I'm a dreamer. Always have been. Always will be. I dream of a life free from worry & stress. A life where I can sleep in when I want, spend more time with my family, and travel around the world visiting exotic locales. Most importantly, a life where I'm my own boss, in charge of my own destiny, with nobody to tell me what I can & can't do (except maybe my loving wife).

My reality is a long way from that dreamy ideal. For a long time I didn't have any hope. I thought I would be trapped in the iron manacles of corporate oppression forever. But a couple years ago a friend introduced me to Bitcoin. And I began to hope again.

Last week the price of Bitcoin surged to more than $1200, within spitting distance of hitting its all-time high (or ATH for short). To put that in perspective, I brought up my firm's commodities trading software and observed that our pricing engines were publishing a gold spot price of $1251.24 per ounce as of Friday afternoon.

Now, let's compare that with Bitcoin. Quoting Wikipedia:

The current all-time high was set on 29 November 2013 at US$1,242.00 on the Mt. Gox exchange.

So if Bitcoin breaks through that barrier to make a new ATH, it will be roughly equal in value to 1 ounce of gold. Pause and really think about that for a minute. A bunch of ones and zeroes, an intangible mathematical construct that you can never hold in your hands, could soon match or exceed the value of an ounce of gold. You know the term "precious metals"? Well now we're talking about "precious bytes".

I don't own any gold. Never have.

I do own a bunch of Bitcoin, bought way back when the price was "only" a few hundred dollars. And I couldn't be happier. It's maybe the third best investment I've ever made.

So you think Bitcoin is going to make your dreams come true?

Not by itself, no. It's true that to achieve my longed-for life of freedom, I'll need a source of money. And lots of it. Hard to escape that fact. The real question is, how do I get enough money so that I can walk into work one day, laugh in my boss's face and say "I quit, see ya wage slave"?

I like to picture my strategy as being somewhat akin to a network of tributaries, small streams that converge on one another to form a great torrent of water flowing down a mighty river to the ocean of a better life. Bitcoin is one of these streams of income. But it is not the only one.

I worry about my Bitcoin stream drying up, or being blocked by a fallen tree, or something. To ensure my raging river continues flowing unabated, I need multiple streams, so that if one is cut off the others may compensate for it.

What are these other streams you speak of?

Bitcoin is only one of a multitude of digital currencies, or cryptocurrencies as they are commonly known. There are many others, of varying quality & attributes. Some, like Bitcoin, are a form of digital money that you can use to pay for goods & services. Others, the so-called Bitcoin 2.0 coins, are more exotic and have additional uses beyond being a simple medium of exchange.

It is these more exotic cryptocurrencies that I like to invest in. They are at the bleeding edge of technology, pushing the industry forward and bringing much needed innovation. Think of Bitcoin as the Microsoft of cryptocurrencies, the behemoth that's been around as long as the industry has existed. You can't go wrong investing in the Microsofts of the world. But there's much more profit potential in companies like Google, Apple, or Facebook, all arguably more innovative and adaptive than Microsoft. They are the Bitcoin 2.0s. Bitcoin is great to have in my portfolio, but it's these other coins that will propel me over the finish line in the end.

Okay, I get the concept. Can you give me some specific examples?

Sure. Here are a couple of the more important streams in my tributary network:

Steem Power

You are already familiar with one very important Bitcoin 2.0 coin: Steem! My Steemit account is a cornerstone of my investment portfolio. It's also the worst investment I've made so far due to the ever decreasing price of Steem. But my strategy takes that into account, leaving me well positioned to benefit when the price eventually goes back up (I'm very much betting that it will).

Objective: accumulate at least 100,000 Steem Power over the course of a few years, enough to qualify as a decent sized dolphin, while earning "dividends" in the form of curation rewards.

Strategy: Dollar cost averaging is King here. I made my first Steem purchase on the Poloniex exchange, 1 Bitcoin (BTC) for 275 Steem last August. Wow that seems overpriced now. These days I typically buy in 0.2 BTC lots, with a new purchase for each 25% drop in price. All Steem gets powered up and I have never powered down, nor do I plan to before reaching my 100,000 Steem Power goal. I've invested more than twice what my account is currently worth, but the advantage of such a mechanical buying strategy is that when the price eventually bottoms, my average cost basis will be very close to the low. And if Steem ever goes back up to even $1, my worst investment ever will turn into my best.

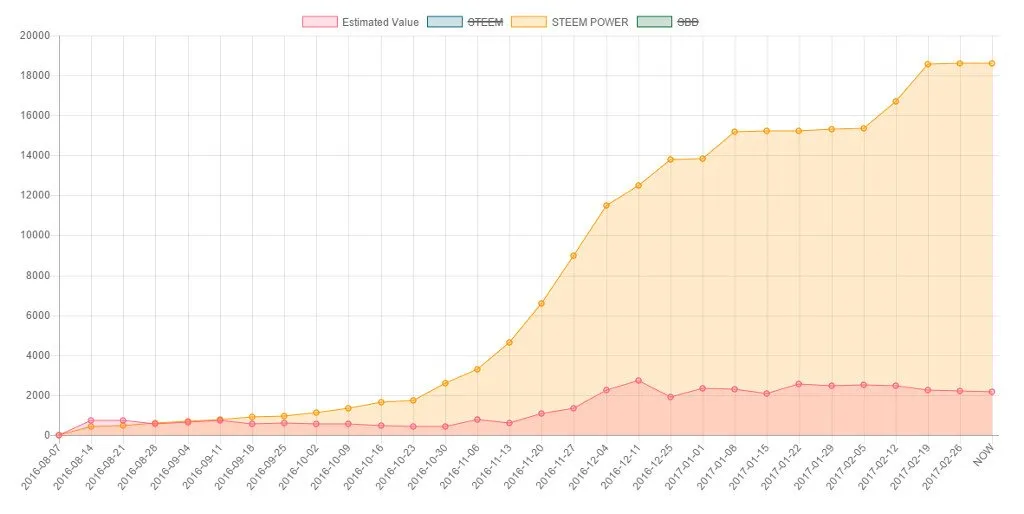

This graph from Steem Whales shows how my Steem Power balance has changed over the lifetime of my account, vs. the actual dollar value of my account. Today I'm nearly 1/5 of the way to my 100,000 SP goal.

Ether

I mentioned above that Bitcoin is the third best investment I've ever made. What then is my #1, you ask? That honor belongs to Ether, the cryptocurrency fuel that powers the Ethereum network. I missed the Ethereum crowdsale, but had the good fortune to stumble across a mention of it in early 2015, before the main Ethereum network went live. I was hooked on it from the beginning. Smart contracts are a revolutionary new form of software, and Ethereum is well positioned to be a leader in this space.

Objective: accumulate 1200 Ether (ETH), then hold long term for years, using the profits to pay off debt and diversify into other investments.

Strategy: I started buying into ETH when it first launched in August 2015, using a cost averaging strategy very similar in style to the way I buy Steem. I reached my initial goal in November of that year, then bought more using a loan in the first half of 2016 after the price took off. I have thus far achieved a return of more than 10x my initial investment. Hopefully Steemit will perform similarly at some future point.

Price graph from Poloniex, showing history of ETH / BTC prices since Ethereum's launch in summer 2015.

I hold many other cryptocurrencies as well, some of which are detailed in my introductory blog post from last August if you'd like to know more.

What are your most successful strategies?

Being successful in investing requires a calm, unemotional, logical mindset. One must be cautious and always skeptical of "the next great thing", which might turn out to be not-so-great after all. Protect your capital at all costs, because once you've lost it, that's Game Over. I invest according to these core strategies:

Look for bargains - smart money buys into new projects before they become widely known and start to take off. Always be hunting for original, innovative new cryptocurrencies that don't have a lot of competition, bring something unique to the table, and are not outrageously priced. Buying into every new pump & dump that comes along on Poloniex is NOT the way to do this!

Hold long term - I do short term trading every now and then, but I'm not very good at it. Being a day trader requires balls of steel and icy cold nerves. It's not for me. My greatest profits have been realized by ignoring day-to-day price fluctuations and holding long term. On some of my core investments, I will wait at least 6-12 months before I even consider selling any of it.

Use dollar cost averaging - As in the examples of Steem and Ether given above, I typically establish my large core positions by a series of small, regular buys over time, following a very mechanical purchasing schedule. This way you don't have to time the market (which I'm quite lousy at) or worry so much about falling prices. NEVER go all in with 100% of your funds at once. As a general rule, I stop buying once I have invested 5-10% of the net value of my whole portfolio.

Buy into ICOs - Initial Coin Offerings are a great way to get in on the ground floor of exciting Bitcoin 2.0 projects. I have bought into several, and made good money each time. Besides dollar cost averaging, this is the other primary method by which I add new streams to my tributary network of passive income. I'll have more to say about ICOs in my next post.

What do you see as being some exciting new opportunities in 2017?

This year promises to be quite a busy one for the cryptocurrency world. Next month we've got a final decision coming by the SEC on whether or not to approve the Bitcoin ETF planned by Tyler & Cameron Winklevoss. This decision, scheduled for March 11, will likely have a large impact on the price of Bitcoin regardless of which way the SEC rules. And later this year, several prominent Ethereum projects are scheduled to launch, which ought to have a very positive effect on the price of Ether.

I am personally focused on establishing 3 new revenue streams in the weeks / months ahead: Byteball, the Mainstreet Investment Fund ICO, and launch of the VIVA economic system by @williambanks are all fantastic opportunities. I'll end here with that as a teaser; more details on these projects to come in subsequent posts.

Until then, keep calm and Steem on!

Links for more info

My introductory post where I give more details on some of my investments:

https://steemit.com/introduceyourself/@cryptomancer/introducing-myself-tales-of-an-expat-code-slinging-crypto-enthusiast-part-2

My introduction to Ethereum: https://steemit.com/ethereum/@cryptomancer/ethereum-for-dummies-introducing-the-next-great-technological-leap-forward

Wikipedia article on the history of Bitcoin: https://en.wikipedia.org/wiki/History_of_bitcoin

This article proves my point that holding long term is a great strategy: Man buys $27 of bitcoin, forgets about them, finds they're now worth $886k

More details on the Winklevoss ETF: Bitcoin could soar if the Winklevoss ETF is approved

For more posts about cryptocurrency, finance, travels in Japan, and my journey to escape corporate slavery, please follow me: @cryptomancer

Image credits: The first two images in this post are taken from Pixabay and used under Creative Commons CC0. The two graphs are screen shots from my desktop PC. The last picture is a photo taken on my iPhone.

Achievement badges courtesy of @elyaque . Want your own? Check out his blog.