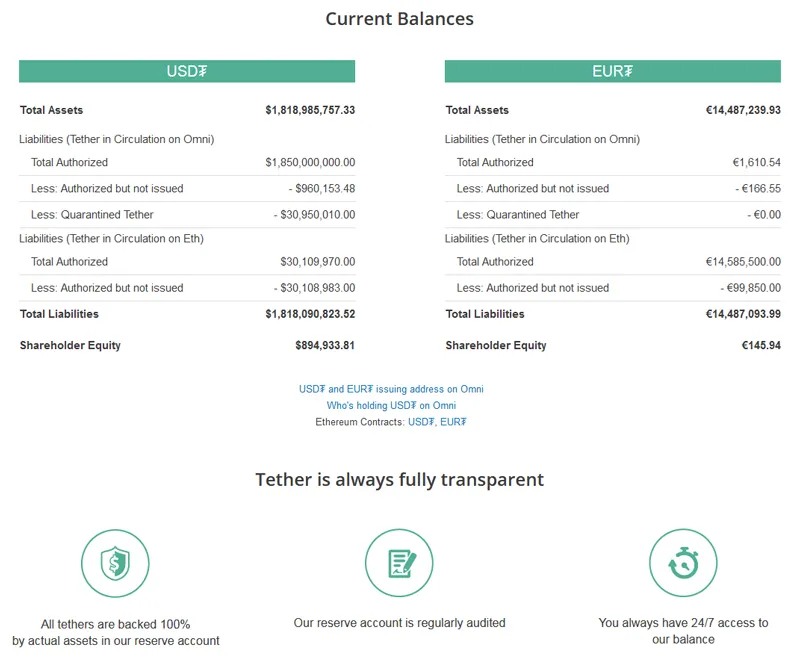

Here's Tethers current balance sheet.

CIA Conspiracy

Can Brock Pierce be trusted? Well, the author of this fully sourced timeline of events thinks not. In response to an open letter written by Brock Pierce in 2014 denying all sexual abuse allegations, and published by the Wall Street Journal, the blogger points out that Pierce failed to cover his time spent in Spain with Rector and Shackley, shortly after the first accusations were made in 2000.

Brock Pierce Timeline | Medium - Crypto Cuttlefish 06/19/2014

According to Debonneville’s original legal complaint (also reported by Julian Dibbell) Pierce spends this time trying to get Collins-Rector out of prison, going so far as to travel to Liberia to bribe / purchase an ambassadorship for Collins-Rector which would grant him diplomatic immunity.

There are at least 5 months before the summary judgement that the lawsuits are being written about in mainstream press, and 3 other DEN executives who are brought into the suits shortly thereafter. During this time, Brock Pierce is not living in some remote place without access to communication, he is launching an online business in Spain, so it strains credibility that nobody in America would have been able to reach him to inform him of the lawsuits as he claims. There’s no indication that he returns to the USA at any time before Marc Collins-Rector is released from Spanish jail, extradited and charged in New Jersey.

So, how is it that out of the 2 people who were arrested for allegedly being part of a high profile Hollywood pedophile ring only one ends up being charged and disgraced, whilst the other becomes a successful Bitcoin billionaire. Was Brock Pierce let off his crimes and then placed into a position of power within the digital assets/crypto space by the CIA? Is Tether a way for the US government to keep track of people cashing out of Bitcoin? Are the CIA secretly funding Tether through offshore companies?

Having the ability to potentially effect the price of Bitcoin, and also having access to peoples financial records at the point of cashing out, would be something I'm sure a lot of government agencies would be interested in. This leads me to speculate that Tether could in fact be a government funded cryptocurrency designed to monitor and control the crypto-sphere.

In my next post I shall be delving further into Bitcoins recent price rise, and also I'll be looking into Bitfinex's business relationship with Tether and Brock Pierce.