I'm not opposed to NFTs. I think blockchain-based digital asset management makes a ton of sense. I'd love to see it used to replace awful antiquated systems for ownership tracking of physical goods (eg the title system for houses), and it would be great for managing ownership of unique assets in interoperable networks of virtual worlds.

If I'm going to try to steelman the art NFT mania, I'd argue that we have a 1-2 decade long backlog of digital art assets that did not have an easy way of being sold and traded by artists, and the prices we're seeing now reflect the fact that these assets have spent a lot of time building up a reputation (eg Nyan Cat) but there was no way to monetize it until now. I've seen earlier artists create limited edition "installations" of digital works, the art world did manage to sell a banana taped to a wall, and copyright law has handled the rights to illustrations and even likenesses for over a century, but NFTs do seem like a more efficient mechanism for smooth and efficient transfer of "rights".

Furthermore, there are similarities between the traditional art world and NFTs. Most art that sells for $millions ends up getting loaned to a museum and publicly displayed. Thus, the only thing that's actually sold is the name on the blurb below the painting saying "on loan from the XXXX foundation". Technically the owner could decide to hang the art in their living room, but this tends not to happen.

So I can buy that NFTs can be a thing of real value; if everyone decides that one NFT platform is the official platform, and these assets are the ones worth caring about, then there is scarcity and there can be a stable market and even arguably a thing of value getting traded, or at least something with similar credibility to the traditional art world.

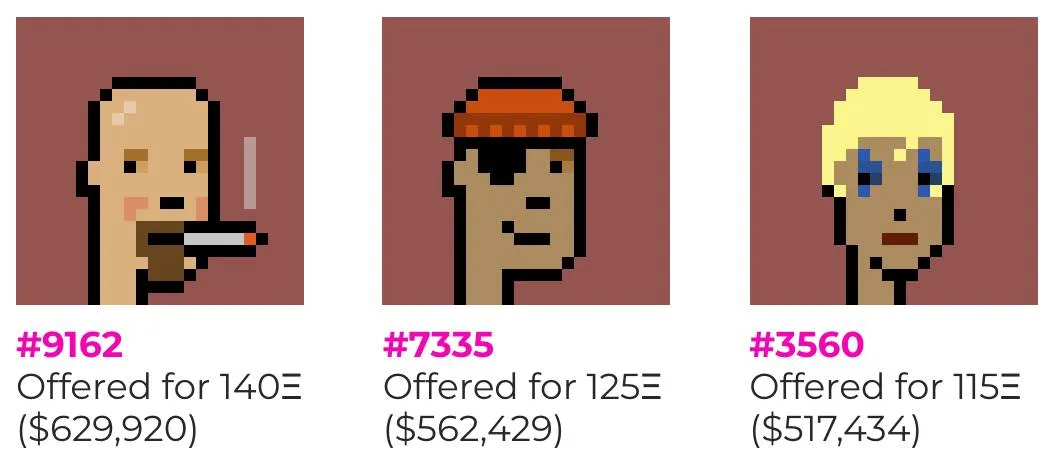

Where I get uncomfortable is when it seems like many people are looking at art NFTs as an investment, but the supply of art NFTs can be arbitrarily increased at any time. Cryptopunks have a fixed supply of 10,000, but anyone else can start a cryptopunk knockoff, and even the Cryptopunks creator could release "3D Cryptopunks", "Noirpunks", "Upside-down Cryptopunks" etc. Artists can endlessly remix and rerelease any of their own work that picks up value, thereby diluting its value. If I want my art to be an investment, I want it to be not-trivial for the artist to create a lot more of it. I see some of these speculation/investment NFTs and think "wow, it's like a cryptocurrency, but crappy". The cryptopunks are conservatively worth >$400m in total (cost of cheapest cryptopunk on the market * 10,000), but the reason any one of them is worth more than any other one is purely a matter of a positive-feedback hype machine and not a matter of artistic merit. I think it's the same reaction I've had to memecoins. Coins like Dogecoin are fun, but someone else can start SHIB, price it deceptively low, promote the hell out of it, and end up with a market cap bigger than DOGE.

If an NFT is trying to be art and a serious investment at the same time, it's sort of working at cross-purposes to itself. I like good art, and I'm happy to pay money for it to support artists, but relying on art as an investment vehicle depends on a hype cycle feedback loop that seems fairly arbitrary to me, and many of the NFTs I'm seeing are expensive enough that I'd need to treat them as investments that need research and evaluation. "Should I buy this particular cryptopunk for $647,000? Let me look at the fundamentals." Yes, regular stocks are also part of hype cycle feedback loops, but those are more familiar to me and feel much more tied to some tangible notion of market value.