A close look at Denarius / $DNR

Once again, Crypto Twitter has blessed me with the knowledge of a crypto project that I had not heard of, until I noticed a new ticker/”cashtag” in a tweet from oneTwitter account I’ve come to pay extra attention to:

https://twitter.com/jiucrypto/status/1021736965451001856

- jiucrypto

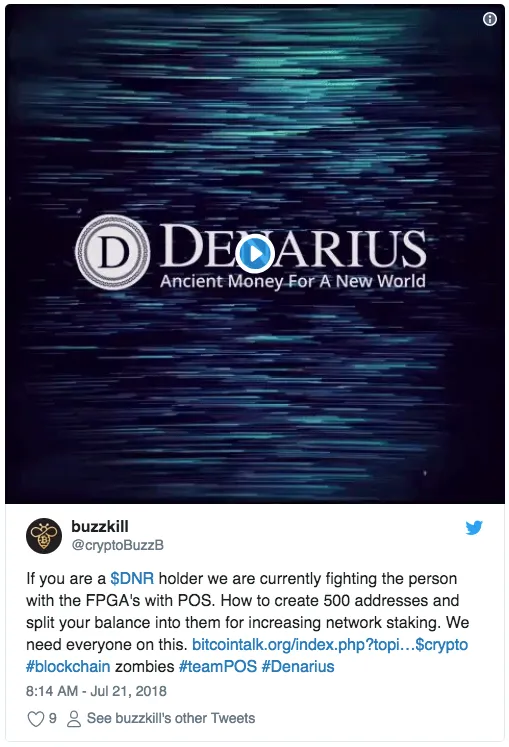

So I diligently start doing a “surface scratch” on the coin, I do the obligatory search for the $DNR cashtag on Twitter and I discover even more tweets that pique my interest:

First of all, Denarius was, to me, unknown. Secondly — the above tweet made me curious as to what the author was describing. A PoS fight with PoW FPGA miners of a coin?

I had never heard of anything like it, and it got me curious. At the moment I mine coins, I stake coins and I run masternodes. Basically, I take part in most coin-minting methods and I like to learn as much as I can about how this stuff works.

What is Denarius?

But first things first, I’ll give a quick look into the Denarius coin project and give some background on why it appealed to me more or less instantly.

The following short description on the projects website was enough to make me want to start digging deeper into this project:

“Denarius is a new cryptocurrency based off the original Bitcoin Core by Satoshi Nakamoto. Denarius features many changes, such as Stealth Addresses, Encrypted Messaging, Tribus a new PoW hashing algorithm that is ASIC resistant, and a max of 10,000,000 DNR to be created during the hybrid PoW/PoS lifecycle of 3 years, which then transitions to Proof of Stake entirely after the first 3 years.”

This is fascinating to me. The project will only allow for PoW & PoS minting of coins until the max supply of 10,000,000 coins have been reached. A quick check on CoinMarketCap.com reveals that we are getting close to 1/3 of the max supply that are currently in circulation.

At the time of writing it has a market cap of ~800,000$ USD so it fits perfectly into the low- to microcap category, which is where I like to place many of my bets. I’ve come to realise (and I’ve also learned from The Altcoin Traders Handbook) that this is a good strategy to follow when you are looking for investments with higher return probabilities.

One should not blindly place investments in any smallcap projects, of course. A thorough FA is warranted everytime, as I’m sure JiuCrypto would like me to emphasize, especially since I used his tweet as the motivator for my further digging into this project 😎

Also, if you’ve read the The Altcoin Traders Handbook you probably noticed how the author recommends buying into coins which have at least 50% of their coins in circulation, DNR currently has 35% of their total coin supply in circulation. I do recommend buying, reading and taking all the tips you can get from this book as it will improve your trading strategy, it sure has for me — however, I don’t always follow every advice/rule in this book to the dot. A reader asked me a question specifically about the circulating supply, as I referenced the book in this piece so I thought it would be in its place to clarify my thoughts on this. The book is full of great advice, however I rarely let the fact that a coin does not match all the criteria of “a perfect coin” prevent me from buying into it.

Ok, so I know the coin is both PoS and PoW, its a lowcap, it has a unique approach to its coin minting. Whats more, their website reveals some more features that inherently appeal to me:

🤟Secure Messaging🤟

🤟Stealth Addresses🤟

🤟Multi-Signature Adresses & Transactions🤟

🤟Atomic Swap support via BarterDEX🤟

So suddenly I see this “new” coin that, after a quick Google search and a glance through the website, seems to be a very interesting project.

Not only that, the same coin is suffering from a FPGA miner who has gained enough hashrate in the coins network to be able to grab a whole lot of coins which he (or she) then dumps at exchanges right away, causing the price development of a promising project to halt.

Needless to say, if you or I were a team member on a coin that started being subjected to such attacks, and we took the project seriously — we would try and find ways to mitigate any activity in the network that might have an overall negative effect on the majority of the coin holders. Considering this, I instantly start appreciating the community surrounding this coin.

To me, it seems that these are people passionate about ensuring that the project continues to be a thriving community — and they won’t allow any single entity (person, group of people or company) to hijack the price development they want to reserve for the wider majority of their supporters. I like what I see.

The community

Shortly after my initial “surface scratch” on Twitter and the projects website, I join their Discord server and I discover that the community has, as expected, a lot of dedicated supporters. Even more, I notice a couple more Twitter personas, that I tend to pay extra attention to, on their Discord.

This gives me additional trust in the projects good intentions and bright future. I’m not going to reveal which Twitter personas that I choose to put extra faith in here, actually — if you’re not active on Twitter for learning about cryptocurrency projects my best tip is that you get on it right away. The number of times a small hint on twitter has put me on to a hidden gem is growing bigger by the week.

Actually, I’m curating a few lists on Twitter of different types of accounts of personas that are worth checking in on, for various reasons. The first one I’ve decided to publish is here.

Now, keep in mind that I do not intend to make any exhaustive lists of CryptoTwitter accounts, this first one is based on people I like to check in on, but there sure might be some pure BS accounts in there as well (and also, there are some high profile Crypto Twitter users I can’t stand that I’ve decided to spare myself from — yeah, I’m looking at you Mister BCash, and you too Mister I’m-Satoshi-I-just-have-no-way-to-prove-it).

But, as I often do — I digress. Back to Denarius and what (to me) makes it special.

After I decided that Denarius is well worth a closer look, I start to investigate more into the PoS fight against FPGA miners. It turns out that someone has been able to obtain a majority hashrate in the network, effectively securing him/her a majority of the PoW payout which then was dumped more or less immediatly on exchanges.

Its not hard to imagine that this affected the price development in a way that the team behind the coin did not appreciate.

I for one, cannot understand how anyone who are able to obtain a majority of the rewards in this manner would decide not to use said rewards to set up Masternodes on their own to further enhance their profits, but hey — people are different.

I’ll be a bit lazy here and use one of the team members responses to my tweet asking for more info on the situation, to bring you up to speed about what that whole POS vs. POW ordeal is about:

https://twitter.com/cryptoBuzzB/status/1021770082387550209

- cryptoBuzzB

And to further elaborate:

https://twitter.com/cryptoBuzzB/status/1021771917529776128

- cryptoBuzzB

So, to break it down a little more detailed than @cryptoBuzzB was able to in these limited tweets. A someone managed to obtain a large enough hashrate of the PoW in the chain, which in turn resulted in them getting a larger than usual portion of the Block Rewards. Now, this will introduce itself as a problem as soon as you discover that those same rewards are instantly dumped onto an exchange over an extended period of time.

In these days, alts aren’t doing just peachy — unless you hadn’t noticed. So having a miner — someone that should be interested in the projects overall well being, mind you — just dump their coins at a market rate over an extended time period, that needs to be dealt with.

And thus enters the strong and supportive community of Denarius. While its a low- to microcap at the moment, its got some bigtime supporters that obviously has much faith in the projects proseperity.

So they — in the face of a threat that someone could just “mine ‘n dump” the coin to oblivion — took action.

And its the action that was taken that got me so damn curious about Denarious in the first place.

To understand how the Community could actually “fight off” a PoW miner that was securing a majority of we need a more thorough understanding of one essential element to Denarius:

The Tribus Algorithm

Ok, bear with me now, folks. But I’mma ‘bout to dive down into the Whitepaper (or the Whitescroll, as the ancient currency so beautifully calls it) an try and give you the crash-course on the inner workings of the mechanics that make this coin incentivise its miners, stakers and node-admins.

In order to discourage ASIC creation which would adversely affect miners of the coin, Denarius seeks to implement a short proof of work phase in hybrid with proof of stake (PoS) where the PoS miners will use low difficulty hashes to create blocks & process a block full of transactions, claiming the transaction fees alone whilst the PoW miners will compete for higher difficulty hashes to create blocks which include a generation payment as well as any transaction fees attached to transactions in the mempool when the hash is solved.

Even if the difficulty of the PoW blocks increases significantly, blocks that are full of transactions can still be processed by PoS miners at a low difficulty to ensure that even at times of very high PoW difficulty, block times can remain at or below 30 seconds.

Ok, so what this tells us is that Denarius stakers will be entitled to claiming rewards from the blocks they process, and these rewards come from the transaction fees of the blocks.

Miners, on the other hand, will be eligible for both a Block Reward and the transaction fees attached to the blocks they mine.

Additionally, despite how much the miners of Denarius increase the overall difficulty — the stakers will still be able to process blocks through the Proof of Stake method, ensuring that the block time is kept at the desired interval.

Interestingly, Denarius will disallow Proof of Work miners after a period of about ~3 years. In this initial period, there will be about 3 mill blocks mined and after this the remaining 2 million Denarius that can be mined is reserved for PoS stakers, who — after the year 2020 — will receive a 6% annual percentage rate (APR) from the coins they stake, in addition to the transaction fees off the blocks they process.

The reason for why PoW is discontinued after 2020 is mainly to eliminate the risk of any ASIC miner being developed specifically for the Tribus Algorithm. The assumption, which sounds reasonable to me, is that there will be little effort put into developing ASIC specific hardware for this Algorithm when it is destined for such a short life-span.

But what this basically means is that PoW rewards will decrease when the number of PoS stakers increase. So the Denarius community, with help of the Tribus Algorithm, successfully launched a counterattack. Also, the Denarius coin has an interesting feature where you can obtain more staking rewards for spreading you coins across a large number of wallets. See this guide, by community member BuzzkillB for more information about this method.

In effect, the more people who stake this coin, the lower the PoW rewards become — and that was what made the community take action. They initiated an operation where a large number of holders put their coins in staking wallets as to make the PoW mining less profitable for the “attacker”. If that’s not cool, I don’t know what is.

The Wrap Up

I started this article after stumbling across a new ticker, and while researching the coin I got more and more intrigued. Not only with the mechanics of this coin, but also the community surrounding it and its collected effort against a threat of a PoW miner that was suppressing its price by dumping a whole bunch of coins onto exchanges at a fast rate.

After joining their Discord, and learning that some of the people I follow (and respect) on Twitter were actively mining, staking and running masternodes for the project, I got in with a small investment to test out the staking methods and to aid in the PoS/PoW fight — but it did not take me long until I decided to go for a Masternode as well.

At the time of writing the Masternode is supplying me with about ~9–12 DNR per day, and the mining rewards go straight to a staking wallet I’m hosting so I’m going all in on the PoS mining on this coin right now. I do, however, admin a mining farm so once I get to setting up a rig to mine DNR I’ll be sure to update this article with the mining speed and results I’m getting from that.

If I were to point out possible red flags regarding this coin, it will have to be the premine and that it seems to have only one developer working on it, though that assumption comes from other articles I’ve read about the project.

The Denarius coin will only ever have 10 mill coins in circulation, and of those 10 million, there is a 10% Premine (which amounts to 1,000,000 DNR).

Now, to me, these premines are not something I tend to worry too much about. If a project has a strong community, a good, working product, and the developer(s) seem focused and dedicated. Then a premine, can be a positive thing. With Denarius, 50% of the premine is earmarked marketing and bounties, and the remaining 50% is for development costs. If you ask me this is fair enough. In the The Altcoin Traders Handbook which I like to reference, the author is somewhat sceptical to premines of this size — but this is a topic of much discussion within the crypto community. Ultimately one needs to make own assessments of whether a premine is too high, or if its being distributed in a manner that does not make sense.

To me there is nothing really suspicious about the size of the Denarius premine, for reference the ZCash currency has a “founders reward” of 20% and this has not had any noticable effect on the adoption of this currency. It also seems that the ZCash team is able to spend these funds wisely on further development on their project so as long as the Denarius team also allocate their funds in a manner that makes sense, I have no objection to such premines. One needs to remember that in addition to the time spent on actual development, the project needs fund to pay for its servers and hosting, etc. The notion that a cryptocurrency project should have a 0% premine in any circumstance is not something that I agree with, but the size of the premine and how it is distributed is something one should always keep an eye on.

When it comes to the single developer, I did some checking on that too. And on the projects Github contributors page we can see that there are at least two contributors that have a fairly high amount of commits. There are also a number of people with 1–2 commits as well but I tend to only consider people that have more than 15–20 commits as actual contributors. Either way, the project might benefit from an additional number of resources, perhaps — or it might not. If the developers that are working on the project as of right now feel that they have enough time and resources on their hands to drive the development further then they probably have a good reason for feeling this way. Adding more people to a team will ultimately lead to more time spent on project management than on actual development for the lead dev(s) and I can understand that this is not necessarily desirable.

However, one can with good reason imagine unfortunate situations where something might occur in the personal lives of the active contributors of this project. And if something like that were to happen, then it would be reassuring to know that there are more than one or two people who are ready to “take the wheel”. For now this is not a major concern to me, but in the future I would be happy to see some more additions to the development team, even if the additions are purely for “worst case scenarios” where a lead dev is hit by a bus or something, and someone needs to step in to handle further development for a specific period of time.

Nevertheless, for my own part I have found this to be a serious and credible cryptocurrency project and I’m going to have my masternode operational for at least 12 months onward and reassess its performance after that. In these days of the altcoin bloodbath the price of a Masternode amounts to about 1200$ so it is not an investment anyone can make, and no-one should do so on a whim. But I feel that this is yet another coin that I will take joy in following closely as its development progresses.

(PS! If you are interested in setting up your own DNR Masternode, I can reccomend Vultr (reflink, btw) as your hosting provider and this guide to aid you trough the process of setting up the node properly.)

Hey, BTW, if you like this article, please upvote, resteem or share it on Twitter (or all of the above;). The upvotes and resteems helps my visibility here and sharing it on Twitter helps even more people learn about DNR 😎

Additional info

There are several things I have not even gotten around to cover in this article, for one — the Denarius QT wallet app is probably the most feature rich and nicest wallets I’ve seen for any cryptocurrency. It gives you a wealth of information about the coin, its price, it has a block explorer, statistics about its blockchain, masternode statistics, secret messaging, and much much more.

If you want to learn more about Denarius, you can check out their website here. If you are interested in checking out their community, hop on their Discord which you will find here:

Finally, if you are convinced that Denarius is well worth owning a stake of (and staking it too😅) — you can go get some at Cryptopia.

(Btw, that is a reflink that I try and persuade you to using there 😇)

Also, if you do decide to invest in $DNR and you realize that this was a sound investment — I will not stop you from passing some coins over to my DNR tipjar address: DFcgMsnuczwLCnX6K7NnnsgTi9Yw7gNYvn

If you’re not a DNR holder yet, but you’re just itchin’ to throw some cash in my face (I don’t blame you😅), here are some other means of passing me a tip:

BTC: 14iKgia5wtdjmLXs7QiJui3Sb6KVP6XebL

ETH: 0x913c1CD95Dc971B304C5217831102E350230efaB

BCH: qq5tjpm0jv460tvk4pa050pwc6u2aj46gs2tce2rd4

NEO: ARdd2cqCSajpzkSZGFtSqAPvBLYcquD7WH

XHV: hvxyCxSYVGLSysjcLhRUhEfpHX3p9wXjpGNFC7iR84DPewEuZ3BxoYAaC7uUVvMxxVVBWwsxWkzPLPfFqwtVxveE7S9tdCbok4

Full Disclosure: I am a DNR holder and I now own one Masternode. Even though my ~5000 DNR hardly makes me a whale in any way here I feel that it is only proper to let anyone who stumbles across this article know about that particular fact. I prefer to avoid situations where people can, with good reason, accuse me of shilling a coin just because I’m a holder. However, I tend to buy in to the projects I like — who doesn’t?

Nevertheless. Now you’re informed that I hold about 5000 coins in this project and you can take that into account before you consider taking any stake in the project as a result of this article.