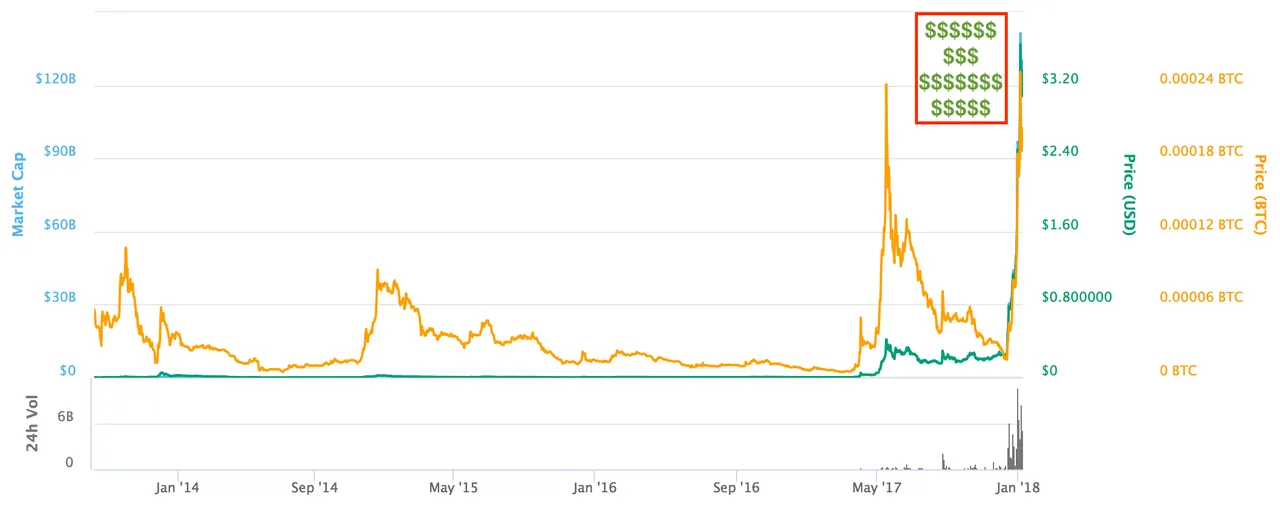

Lately, I've been having conversation after conversation with friends and family about whether people should buy into cryptocurrency right now. There's such a wild sense in the crypto world of the money-making possibilities; peoples' eyes tend to bug out when you tell them that if you made less than 10x on your investment in 2017 that you're doing something violently wrong. Practically every single price chart for every single cryptocurrency looks like this:

This is Ripple's all-time price chart from coinmarketcap.com

People see this and they feel like total dipwads for not buying Ripple (XRP) a year ago: in 12 months, XRP gave investors a 515x return! $2000 invested in XRP 12 months ago is now over $1 Million. So the natural question is something like this: "how much higher can it go?"

Everything that follows is my personal opinion, and not investment advice.

I first got into Bitcoin in November 2013 when the price of BTC was about $350. By the time I'd gotten myself verified with Coinbase and linked up a bank account, BTC was at $700 -- and it topped out just over $1000 before it started sliding back downwards for the next couple of years. In the meantime, I also got involved with Memorycoin (where my $100 investment was quickly worth less than $10) and Bitshares, and also picked up a few thousand Nxt and some other random coins. As prices were crashing, it all felt like an expensive hobby: lots of people talking about lots of interesting projects, but nobody really knew what cryptocurrency and blockchains were for. As a result, the air quickly escaped the bubble and prices fell to fairly low levels.

In 2014, quite a bit of money changed hands in cryptocurrency, but there wasn't anything like an economy.

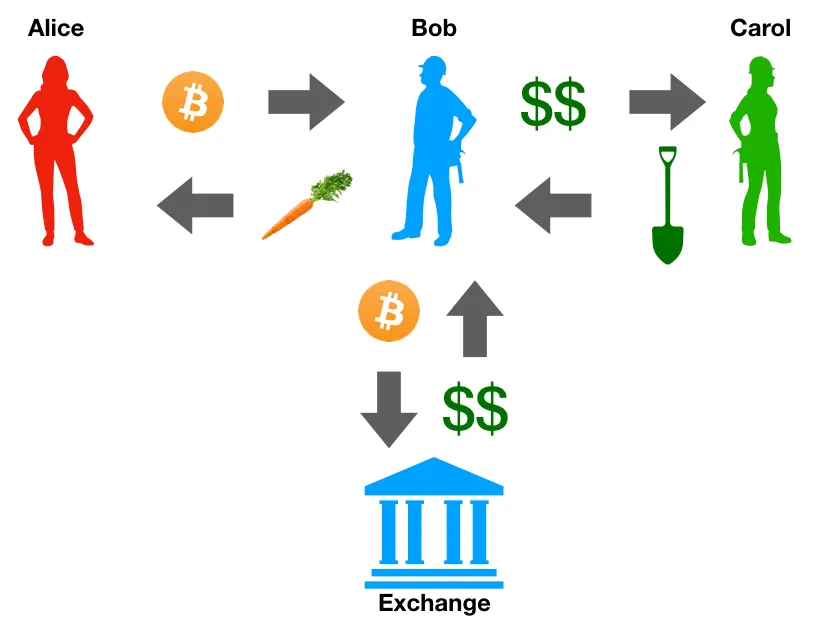

It seems to me that one of the reasons the 2013/2014 bubble popped so quickly was that there was no economy for cryptocurrencies. By "economy," I mean some kind of cycle of commerce: I trade bitcoin for carrots, my farmer trades bitcoin for fertilizer, the fertilizer guy trades bitcoin for machines, and the machine company pays me in bitcoin for engineering services. In 2014, there was no cycle. Almost any time you bought something with bitcoin, the person you sent the bitcoin to would simply sell it to pay their costs. If the farmer needs to buy fertilizer, but the fertilizer guy only takes cash, then the farmer needs to sell his bitcoin before he can engage in commerce.

The best we could do with cryptocurrencies in 2014. Carol doesn't accept bitcoin, so Bob has to trade his bitcoin for cash before he can trade with Carol. Not all that great, since when Bob sells his bitcoin to the exchange, it pushes down the price of bitcoin.

Is today really all that different?

Suppose that the fundamental problem in 2014 was that nobody knew what to do with their cryptocurrencies other than sell them. Is today really all that different? Is there something economically meaningful that you can do with your cryptocurrencies that you couldn't in 2014? Yes, there are some businesses which accept cryptocurrencies. It's a bigger scene now than it was in 2014, but at least in the United States there are some pretty severe barriers to commerce in Bitcoin.

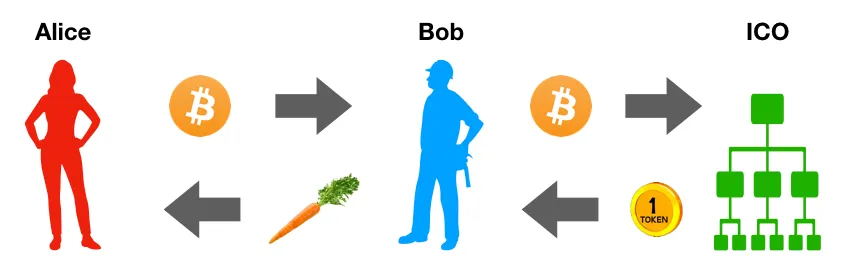

However, I'd argue that there is basically one major difference between 2014 and today: Today, there is unlimited demand for cryptocurrencies from ICOs. Not only is there unlimited demand for cryptocurrencies, but ICOs almost never even accept fiat currencies. (Yes, I know that ICOs existed in 2014 as well -- but not even remotely on the scale that they do now in 2017-2018. The big difference is Ethereum, which has been an extremely important enabling technology for fundraising.)

In 2018, Bob now has something to do with his bitcoins that does not involve immediately selling them: He can invest in the latest hot ICO!

How is this different from the 2014 picture? Now, there's something that anybody can do with their cryptocurrencies that delays their sale. Why is this important?

Every time you sell a Bitcoin, you directly push the price of Bitcoin down a tiny amount.

However, when you contribute a Bitcoin to an ICO, the price of Bitcoin essentially remains constant -- but now you have your magic ICO token that you bought, and you ascribe value to it because you traded something valuable for it. Get it?

On paper, by contributing a Bitcoin to the ICO, you just created a Bitcoin's worth of value out of thin air. The original bitcoin that you contributed still exists, but now you have these brand-new tokens that are also worth a Bitcoin. How do we know they're worth a Bitcoin? Because you just traded a Bitcoin for them.

Should that kind of value-printing magic make us nervous?

Maybe. It's always important in an asset bubble to ask "where is the value coming from?" In a perfect world, an ICO really does create literal value because it's putting funding in the hands of talented individuals who will be empowered to go employ their talents to build a powerful system.

However, in a world like today's where every ICO is giving investors immediate positive returns, it's likely that very many of those ICOs are not truly creating value; rather, they're just riding the wave of hype and leaching value out of the system. Unfortunately, I think it can be very difficult to tell which ICOs are "good" and which are "bad": the market might not immediately reflect that value is being leached out. This can lead us to a dangerous place where cryptocurrency prices are vastly higher than they truly deserve to be.

Furthermore, there still is no "cycle of value."

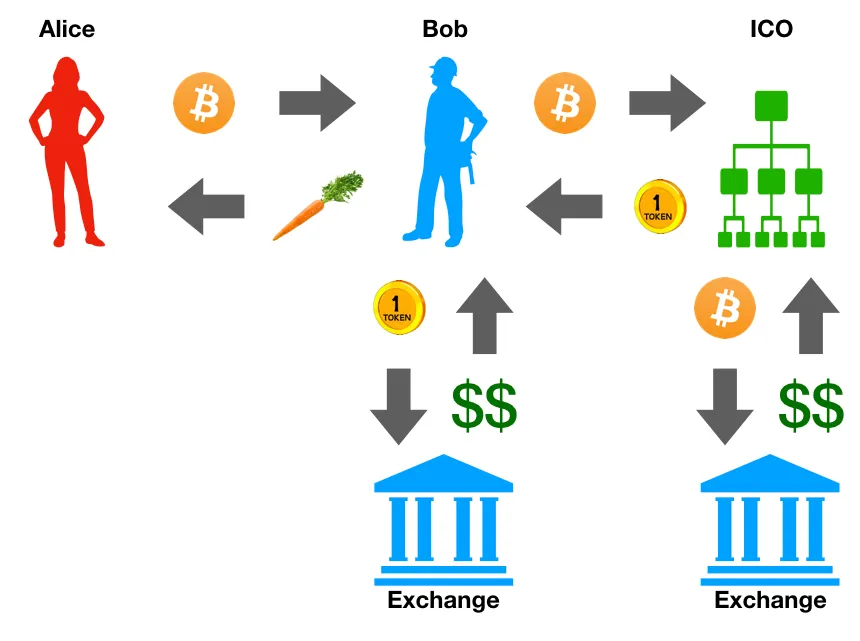

Recall that in 2014, Bob had to sell his bitcoin before he could engage in commerce. Today, that is still likely true for people who are raising money through ICOs. That is, the real picture probably looks like this:

Even though Bob didn't sell his bitcoin, the ICO will eventually have to as they pay employees, rent server space, etc. Also, remember that Bob needs money to buy tools -- so he'll have to sell his magic ICO token as well to pay Carol. Thus, the fact that there's demand for cryptocurrencies from ICOs doesn't mean that nobody will eventually sell the cryptocurrencies.

This is an idea that I'll continue to explore as I have time to write about it. Until then, I'd like to hear your thoughts on this question: "Are ICOs creating value out of thin air, and should we be worried about that?"