Origins

Ethereum was first specified in 2013 in the white paper written by the infamous Vitalik Buterin, which at the time was a programmer working with the Bitcoin Magazine. Vitalik argued that Bitcoin needed a way to allow programming decentralized applications on the Bitcoin blockchain, but his idea at the time didn’t gain much popularity between the Bitcoin community. Failing to gain agreement, Vitalik proposed the development of a platform with a scripting language, which after looking through various Sci-Fi related articles, he decided to name Ethereum. (In later interviews, Vitalik said he chose the name “Ethereum” because it had the work Ether in it, which refers to the hypothetical invisible medium that allows light to travel throughout the universe).

Later in early 2014, the development of the Ethereum Project started through a Swiss company called Ethereum Switzerland GmbH, later the more known Ethereum Foundation was created. The development of the project was funded through an online public crowdsale of the Ethereum token (Ether) which users could buy using Bitcoin.

The creation of the Ethereum Blockchain

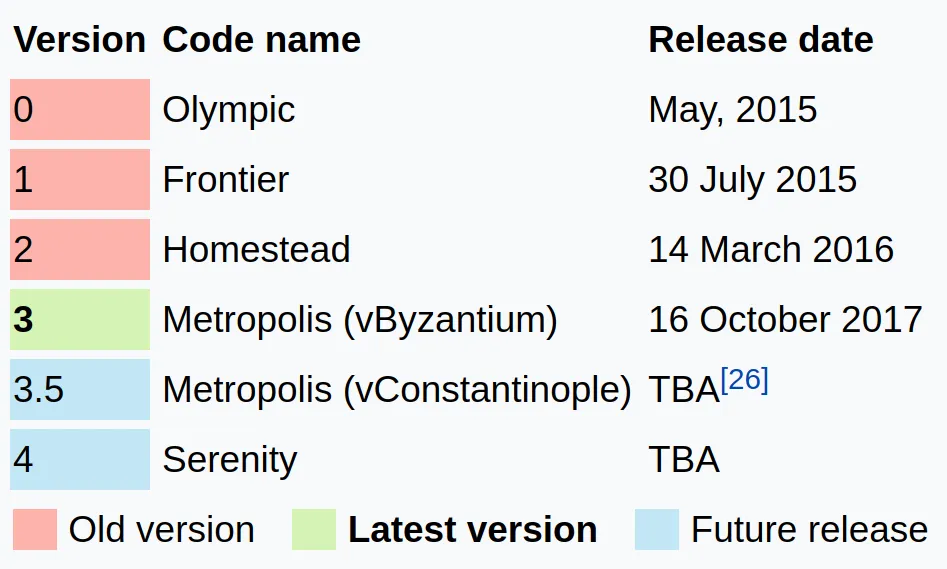

In May 2015, the proof-of-concept (version 0) Ethereum release codenamed “Olympic” was announced. It was the last of these prototypes, and provided users with a bug bounty with a prize pool of 25.000ETH for testing the limits and the security of the Ethereum blockchain.

After that, version 1 codenamed “Frontier” marked the experimental release of the Ethereum Platform in July 2015.

Version 2 codenamed “Homestead” was released in March 2016 and was considered to be the first stable release of the Ethereum Platform. This release made the price of ETH jump from less than 10$ to more than 50$ by the end of March and more than 185$ by mid-May. This release also made the ETH trading volume and market cap increase by more than 20x!

Next release (and current one at the time of writing), was version 3 codenamed Metropolis (vByzantium) and was released in October 2017 and implemented more flexibility for developers of smart contracts.

The DAO Hack and Ethereum Classic

In 2016 the so called DAO (Decentralized Autonomous Organization), which had been developing a set of Smart Contracts over the Ethereum Platform, raised a record $150 Million in a crowdsale to fund the project. The DAO was exploited in June 2016 when $50 Million in ETH were stolen by an anonymous entity. This sparked a tense debate in the crypto community about whether Ethereum should perform a hard-fork to return the stolen funds to their owners.

As a result of this dispute, the Ethereum Network split in two, where Ethereum hardforked returning the stolen funds, and Ethereum Classic was born by some individuals following the original blockchain leaving the funds in the thieves wallets on the grounds of the “immutability” of the blockchain.

The technology behind the Ethereum Platform

Let’s start diving deeper into the world of Ethereum, because here is where things start to diverge a lot from Bitcoin.

The fundamental cryptocurrency of the Ethereum Platform is called Ether. It is used to pay for gas, a unit of computation used in transactions and smart contracts computation. A common mistake all over the crypto community is to mistakenly call the cryptocurrency “Ethereum” instead of Ether.

Ether is listed under the code $ETH and traded on all almost all cryptocurrency exchanges, making it the second largest cryptocurrency by volume right behind Bitcoin itself.

As with all other cryptocurrencies, the blockchain provides validity for each Ether. And basically the same public-private cryptographic key logic found in Bitcoin applies to the Ethereum Platform (almost). Ethereum address have “0x” as the prefix (known to be a common identifier for hexadecimal notation) and are 256bits long (Keccak hashes). It is also worth mentioning that user addresses are completely indistinguishable from smart contract addresses.

The biggest differences with Bitcoin are that Ethereum has no defined max supply at the date of writing, but it is expected to be implemented at some point to prevent inflation. Also, block time is around 15 seconds compared to the 10 minute mean block time of Bitcoin.

The ether production rate when mining new blocks is constant, instead of halving every few years like Bitcoin. Also, the proof-of-work algorithm is Ethash, which reduces the advantage of specialized ASIC miners.

Ethereum fees tend to be considerably lower than those of Bitcoin.

Smart contracts and Decentralized Applications development

Ethereum Virtual Machines (EVMs) are the runtime environments responsible for Smart Contracts in Ethereum. It is a 256-bit stack designed to run the same code exactly as intended. Each Ethereum node runs an EVM implementation, and in February 2018, there were more than 27000 nodes in the Ethereum Network. EVMs have been implemented in C++, Golang, Haskell, Java, JavaScript…

Ethereum Smart Contracts are based on different computer languages, which developers use to program their own decentralized applications. They can be written in Solidity which is similar to JavaScript or C, or LLL.

Smart Contracts are public as is everything in the blockchain, thus it can be used to prove functionalities, like for example probability in online casinos. As of 2018, there are more than 250 live Decentralized Applications running on the Ethereum blockchain!

Hope you enjoyed chapter #2 of Crypto Tales, telling you everything about Vitalik's Ethereum Platform. If you enoyed, please leave an upvote and follow me now to keep track of the upcoming articles of the Crypto Tales Series!

(Check out chapter #1 of Crypto Tales here! https://steemit.com/cryptocurrency/@antonvalletas/monero-the-cryptocurrency-for-privacy-enthusiasts)