Introduction

Investors are always looking for what the next big thing will be. They browse down the coinmarketcap.com list in search of the top 20 coin movers and shakers. Perhaps a glance or two at top 100 or 200 coins, wondering which coin will make it to the top 20 next. In many ways, you invest in a share in a company, and optionally, a chance to be a part of a community. When you invest in a company, you need to see if the company is profitable, the community is respectful and of a certain mentality. Seasoned investors have though trial-and-error developed a sense for how to quickly decide if a coin is "good or bad". They go about the problem solving heuristically. Newcomers are advised to choose a more methodical approach as to what cryptocurrency to invest in. Much like following a treasure hunting map. No shortcuts.

Going about picking your earth-shaking cryptocurrency

There are currently nearly 1450 cryptocurrencies trading on 7500 marketplaces to choose from. Old investors have a nose for what is good and the caveats. New investors generally tend to go for top 20 coins. Here are a few tips for the newcomers on how to select a high quality investment. When you invest in cryptocurrencies, you're actually speculating in a highly volatile, non-mature asset. Chances are that all the money you invested will be gone. But risc calculations show that you can earn more than you can loose provided you find the right coin(s) to invest in. When you invest in cryptocurrencies, you're putting an amount of money=trust into the coin of your choice. By that, you're trusting the coin's developers, community and the inherent perks of the cryptocurrency to hold (and preferbly increase) the value of your initial investment.

Decide how much you want to enter the market with. Divide your portfolio into high risk, medium risk, low risk

Determine your needs beforehand (are you here for the long run, day-trading, saving for the kids, pensions-saving etc)

Have a clear plan on when to enter the market, when to sell, do you have stop-losses, when to cash out for profit-taking, when to buy. When to hold. Write it down. Ask someone knowledgeable to look at it, if it's sound, stick to it.

No whitepaper, no investment. Read the whitepaper and determine if the currency is worth your time and trust

Reading the whitepaper

While reading the magical whitepaper, see if the paper can help you answering the following questions:

A) How old is the cryptocurrency? Is it minable? What method does the coin use to validate transactions (mainly proof-of-stake or proof-of-work)?

B) What's the economics behind the currency, what's it's historical value, present value, it's scarcity, coin roll-out planned for the future?

C) What is the currency designed to accomplish? What real world problem is the currency trying to solve, or plans to solve and what is the timeline?

D) What are the key features and coin-perks laid out before you? What has been implemented to date and what will be? Is the crypto trying to solve problems for corporations, for people or for both? (corps first, people later, that's my guess)

E) Is there a roadmap/timeline for development of said features and perks?

Now that the whitepaper is done with, head to coinmarketcap.com

Find the currency and look at it's price graph, volatility, why the ups and downs, what patterns/events do the ups and downs follow? Is this a "pump'n dump" coin?

Which marketplace is the coin mainly traded at? Is said marketplace trading other coins that you have in your portfolio for ease of access and avoid unnecessary transactions?

How large is the marketcap and daily trading volume? If the volume is low, expect higher price volatility, harder to sell and buy for you when you decide to before moving the price too much.

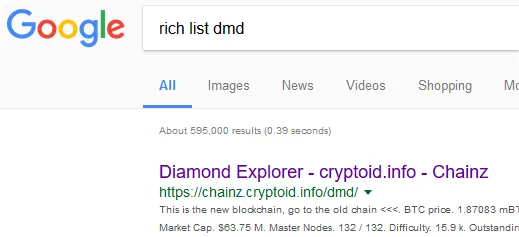

Now google your coin for its rich list and check out the largest wallets and network distribution:

Were looking for a situation where the top 10-20 holders or wallets of your chosen cryptocurrency cannot somehow alone or together make a concerted 51% attack on the network or your cryptocurrency (here we see in this case that top 10 DMD wallets only control 14% of the currency, and top 100 control 50% of the currency making an attack on the network virtually impossible. We also see that the absolute majority of the coins are in the hands of top 1000 wallets, which is outstanding.)

Are we investing in a fraudulent coin?

Now google your coin for "scam and bitcointalk.com" to see if there are any mentions of your chosen coin and potentially it's shady historical past. Google "problems and-your-chosen-currency".

Once you've gotten this far, it's time to get to acquainted to the coin.

A) Download its apps for your mobile phone and your desktop. Does it feel safe, is it robust, send some coins back and forth? Are transaction times long? What does one transaction cost?

B) Try to crash the software, is it crashable? is it easy to mend? is it easy to get help to fix your problem?

C) Are high technical skills required to setup different coin-perks/features? Ease of obtaining help if you get stuck?

D) Google "software problems and your-chosen-cryptocurrency"

Now, the one of the most important part, the community and the developers.

Go to the main channel or your chosen coins crypto-HQ, what chat-program are they using, any spammers around? What are people talking about? at what level of "intelligence"? What is the channel activity? What kind of people are frequenting this place? Talk to people, ask around.

How available are the developers, can you get any help? can you directly talk to the developers? What is the history of the team? Are they still working with the development of the cryptocurrency now or have they left? Why have they left? Are they replaced by a better/worse team? What are the long term goals for the team leading the currency?

Bottom line

The above algorithm is by no means exhaustive. It merely scratches the surface on how to pick a cryptocurrency worth our time and money to invest in. Based on my previous posts, my investor needs and the research I've made, Diamond coins (DMD) is a relatively unknown cryptocurrency definitely worth more attention. Looking ahead a couple of years when interconnected blockchains appear, this coin is not only time tested, scarce and secure, it is also provides an impressive amount of passive income, making DMD a close to the ultimate storage of value vs other cryptocurrencies.

In my opinion, DMD is that very special hard to find four leaf clover coin.

Best regards

Dr DMD

DISCLAIMER: THIS IS IN NO WAY AN INVESTMENT ADVICE AND IS TO BE TREATED AS INFORMATION FOR RESEARCH PURPOSES ONLY

If you're interested in a sneak peak into our community, fill in the form here and ask for an invite and you will receive an invitation shortly to our DMD-slack channel. You are warmly welcome!

(demon is from Dungeon Keeper, PC game from the -90s)

(fair lady is none other than Freya endorsing DMD!)