If you've been following the world of cryptocurrency you'll soon realise that it really is the wild west with crypto projects popping up every day and disappearing just as fast and doing so with a lot of their investor's money. Cryptocurrencies because they are open source allow people with nefarious intentions to start a project even if it only meant to fail and secure them some money.

The good thing is that the free market that is cryptocurrency quickly realises when a project is not worth it and corrects itself fairly quickly, relatively speaking. Once such popular crypto trend is lending platforms, while there are many currently in circulation the most popular would have to be Bitconnect which recently exit scammed investors out of millions of dollars. Next to follow was Davor and Falcon.

You can read more about Falcon coins scam exit in my post here

While lending platforms are getting the rap for being scams it has not stopped new projects in this space from popping up and launching ICOs.

Why are lending coins so popular?

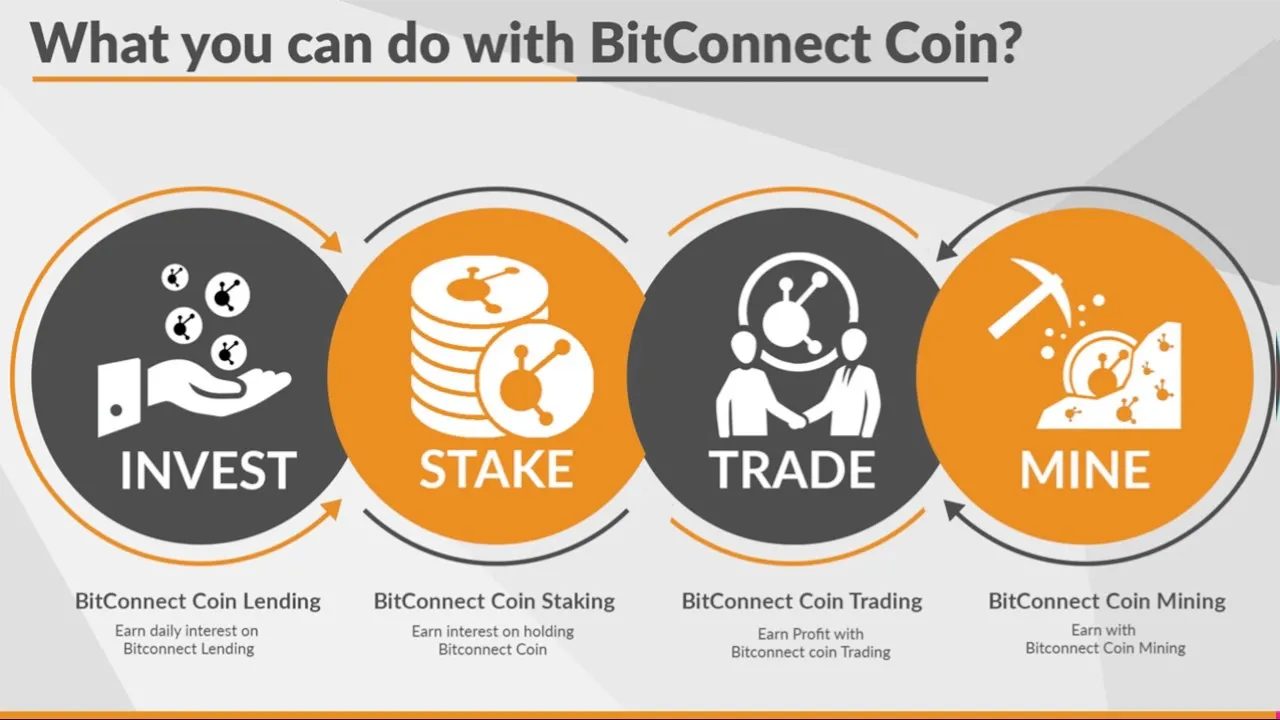

The simple premise of lending platforms is that If you have some Bitcoins, you may want to see them work for you instead of lying around in a wallet they can do it for you.

What are lending coins?

Lending in cryptocurrencies has the noble idea of providing financing for world areas where finding bank loans may be difficult or impossible. Also, it is a tool for traders who want to sell borrowed Bitcoin at a high price and then buy them again to return the loan.

While the concept of decentralised loans is a great idea there is still way too much risk in getting it right, it will also never guarantee returns and when they do interest would be similar to what banks would give you.

Unfortunately, the truth is not an attractive pitch when you're looking for investors and many lending platforms try to lure in investors by offering eexorbitant interest returns and using new investor money to reimburse high interst rates.

As new investor interest increases the demand for their tokens drives up the value and allows them to the added room to attract investors. However as the coin peaks and funds to repay investors begins to wane, then its time to pull of an exit scam. Which usually means shutting down the platform and making off with all the viable cryptocurrency (Like BTC, ETH and LTC) sent to the lending platform by investors.

While leaving investors with a useless coin that either only had value in its proprietary platform or will be sold off on exchanges by those who want to minimize loss

How many lending coins are there?

There are well over 60 lending platforms based on cryptocurrency the most popular projects still running are Ethlend, Lendconnect, Salt Coin and thorn coin.

Where to find lending coins?

If you're still not deterred and have a strong stomach for the risk you can find lending platforms here -

https://www.cryptolendingprograms.com/

How to analyse a lend coin

My personal opinion is to stay away from lending coins all together but that's not to say you cant make money on it if you get in early. If you are in a lending platform or you're doing research prior to investing I recommend looking at the following factors when evaluating your prospects.

hype analysis

- website traffic and ranking from Alexa

- google trend ranking by Google

- telegram , whatsapp group and follower activity

- social media activity and followers : facebook , twitter , etc

- populatiry from bitcointalk.org forum

- coin sale speed and demand , difficulty level

- post-ICO black market coin transactions on social media and other communication group

scam analysis

- website ranking vs coin sale speed

- how coin sold pattern, sometime Developer buy their own coin. our job is to analysis that pattern

- Hosting and domain whois Analysis

- social media activity and followers (real or bought)

- website coding check and github coding provide .

- coin or token issuance configuration check (scammers plainly copy coin/token settings from other ICOs)

- website and whitepaper tardiness

Potential analysis

- coin sell speed vs sold pattern - the Hype of the ICO itself

- How's post ico black market coin transaction

- Developer Update and Plan

You can find all this data at a site like -

Remember the risk

Even the best lending sites and services contain risk, and despite due diligence, the receiver of the loan cannot be fully vetted. Users on Reddit have been critical of Bitcoin lending, at the time when direct gains from the market price appreciation of Bitcoin are much higher than interest rates.

If it sounds too good to be true, it probably is. Anyone that promises to double your Bitcoin in 24 hours or 1% daily compound returns, if they speak about guaranteed returns then its is probably running a short-term pyramid scheme.

Doing your research

At BadBitcoin.org, you can check any service or address before sending Bitcoin. Remember that any Bitcoin transaction is irreversible and non-refundable. Even if the address does not bear the signs of a scam, research it to be certain it would not lead to losses.

Final word of advice

If you're going to dive into lending platforms make sure you don't invest more than you're willing to lose, resign yourself to losing money and if you do get gains i would suggest to pull it out rather than reinvest.

Follow me for more

For more on cryptocurrency feel free to follow me @chekohler