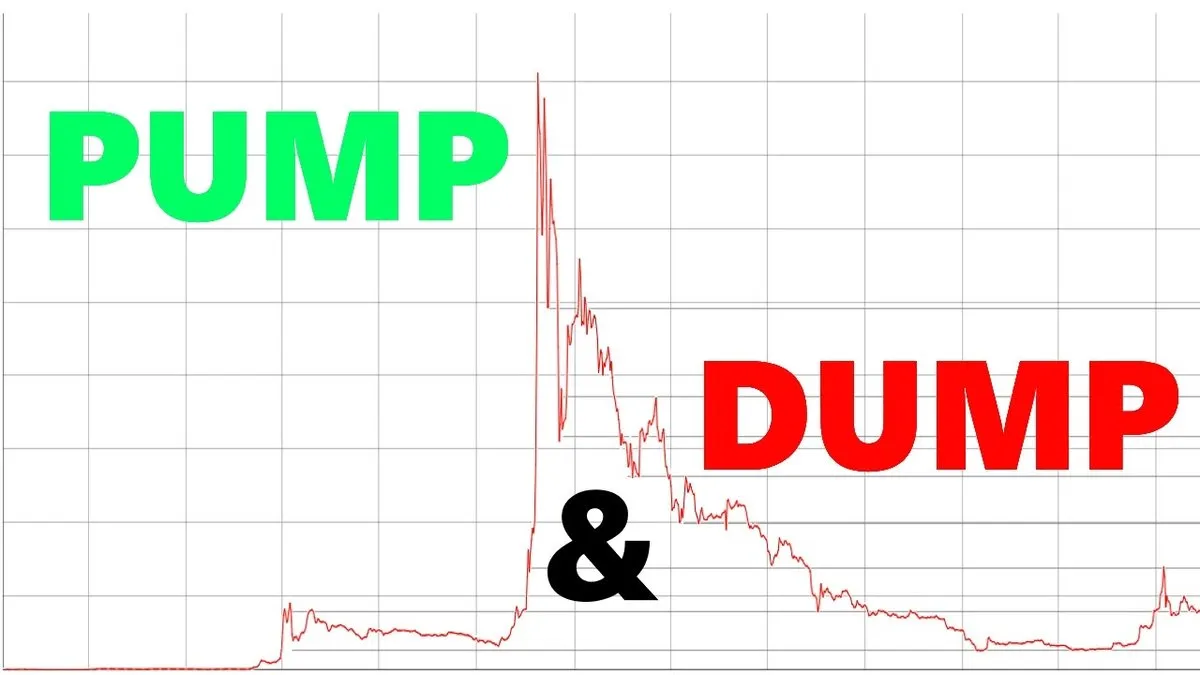

The crypto wolves and their multi-million ‘Pump and Dumps’

A six-month investigation by the Wall Street Journal, that examined crypto exchange data and online communications between traders, claims to have found 175 “pump-and-dump” schemes for 121 different crypto-tokens.

Cryptocurrencies are sometimes treated as investment tools for traders that want to make a profit by betting on the price of them, and of that use, a big speculative market for cryptocurrencies has derived. But, according to an investigation carried out by The Wall Street Journal, there is more than just only the invisible hand of the market moving these prices up and down. Supposedly, there are groups that carry out what is called “pump and dump” operations to profit from the investments of other traders and then letting the prices fall hard, artificially manipulating prices.

These groups act under the veil of Telegram encryption to carry out their operations, and they are focused on little and new cryptocurrencies, those with little participation in the market, to manipulate them better for their purposes. More known and popular coins that have a big market share are more difficult to move, because of trading volumes.

As strange as it can be, these moves are not entirely illegal, because cryptocurrency markets are not regulated. If these prices were being manipulated in the stock market, the story would be different. But there is more to it.

The groups operate in exchanges that list little to no activity cryptocurrencies, like Binance, one of the biggest exchanges in the whole crypto world that lists a lot of cryptocurrencies that are obscure to many traders.

It is impossible to know how many of these groups are out there, but the investigation estimates that more than 60 groups are active with more than 236.000 followers in total. There might be more in other encrypted invitation services like Discord, a popular room-based chat platform. The truth is that more vigilance and regulation is needed to protect investors from these kinds of stealth attacks to the market, that is being manipulated even as we speak.

Share Your Thoughts Below Thanks