Economists and pundits pontificate about what gives cryptocurrency value. Even Bill Gates chimed in saying he would short Bitcoin if he could. But he can.

Money has value because of wide-scale public confidence that others will also accept it in exchange.

What gives Bitcoin value

But underlying or backing money has always been the productivity of society. In the agricultural age, land was precious because a significant portion of our economic activity was involved with the production of food:

Even Julius Caesar and Andrew Jackson restored economic order by backing the debt with land. But the Industrial Age and now especially the Knowledge Age is rendering food production a shrinking share of the economic activity, and thus money is no longer backed by land. Thus borders, empires, and nation-states are becoming irrelevant!

Even a peasant worker in China realizes this stating, “We live in an economic age, a family cannot rely on a bit of land.”

(make sure you click my links for the background information)

The What Happens Next series touches on some of the concepts of this period of rapid, epochal technological paradigms shifts:

Specifically the Future of Money episode:

Note the concerns about privacy and phishing theft expressed in the above video are fixable.

Bitcoin generates revenue indirectly

Warren Buffett doesn’t like Bitcoin for the same reason he doesn’t like gold, because in his opinion it generates no revenue and the only demand is speculative depending on other people wanting to buy Bitcoin.

In my opinion, what Buffett fails to appreciate is that Bitcoin is the reserve currency of the decentralized digital goods economy which blockchains (or more generally decentralized ledgers) will create. The revenue that will be generated by said economy will end up back in Bitcoin because Bitcoin is the de facto reserve currency of that said economy.

Bitcoin Likely to Replace Gold as a Reserve Asset

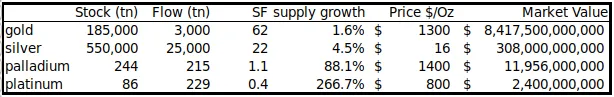

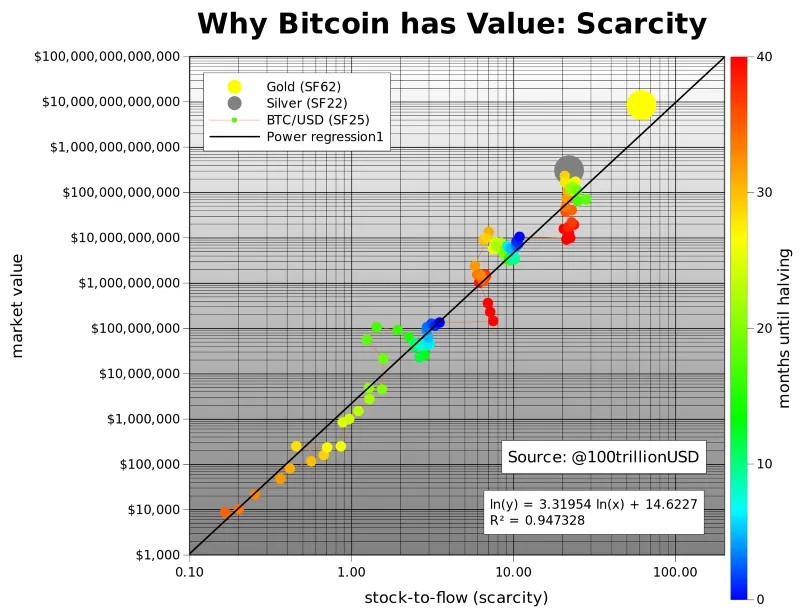

Monetary assets have a much higher stock-to-flows ratio and thus higher valuation, because of the power-law distribution of wealth and the fact that the wealthy spend a much smaller fraction of their wealth per annum than the poor:

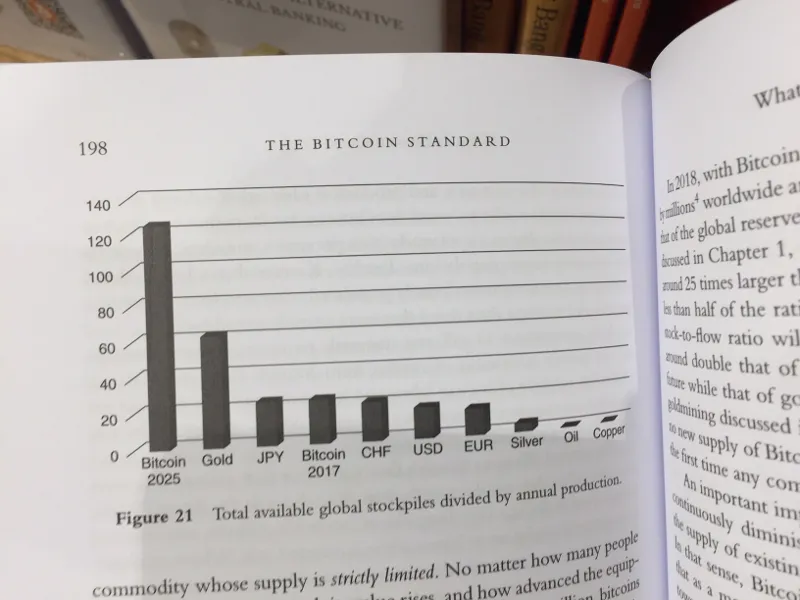

Bitcoin’s stocks-to-flows ratio is already higher than silver and as transaction fees rise and only the wealthy can afford to transact on-chain, the stocks-to-flows ratio is likely to climb higher than gold.

I discussed in a comment post on another blog of mine, @PlanB’s stock-to-flows model in more detail along with a projection of the future Bitcoin price:

Modeling Bitcoin's Value with Scarcity

As I discussed in a comment post below this blog, The Bitcoin Standard book on page 198 also mentioned the stock-to-flows model from which @PlanB sourced the idea (←listen from the 9min mark of linked audio interview) :

Stocks-to-flows Projection of Bitcoin’s Relative Market Capitalization

See also in the comment section below, the ongoing lengthy debate I have been having with Martin Armstrong via email and his responses to email comments in his blogs. The latest Armstrong blog in this debate is obviously a response to my most recent emails. Some of the content of those recent emails is summarized here and here in my recent Quora posting activity.

Armstrong makes the following incorrect arguments in his blog:

- He conflates Bitcoin with tangible commodities.

- He asserts that the world will continue to value tangible assets more than intangible assets.

- He asserts that central banks only will hold interest bearing assets.

- He asserts that institutions’ need for interest bearing assets precludes Bitcoin being a reserve asset.

- He asserts that no unit-of-account has ever been the main reserve asset.

Let’s rebuke each of these myopic assertions:

Bitcoin is an idealized commodity because it doesn’t have any marginal cost of production as the total supply is fixed at 21 million. By idealized we also mean it is trustless (aka trustproof or not relying on any trust), something which gold is not because governments can distort the supply of gold or silver (as they have done in the past) and gold can be regulated by governments because it has to physically cross their borders. Armstrong has not read famous mathematician and game theoriest John Nash’s Ideal Money manifesto (c.f. also), so he does not have a clue.

I explained in this blog that the world is moving away from tangible assets and towards digital assets. Does Armstrong not observe the rise of the Internet? Has he not noticed that the youth collect digital assets and spend an increasing portion of their time and income on digital goods. The recent reserve unit-of-account the dollar is not backed by anything except the power of the USG to enforce its clout and viability in the world. As Bitcoin rises to have more clout than any nation-state, it will have more clout and confidence than the dollar.

Central banks have historically held gold which is not interest bearing unless you lease it out. Bitcoin can also also be leased out (for use in shorting for example) for those who want some income. Central banks will be forced to hold some Bitcoin because Bitcoin will likely become the fulcrum unit-of-account for the world (or at least at the stature that gold once was if not the only dominant unit-of-account), because for one thing bond vigilantes are going to be able to use Bitcoin to punish and discipline sovereign nation-states, which was one of the main thesis of Nash’s Ideal Money paper. Also some lenders are going to prefer to lend in denominated in Bitcoin, so they will not be paid back in Zimbabwe dollars as the sovereigns blow up as they always do.

Institutions are more or less irrelevant to this discussion. They may choose to hold sovereign debt and blow up as they always do. Bitcoin is actually here to discipline and destroy democracy and collectivist institutions.

The dollar has been the unit-of-account of the main reserve asset. No one is arguing that everyone will hold onchain Bitcoins. In fact, I clearly pointed out that most people will not be able to afford to transact onchain because the 1 MB blocksize will drive the transaction fees above $5000 eventually. Armstrong is conflating unit-of-account with the variety of finance vehicles (such as bonds) denominated in that unit-of-account. One would not expect someone of Armtrong’s credentials to make such a lame conflation.

Armstrong is also very disingenuous to publish that linear scale chart when he blogs right before he thinks Bitcoin is about to make a correction. He enjoys gloating during this temporary Bitcoin correction. He is fooling his readers because the logarithmic scaled chart clearly shows a repeating pattern of highs and crashes that occur long a logistic (aka log-normal) adoption curve. Armstrong is going to end being the huge fool and highly discredited when Bitcoin rises to over $50k and then over $500k. He has been warned numerous times, so he has no one to blame but himself.

Armstrong has also essentially lied in his subjective desire to fool his readers, by misrepresenting the findings of a report about about the extent of regulation of the cryptocurrency exchanges being actually quite high and that the ten reputable, popular exchanges tend to have mostly genuine trading. The 95% wash trades are how the unpopular exchanges attempt to make their exchanges look more popular and liquid than they actually are. But the most disingenuous facet of Armstrong’s blog is that he fails to acknowledge that exchange trading is off-chain. Martin continues to display his ignorance about the technology of cryptocurrency and blockchains. Thus 100% of on-chain transaction volume for Bitcoin is genuine (unless miners are mining their own transactions and paying themselves) because on-chain transactions have a fee that is given to the miners. Repetitive wash trades on-chain would be very costly.

(Tangentially note that Armstrong may be correct about another coming decline in Bitcoin before it bottoms before climbing north of $50k in next few years, but that is not relevant to this main debate. However, there also appears to be developing a potentially bullish ascending triangle)

I wrote privately:

Armstrong wants to believe that Bitcoin is not changing the world. His confirmation bias prevents him from studying the issue objectively. He wants to believe Bitcoin is at most either another Tulip bubble (perhaps of a lesser scale) or another alternative asset among many 1000s or 100s of assets. He lacks discernment.

People just have a hard time trusting something that is completely intangible and not backed by institutional money or violence.

Well put. Most people don’t yet have confidence in money not backed by Max Weber’s theory of govt’s monopoly on violence. Bitcoin was put here by the global elite to disrupt that nation-state model.

Most people can’t accept that John Nash’s idealized asset theory is sound. They think that an asset has value because it’s physical. Actually assets only have value because they have demand. The tangible facet of assets has historically been a manifestation of humans lacking the technology to demand digital assets. And then lacking the technology to enforce scarcity of the digital assets outside of a government enforcement regime (e.g. copyright). Bitcoin enforces the scarcity algorithmically and via game theory, because there can only exist one longest-chain which is immutable, stable fulcrum, immutable token supply, and maximizes fees (with the small 1 MB blocks) for maximum security (actually this point needs an essay to be explained comprehensively). That is a crucial point that nearly nobody recognizes.

EDIT: Armstrong has released 1 apologetic and 3 more idiotic blogs in response to my refutations above. I’m noting them so we can laugh at Martin when Bitcoin rises above $50k and then $500k and then sustains for decades as a store-of-value with the indicative high stocks-to-flows ratio.

Has backtracked from claiming 95% of all Bitcoin trading is fake. Note I forgot to emphasize in my prior rebuttal that the logistic adoption charts clearly show that there’s ostensibly manipulation of exchange trading that drive the peaks in the Bitcoin price and subsequent crashes. But to imply that 95% of the Bitcoin adoption is fake is contrary to the evidence. The high stocks-to-flows for Bitcoin clearly indicate that majority of the demand is long-term buy and hodl.

Claims Bitcoin’s $20k peak was a rogue wave, lol. What a doofus! Continues to use a linearly scaled chart which obscures the logistic curve growth and adoption pattern.

Conflates securities law concerning ICOs with Bitcoin when in fact the SEC has already ruled that Bitcoin is not a security. What an Dunning-Kruger-esque idiot! Any number of nations could declare exchanges illegal for ICO tokens (i.e. not Bitcoin), but other exchanges would continue operating in other countries and the traders from any country can use the exchanges in any country. For example, the SEC does not even have the jurisdiction to tell US citizens that they can’t trade securities that trade offshore. Armstrong just does not seem to comprehend how impotent the nation-states are versus this globalized phenomenon blockchains and cryptotokens.

Claims that Facebook’s stable value coin pegged and backed with fiat bank accounts will be of greater value than the trustless, permissionless Bitcoin. Bwahaha 😂 He just doesn’t get anything we’ve tried to explain to him about why his proposed corrupt (print more money so the banksters and socialist pension plans can buy up all the valuable assets) “Solution” to the sovereign debt crisis offer nothing to solve the underlying political problem. Bitcoin is going to help burn that socialism shit to the ground in a scorched earth outcome and thus (civil, regional and maybe even world) war is coming. The nation-state is antiquated. The world is moving to a globalized financial model with greater local decentralization. After monarchy came democratic nation-states. Now humanity is moving on to the next paradigm for greater cooperation which has been facilitated by these light-speed networks known colloquially as “the Internet”.

Demographic shift towards a digital economy

I wrote on Quora:

Motorcycle and even big bike demand seems to still be growing in the Philippines. Perhaps also India and China? Your astute analysis seems to be tailored to the USA?

Is this a general trend of most physical luxury products marketing in the West is moving bespoke upscale due to the changing demographics of income and the Millennials preference for digital goods?

P.S. I’m 53.6 and I still want a big bike, but as you say it depends on my health, finances, and vitality.

Rise of the decentralized digital, intangible goods economy

Juan S Galt posits at 4:21 that Bitcoin is the default investor choice because of imperfect information on (i.e. less confidence in) altcoins. I have extensively explained/argued that it’s instead driven more by dominance in first-mover network effects (which includes regulatory maturity as Robert admits at 1:16:16) and being the only reliable store-of-value because only the original, 1MB blocks Satoshi Real Bitcoin is immutable. Thus can’t be successfully forked and thus the money supply can’t be increased by self-destructive social consensus. I explained at that link why Bitcoin becomes the de facto (i.e. not by fiat decree) reserve currency of the cryptocosm ecosystems of altcoins.

Note Richard claims his BitcoinHEX is more immutable than Satoshi’s protocol Real Bitcoin. Although true that the smart contract can’t be altered (unless it has a designed feature to do so) after placed on the blockchain, Ethereum has in the past forked itself to rollback and change The DAO smart contract. So this seems like a failure to accurately compare to the Nash equilibrium game theory of the dominant network effects of the original Bitcoin which prevents fork-offs from successfully displacing the original immutable Bitcoin. Satoshi’s protocol has never been changed (Bitcoin Core is not Real Bitcoin and will end up being donated to the miners!). More fair would be to claim his BitcoinHEX is about as immutable as Satoshi’s Bitcoin protocol. Richard even admits the Nash equilibrium when he states at 1:01:00, “attaining consensus is harder as the system grows larger.”

Even Armstrong recognizes that the dollar became the de facto global reserve currency, i.e. not by fiat decree. Altcoins aren’t just for payment systems and thus we can indeed have a plurality of them (especially while the main use case is speculation about which altcoin will end up having the killer app of crypto which I discuss below). Armstrong also has a related myopia where he incorrectly thinks that Bitcoin needs to be a (traditional, tangible goods commerce) payment system adopted by the masses in order to be adopted globally.

As Juan alludes to at 6min, Richard correctly explains from 8min that speculative demand for altcoins creates demand for Bitcoin given it’s the reserve asset of the cryptocosm ecosystem. But Richard is incorrect to argue that altcoins are the only demand driver for BTC. There’s also demand from HODL store-of-value, investment and increasingly (as the global financial system collapses, c.f. also and also) for moving funds out of the fiat banking system.

Note Richard is spot on correct from 13:15 wherein he explains the critical importance of onboarding. I also discussed this concept of onboarding this in my aforelinked Medium comment post. Also his astute point (which I have also thought out previously) that newbies have to get burned by scammy altcoins (and the USAF social consensus scam due to SegWit donations theft coming to Core in the future) in order to appreciate the immutable Real Bitcoin (the one that can’t be forked with its 1 MB blocks). Richard from 18:30 makes an astute mathematical point about the cryptocosm being inherently geared towards longs, not shorts. Note manipulation can be long or short. But the fact that shorts can borrow on margin doesn’t ameliorate his point because longs can also. Shorts only have an upper hand when bubbles must collapse.

But Richard has a category error or strawman dichotomy where he makes a distinction between the relative value of payment systems versus speculation-and-investment. He even insinuates from 1:04:00 that there’s no other possibilities. Armstrong also has that myopia. From 9min where Richard insinuates that his BitcoinHEX pyramid-scheme speculative gimmick pump (c.f. 1:32:26) coin could drive onboarding demand faster and sooner out of the current crypto winter correation, he’s implicitly continuing his point that payment system demand couldn’t drive demand on the next Bitcoin bull market.

The strawman is complementary to Armstrong’s other myopic category error of presuming that decentralized cryptocurrency won’t gain traction because nation-state governments dictate which currency is used in their internal national economies. Armstrong is referring to the physical goods economy and tangible barter transactions as a potential substitute.

Armstrong fails to appreciate that as evidenced by the prior section of this blog, the world is leaving the industrial age and moving into a digital goods (aka knowledge) age. Ironic because Armstrong does recognize the demographic shift to intangible money, but fails to assimilate that also accompanies a shift to intangible goods which the government can’t effectively regulate. Remember no government (not even Bolivia nor Russia) have effectively (or even officially) banned Bitcoin, because it is impossible for them to enforce a ban. How would they block the transactions of digital goods? It’s akin to the futility of governments attempting to block decentralized, peer-to-peer file (e.g. BitTorrent) downloads. They would need to block all encryption (which would make the Internet fail, which is an integral part of their system of control) and send a policeman to monitor every person’s computer. Total nonsense what Armstrong is thinking. Armstrong even conflates banks freezing fiat accounts with the freezing of cryptocurrency (the cryptocurrency was not frozen!). What a hypocrite because even Armstrong has easily subverted attempts to block his digital goods sales. That dinosaur, buffoon Armstrong even fails to distinguish between decentralized and centralized payment systems, thus implicitly failing to understand why decentralization is orders-of-magnitude more resilient. Has Bitcoin ever been offline it its 10 years of existence! Will every nation simultaneously turn-off the Internet without defection by any nation? Come on now Armstrong, get a grip on reality and stop writing absolute nonsense.

Countries have only banned exchanges which they can regulate because of the large exchanges are centralized entities and because the exchanges require fiat bank accounts. The digital (i.e. intangible) goods economy can be significantly independent of the fiat banking system! Armstrong is incorrect to presume that our thesis is the digital goods (aka knowledge) age (which Armstrong erroneously conflates with an Age of Enlightenment, c.f. also, also, and also) will force the tangible economy to use decentralized cryptocurrency. Rather it will be the faster growing, fledgling economy and eventually become larger and more significant than the tangible economy. The future for example is a 3D printer in every home and ordering CAD designs over the Internet and printing the actual product locally. Even for example the technology for the sintering of 3D printing of metal is improving. This new economy is the only way out of the otherwise hopelessness for the Millennials.

The two strawman arguments can be related in a way that empirically demonstrates how readily the separate conclusions formed from the separate errors can be overcome. Specifically let’s consider the case of social networks on a blockchain (by which I include in my plans decentralized clones of Wikipedia and Reddit, in addition to disintermediating behemoths such as Facebook, Google, Amazon, Apple, etc). I have explained (c.f. the prior link and my blog archives) why their disintermediation is imminent and to be in high demand. So Richard’s thesis is the market cap of gold is $5+ trillion but the market caps of the various payment networks such as Visa, Mastercard, and Paypal, don’t total to even $1 trillion. Well that is expected by the power-law (Zipf's law) distribution of wealth that there’s less value amongst those who spend versus those who save and invest. But that presumes that the only non-speculative FOMO use case for Bitcoin (or its ecosystem of decentralized cryptocurrency) is payment systems (and in Armstrong’s myopia, payment systems for tangible goods only). Yet the blockchain is going to be applicable for payment systems for intangible digital goods integrated into the context of the disintermediation of entire sectors of the behemoth Internet economy. These are Fat protocols (c.f. also) where the token is an investment that captures of the market capitalization. I even explained the flaws in the — “economics of bundling” and ChangeTip Must Die cognitive load — arguments against the feasibility of microtransactions for intangible goods. Armstrong erroneously thinks that existing payment systems already cope with real-time (i.e. fractions of a second confirmation) microtransactions (i.e. fractions of a penny) and do so in the necessary permissionless, trustproof context.

The market capitalizations of the large Internet social media companies total to over $5 trillion. And again my thesis is this intangible sector is growing faster and will increase to perhaps $50+ trillion capitalized by 2032. These large capitalized fat protocols will be a self-feeding upward spiral of de facto (i.e. not by fiat decree) widespread CONFIDENCE, which is (as Armstrong has repeatedly explained) precisely the attribute that makes money widely accepted.

The large military of the decadent USA is useless because territory is no longer the strategic asset it formerly was in the industrial age where production was in stationary, centralized factories. Technology (especially for decentralized activities) is the new strategic asset. Let China have the rule over the South China Sea. If China blocks right-of-way, they shoot their own trade and exports foot. The new economy is about technology and land is becoming worthless as people are turning more to digital goods. This is involved with why Bitcoin will become a de facto reserve currency initially of the cryptocosm in which (via the rise of digital goods) becomes a dominant sector of the economy (and also because nation-states will find it arduous (c.f. also) to agree upon and administrate an impartial, trustproof reserve currency, if formulated by decree instead of de facto). Even Armstrong has noted that the value of a nation is its productive capacity, not its territory (c.f. also and also).

P.S. Tangentially note the problem that Richard admits about his BitcoinHex that of self-referrals because his system doesn’t verify identity (of the referee, not referrer which is also never required to provide identity in my system design). Airdropping at no cost to extant Bitcoin HODLers isn’t exclusive enough as they will have nearly no cost (just a small effort) and thus very little incentive to be highly motivated to widely promote (e.g. Byteball did similarly and was mostly only promoted in signatures on bitcointalk.org). Also unlike Bitcoin and Ethereum, there might be no demand for anyone to buy BitcoinHEX because the only ongoing use case to hype/pump is as Richard explains the “pump-amentals” from 1:48:30 locking your tokens to participate in the interest payments dilution (a feature which Steem had since 2016). Note I’ve been planning to have that feature (but improved by tying the rate of interest dilution to the rate of onboarding adoption giving all stakers an incentive to virally promote the fuck out of it) while also allowing staked funds to be spent on dApps without allowing them to be exchanged (i.e. cashed out) in a very clear non-fungibility manner, thus adding numerous use cases and superior flexibility over the design of BitcoinHEX. The claim, “BitcoinHEX is […] Bitcoin forked into Ethereum. That has advantages normal Bitcoin forks do not,” has the problem that ETH is more widely accepted and has more liquidity. Thus the demand side will likely be to cash out of BitcoinHEX. BitcoinHEX would need some advantage over ETH that doesn’t forsake any of ETH’s (nor for that matter Bitcoin’s) advantages. Note in the video Richard laments some of the technical limitations of Ethereum such as the high cost of computation and inability to have contracts run on timer, but we’ll be removing most of those limitations.

References

Michal Brzezinski. Do wealth distributions follow power laws? Evidence from "rich lists". Physica A: Statistical Mechanics and its Applications (406) pp. 155–162, Jul 15, 2014.

J. Doyne Farmer, John Geanakoplos. Power laws in economics and elsewhere. Chapter from a preliminary draft of a book called “Beyond equilibrium and efficiency”, §4.1 Summary of empirical evidence for power laws, p. 15, May 14, 2008.

Adrian A. Dragulescu, Victor M. Yakovenko. Exponential and power-law probability distributions of wealth and income in the United Kingdom and the United States. Physica A 299, pp. 213–221, proceedings of NATO workshop Applications of Physics in Economic Modeling, Prague, Feb 2001.

Adrian A. Dragulescu, Victor M. Yakovenko. Statistical Mechanics of Money, Income, and Wealth: A Short Survey. Modeling of Complex Systems: Seventh Granada Lectures, AIP Conference Proceedings 661, pp. 180-183, Sep 2, 2002.

Victor M. Yakovenko, J. Barkley Rosser, Jr.. Colloquium: Statistical mechanics of money, wealth, and income. Rev. Mod. Phys. 81(4), 1703, Dec 2, 2009.

Jean-Philippe Bouchard. Power-laws and Scaling in Finance: Empirical Evidence and Simple Models. Conference on Fractals 2002, Emergent Nature: Patterns, Growth and Scaling in the Sciences, pp. 157–171, Mar 17, 2002.

Xavier Gabaix. Power Laws in Economics: An Introduction. Journal of Economic Perspectives 30(1) pp. 185–206, §What Causes Power Laws?, Winter 2016.

Thomas Lux. Financial Power Laws: Empirical Evidence, Models, and Mechanism. Power Laws in the Social Sciences: Discovering Complexity and Non-Equilibrium Dynamics in the Social Universe, §IV. Multi-Agent Models in Behavioral Finance, 2006.

SUBJECT: Armstrong’s myopia on Bitcoin is only his opinion, not his Socrates computer or models

hey, is there any record of Armstrong’s computer being big-time wrong in the past? cause it will be big-time with Bitcoin, if wrong. or are these his opinions? i thought he tries not to express personal opinions...

Those are Armstrong’s opinions only. The Socrates computer only said, “A year-end closing below 4150 will point to a drop back to 775 area.” But BTC closed the year $4177. So we’re okay.[C.f. extended discussion]

Also don’t forget that BTC along with the dollar and U.S. stocks were the only global investment assets (of all world stock markets and currencies) that moved higher out of downtrends on the Pi model ECM turn date of July 12 and the flash crash to this final bottom on the subsequent Nov. 21st Pi model date. And let’s not forget the chart (c.f. also) showing remarkable similarity of the adoption of Bitcoin to gold since 1971 after Nixon ended the Bretton Woods fiat peg. Armstrong’s ECM and Socrates are apparently indicating something special going on with Bitcoin, but Armstrong is blinded by his lack of understanding, hubris and over-inflated fear of governments.

And someone who attended his recent conference in Orlando, was told by many old-timers that Armstrong’s opinions have sometimes been wrong in the past. They typically only want to hear what the Socrates computer has to say and temper Armstrong’s interpretations with his natural human imperfections.

I have also previously rebutted Armstrong in the comments of this blog. And the thesis that Bitcoin could be a better reserve asset than gold has now become supported in reality with the recent news:

Venezuela Denied Access to Overseas Gold: This is Why Bitcoin is Important

After UK Denies Maduro $1.2B Gold Withdrawal, Kraken CEO Cites Importance of Crypto