Insider trading in cryptocurrencies has been a hot topic in my @insidertrading_ twitter time-line of late and, increasingly, in the regular business and mainstream press. Allegations that employees of Coinbase, a large Cryptocurrency Exchange, bought Bitcoin Cash in advance of its listing started much of this debate in 2017; especially after Roger Ver, a popular Bitcoin Cash proponent, stated in a CNBC interview his belief that insider trading should not be considered a crime as it helps curb volatility and allows the price of what is being traded on with inside information to “much more closely reflect the price after the news became public.” Other proponents of cryptocurrencies argue that insider trading rules should never apply to this new “asset class” -- not for legal reasons but philosophical ones. They contend that an entity or asset class that inherently allows its holders to hedge themselves against the excesses of government and state power should never be held to the same standards that normal regulated assets are held to as such would necessarily involve that very same government and state power and, in so doing, limit the characteristics that make cryptocurrencies attractive to their holders in the first place.

Calls in the United States for the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) to investigate violations of insider trading laws in regard to cryptocurrencies assumes that they are a “security” or derivative commodity in the first place. While I might disagree with such scrutiny for the philosophical reason noted above, both U.S. regulators have asserted such jurisdiction with the SEC even bringing actions  against Initial Coin Offering issuers for, among other things, issuing unregistered securities.

against Initial Coin Offering issuers for, among other things, issuing unregistered securities.

The question of whether one of the growing number of cryptocurrencies is a security, commodity, currency, derivative contract, or something else entirely has not yet been settled by law or the Courts (though such has been the subject at the center of many civil litigation lawsuits involving cryptocurrencies and their Exchanges that seem to grow in number by the week). As someone with first-hand knowledge of insider trading prosecutions and their costs (financial, personal, and otherwise), I would advise traders and issuers of cryptocurrencies to put compliance with regulatory obligations at the forefront going forward and to also implement common sense and other controls to prevent the theft or misuse of material non-public information.

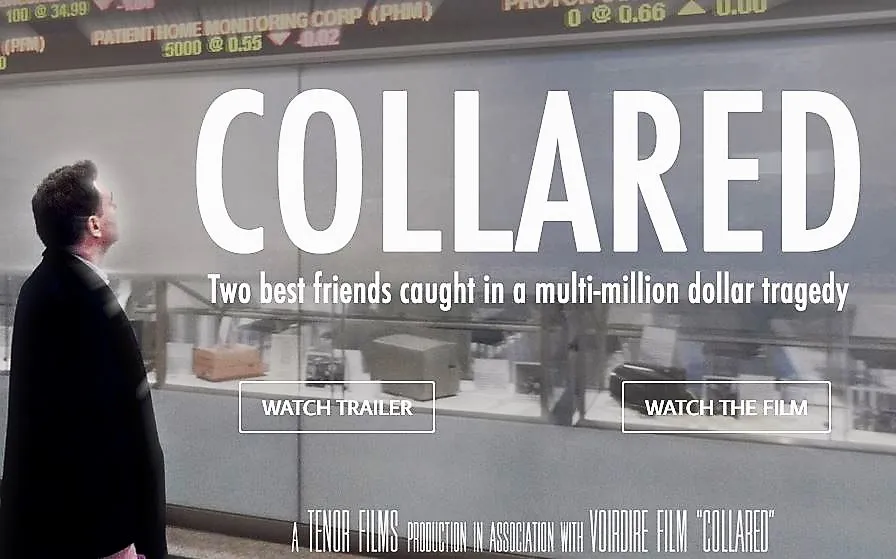

If you would like to know about those common-sense controls and reviews that should be implemented based on my own experience of what I and my co-accused did to obtain enough information to trade on inside information in over a hundred separate deals that spanned fifteen years of illegal activity before finally being identified and later featured in the educational documentary “Collared” (http://collareddocumentary.com/), please contact me at collared.speaker@gmail.com for my insights and how I can help.