Hello Steemians! What is a currency? And what are the differences between cryptocurrencies and fiat currencies? Let's take a look at this today.

What is a Currency?

In the Merriam-Webster dictionary, a currency is defined as something (such as coins, treasury notes, and banknotes) that is in circulation as a medium of exchange. Since it is a medium of exchange, currency therefore has a point-in-time value. And since it has value, it can also be a store of value.

What is a Fiat Currency?

Fiat is a Latin word which means "let it be done". By definition, Fiat means a legally binding command or decision entered on the court record. A Fiat currency is legal tender whose value is backed by the government that issued it.

In the past, currencies were backed by physical good such as gold or silver, called commodity money. The United States, for example, used a gold standard for most of the late 19th and early 20th century. A person could exchange U.S. currency for gold as late as 1971. Since a fiat currency is only backed by a government, the value of it is directly correlated to the trust and the strength of the government that issues it.

What is a Cryptocurrency?

Crypto stems from the word cryptography and thus, cryptography plays a huge role in cryptocurrency. Borrowing the definition from Investopedia:

A cryptocurrency is a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature. Many cryptocurrencies are decentralized systems based on blockchain technology, a distributed ledger enforced by a disparate network of computers. A defining feature of a cryptocurrency, and arguably its biggest allure, is its organic nature; it is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.

Centralized vs Decentralized

Cryptocurrencies exist both in centralized and decentralized forms and it is actually quite subjective as to whether a particular cryptocurrency is centralized or decentralized. For example, Bitcoin is commonly known as a decentralized cryptocurrency. However, there exist a school of thought which says that Bitcoin is centralized given that much of the hashing power belongs to a few mining giants. Jimmy Song discussed the risk and impact of mining centralization in this article which is worth a read.

The reason why there is no clear line as to whether a cryptocurrency is centralized or decentralized is because there are various ways for centralization. This is depicted in the image below from MasterTheCrypto:

STEEM for instance, is arguably centralized within the witnesses as they are the only one who can produce blocks (mine more STEEM). In addition, the whales are still owning majority of STEEM. That being said, I have never seen any cryptocurrency, which is publicly traded and 100% centralized.

On the other hand, all fiat currencies are centralized, period. By definition, it is impossible to have a decentralized fiat currency.

Origin of Trust

Ultimately, currencies only have value when there is trust in them. In fiat currencies, we are told what to trust and were not given much of a choice. If you want to do business in Singapore, you have to use the Singapore Dollar. If you want to buy something in the United States, you use the US Dollar. There is not much of a choice and we are all forced to trust fiat currencies.

On the other hand, we are not forced to trust cryptocurrencies. Our trust on cryptocurrencies is grown organically. It is entirely our choice and that is the beauty of it. When one person trust Bitcoin, and he/she convinced another person that there is value in Bitcoin, the trust on it grows. The trust on cryptocurrencies is built through a network effect.

Take a minute to ponder. Would you prefer trust to be forced or grown organically? What will generate a strong sense of trust? In my opinion, organic trust is certainly going to be much stronger and it can only get even stronger over time. In the case of fiat currencies, we just need the issuing government to collapse/bankrupt and all trust would be lost. On the flip side, a cryptographically secured currency network will be much harder to be untrusted.

Digital or Not?

People talk about digital currencies and cryptocurrencies interchangeably, as if they are the same. I will like to point out that fiat currencies are also getting digitalized very quickly. In China, most of the spending are done through mobile payment methods and physical cash are getting less and less preferred. So it would be wrong to say that cryptocurrencies are synonymous as digital currencies.

Personally, I think the key difference here is that cryptocurrencies are digital from the start. In fact, cryptocurrencies are a by product of a decentralized, cryptographically secured and peer-to-peer payment network with built-in incentivizations. Hence, we have the digital network before we have the currency. In fact, we cannot have a cryptocurrency without a network. On the other hand, we first have fiat currencies then we built systems and payment networks around them. Thereby digitalizing them. This, in my opinion, is the key difference.

It is important to understand that systems are much more secure if it is designed to be secure from the start. Cryptocurrencies are designed to be a trusted payment network upfront while fiat payment networks are added on later. The design of a fiat payment network are restricted and constrained by limitations of fiat currencies. For instance, there is a huge cost to exchange from 1 fiat currency to another because it is physically costly to do so. Hence, this is also represented in fiat payment networks where one has to pay additional fees just to make cross borders payments. Our imagination on cryptocurrencies are not bounded by traditional fiat currencies. Hence, cryptocurrencies can be borderless, censor resistant, transparent, cost-efficient and basically unstoppable.

Deflationary vs Inflationary

There is a common misconception that all fiat currencies are inflationary and all cryptocurrencies are deflationary. The truth is fiat can be deflationary as well and cryptocurrencies can be inflationary.

For many years, the Japanese Yen is deflationary. While it may sound like a good thing at first, having a deflationary fiat currency is actually bad of the countries economy. This is a result of coupling the currency with the country's economy. In order to spur economical activities, there need to be a sustainable level of inflation (experts believe it is in the range of 2-3%). A healthy level of inflation will force people to spend instead of saving too much in the banks. With spending, there will be transactions and in turn there will be revenue/profits for companies. Because of this reason, most fiat currencies are inflationary and they are made to be inflationary by the central banks.

On the other hand, there is an equal share of inflationary and deflationary cryptocurrencies. Generally, cryptocurrencies that do not have a hard limit on the total supply is considered inflationary (e.g. Ethereum & Dash). While cryptocurrencies with a limit on the total supply is considered deflationary (e.g. Bitcoin & Litecoin).

Conclusion

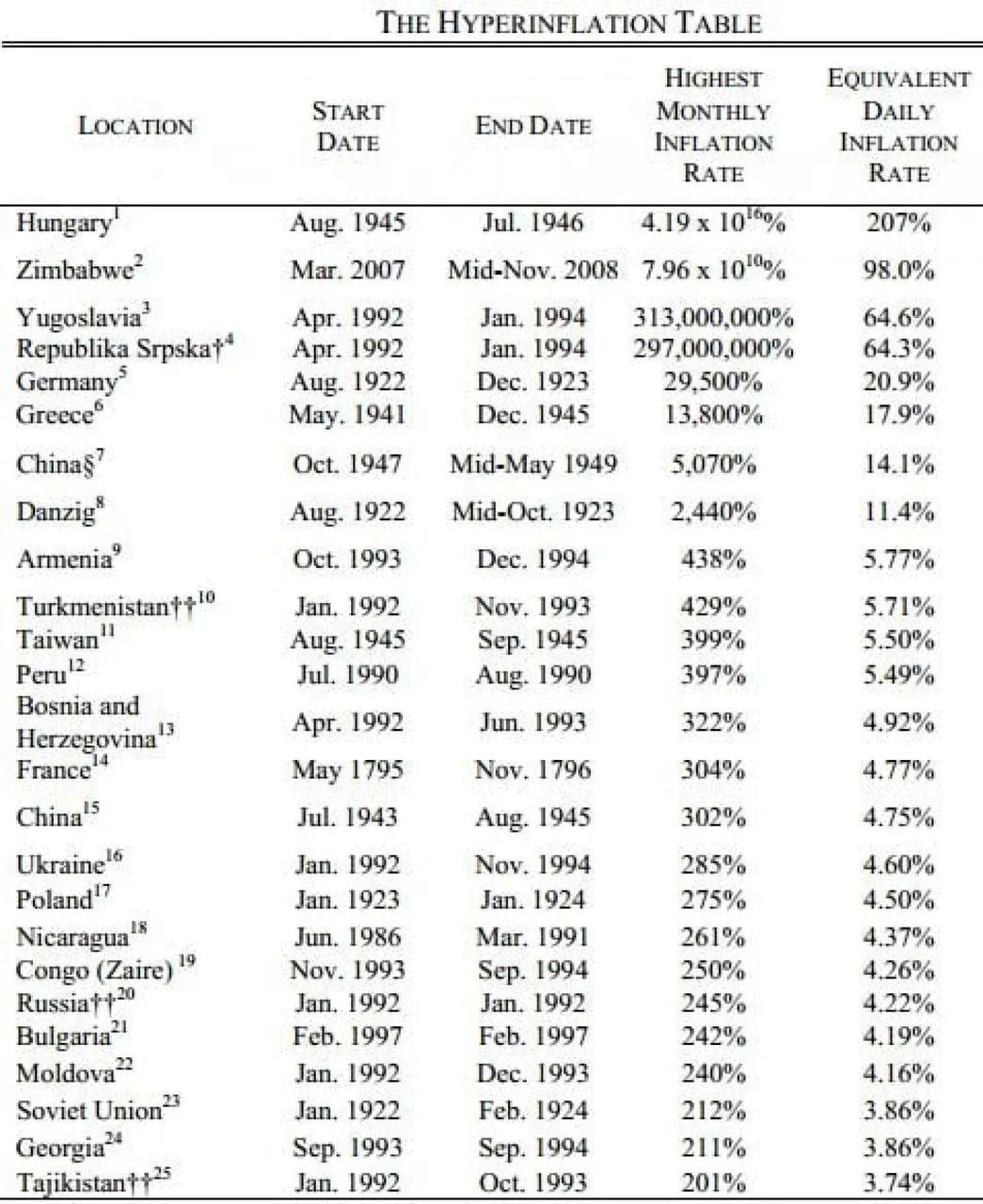

Fiat currencies have been around for centuries and has a history of failures. Taking a look at the table below, we can see how many times fiat currencies had experienced hyperinflation from around the world.

Ask yourself, how much of your assets are held in one particular fiat currency? I bet in most cases, our assets are held in only 1 or 2 fiat currencies. This makes us extremely vulnerable to sudden hyperinflation when the government of our countries suddenly turn unstable. In recent times, it has happened to Venezuela, Turkey, Iran and Nigeria. What is it for us to say it won't happen to us?

To me, buying into some cryptocurrencies serves as a hedge against the risk of fiat currencies. Another way I can hedge my risk is to buy into fiat currencies from different countries. But that is very difficult to achieve for common people like us. If you are not a resident of a country, it will typically be very costly for you to own and hold the currency of that country. Hence, owning some cryptocurrencies, serves as a good hedge in my opinion.

What do you think? Do you own cryptocurrencies to hedge against fiat risk? Thanks for reading!

Projects/Services I am working on:

You can find me in these communities: