Investors today have a binary feeling towards cryptocurriences. They feel that it’s a poor investment or they become obsessed and invest every penny they can spare.

It is my believe that everyone should hold a percentage of their wealth in Crypto but not all of it. The amount an investor puts into crypto will be heavily determined by their income, life situation and tolerance for risk. The cryptomarket is a very volatile space but it does have the potential for exponential growth. The pot-odds are very high.

When I first started in crypto I put down a conservative two percent of my net-worth. It was in 2013 and I saw immediate gains, which then turned into immediate loses as the market crashed. I didn’t get emotional and continued to hold what I had purchased and conservatively bought more throughout the years. It is now 2017 and the crypto portion of my portfolio has seen significant gains and makes up a much higher percentage of my total portfolio.

Overall portfolio

Below I have outlined what a typical portfolio may look like that includes traditional stocks and bonds and adds in cryptocurrency. This was modeled around someone age 30 who has a medium-high tolerance for risk.

Stocks (ETFs) 55%

Bonds 30%

Crypto 15%

so if you had $10,000 to invest your investment might look like:

Stocks (ETFs) $5,500

Bonds $3,000

Crypto $1,500

Crypto Portfolio

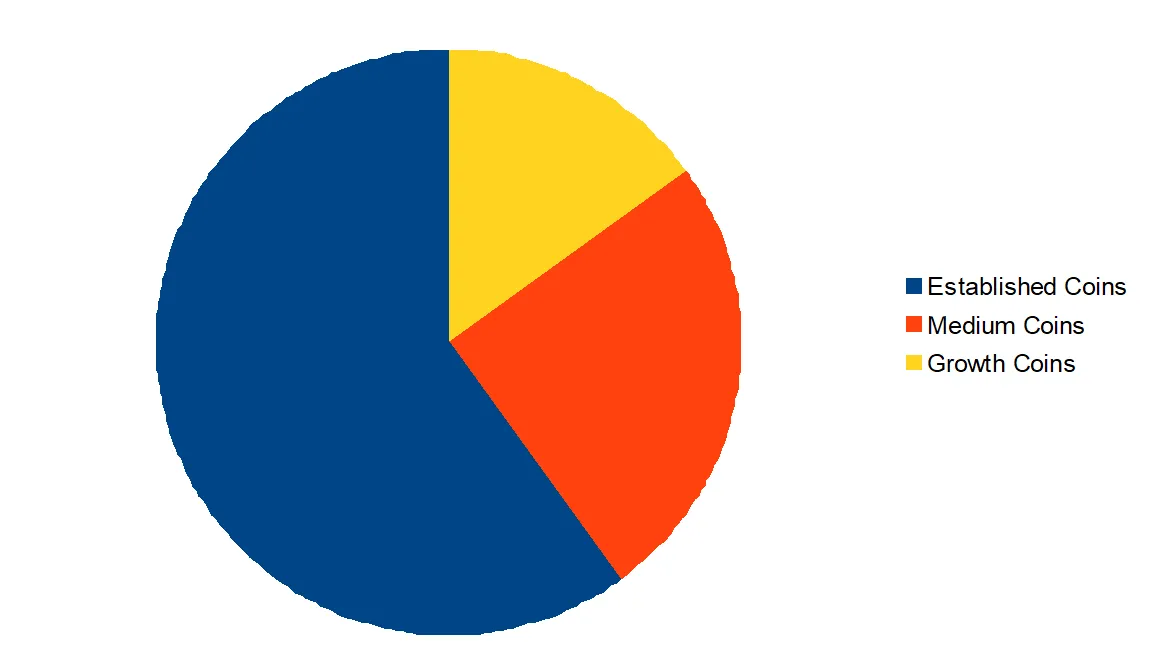

Within the Crypto portion of my portfolio I like to diversify into different type’s of coins, simplified into three categories.

Established coins:

These coins have been around for years and will likely be around 5+ years from now. They are your “safe” bets within the Crypto world. They will not get you rich over-night but should steadily increase in value over the years.

Medium Coins:

These coins have been around for awhile and have a medium share in the market cap. These coins bring real world value and could see an increased rate of adoption which could net a large increase in value.

Growth Coins:

These are non-established coins that show potential. Their current market price is based solely on investor speculation. These coins have the largest chance to bring significant returns but are also the most risky to hold as a lot of coins can’t deliver on the promises they make.

The percentage of each holding is up to the individual and their tolerance of risk vs. growth. I myself try to hold a 60/25/15 split.

Established 60%

Medium 25%

Growth 15%

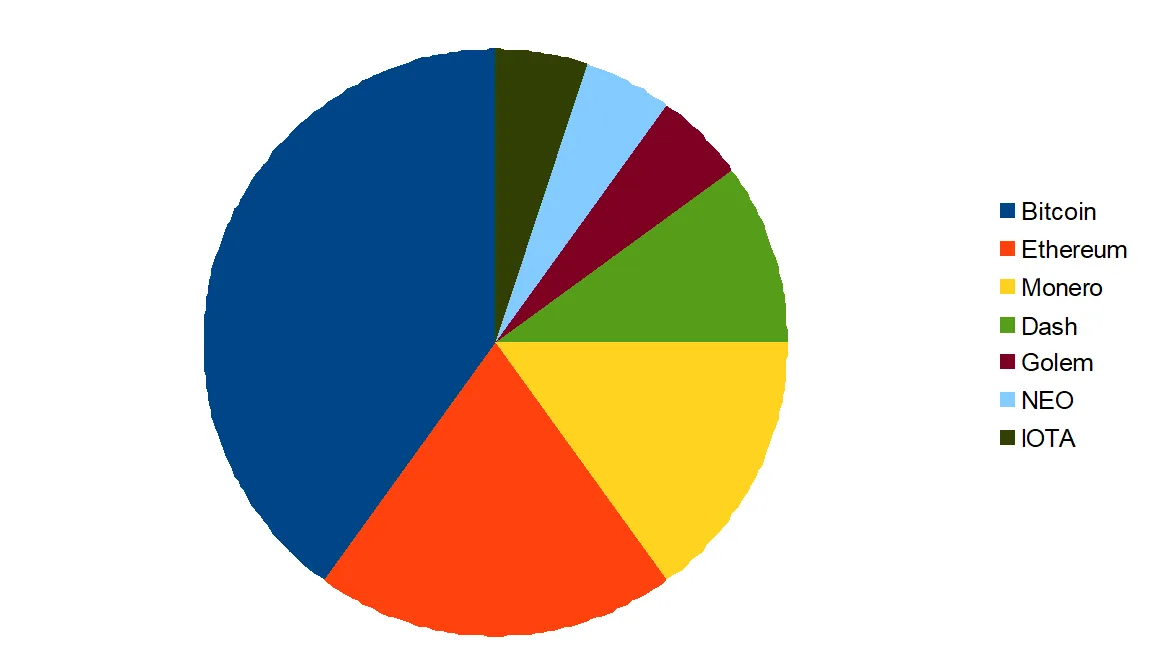

In-depth Diversified Crypto Portfolio

Below is an example of what a well diversified Crypto portfolio may look like. Again, this is just an example and not a strict science. Actual percent is entirely based on someone’s personal preferences and tolerance for risk. The number of holdings (types of coins) is also up to individual preference. Holding more types of coins doesn’t automatically mean your portfolio is safer then someone who only holds 2-3 types. In my experience holding 5-7 different types is the sweet spot in diversity.

Established

Bitcoin 40%

Ethereum 20%

Medium

Monero 15%

Dash 10%

Growth

Golem 5%

NEO 5%

IOTA 5%

Remember to do your own research and only invest in technologies you believe in.

If you would like more information on adding crypto to your investment portfolio please visit my blog.