So the crypto market cap has plunged to $60B from a high of $115B -- a staggering 48% drop since last month. If this were Dow Jones or the S&P 500 then there'd be chaos in the streets. In the crypto market it's called "just another bloody weekend."

I got into Bitcoin relatively late in 2013. Since then I've gone through multiple crashes caused by China and Mt. Gox. In the middle of the Bitcoin crash in 2014, Ethereum was conceived. I boarded the Ethereum train because it was a no-brainer. Then came the DAO hack which caused Ethereum to crash and split into Ethereum (ETH) and Ethereum Classic (ETC). Then starting February of this year the crypto market skyrocketed. Billions of fiat money poured into Bitcoin, Ethereum, Ripple, Litecoin, Dash, and other new cryptocurrencies. Then came the ICO mania which pushed the crypto market to new dizzying heights, only to crash it down by those same projects as they sell ETH into fiat to fund their projects. And then there's the looming climax of the Bitcoin scaling war this August. This brings me right smack in the middle of the current crypto market crash.

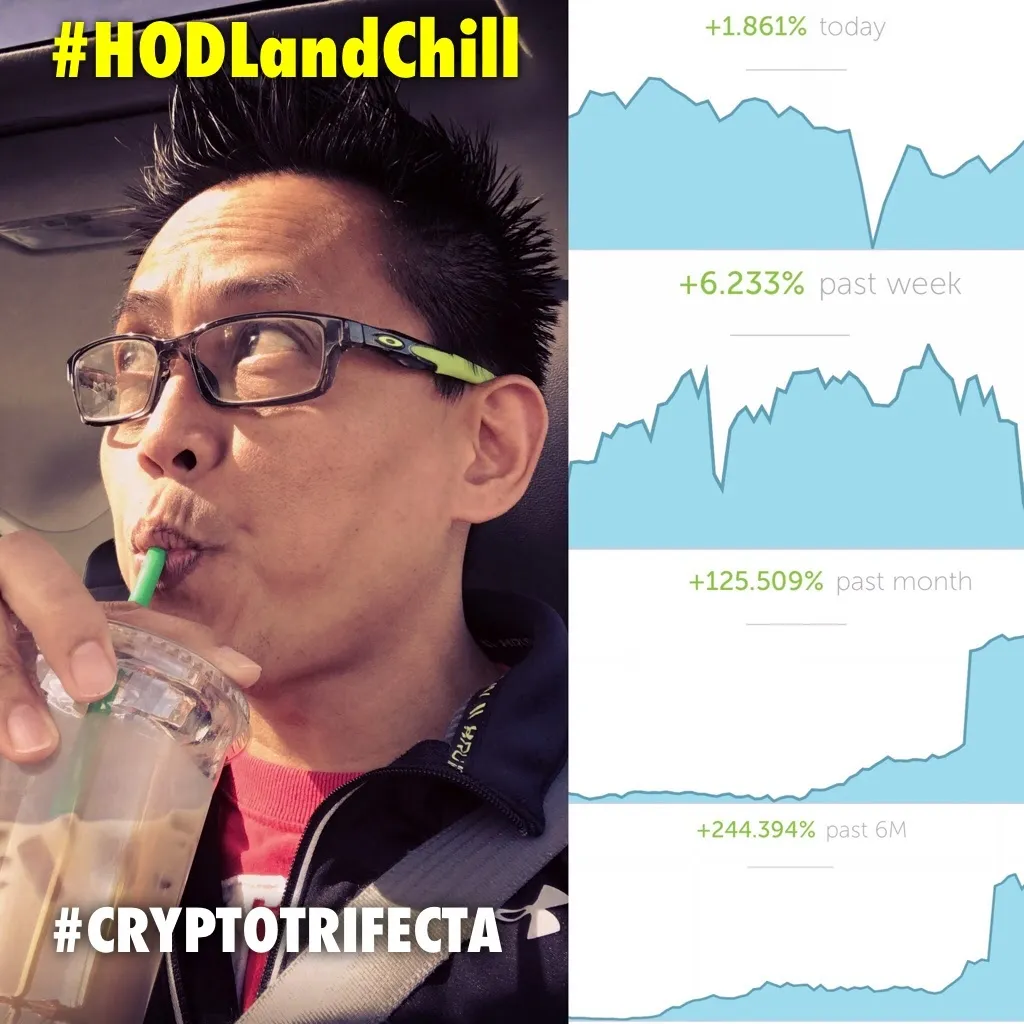

I could've taken profit when ETH peaked this year and have some comfy savings in the bank. Then just waited to get back into the crypto market when it's on the bull run again. But I'm the classic HODLER. In spite of the series of crypto market crashes since 2013 I haven't sold any crypto into fiat. Of course, I would never advice anyone to do it the same way as me. Everyone has different levels of tolerance when it comes to losing money. From a perspective of a seasoned trader, what I'm doing is plain madness. And they're right. But I'm in it for the long haul. I"m a hodler not a trader. So I just continue to pick my Cryptotrifecta then #HODLandChill.

If the crypto market is "Stock Market on Steroids" during bull runs, then when it comes to market irrationality, the crypto market is "Stock Market on Ayahuasca" -- with lots of moaning, stomach grumbling, puking, and shitting while tripping along the way. But like an Ayahuasca trip, those who brave the crypto market and embrace the chaos generally come out on the other side transformed with new insights and sense of purpose. This is what happened to me when I plunged into the Bitcoin rabbit hole in 2013. And I intend to keep digging into this rabbit hole until I reach that sweet spot that I've been searching for.