Hey folks, so in today’s article (which I’m trying to publish as quickly as possible), I’m going to be doing a bit of a deep dive into Mitosis — a “unified liquidity solution” which currently has an ongoing Mitosis Expedition campaign that allows people to deposit their liquid restaked $ETH (more specifically Ether.fi’s $eETH) in order to earn MITO points.

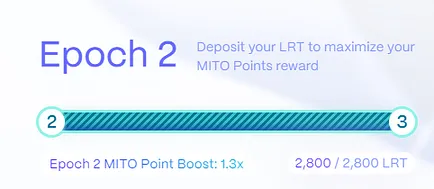

The reason why I’m writing this expeditiously is because as of this Friday 3PM UTC, Mitosis will be opening up deposits for the start of Epoch 3, and if you’ve followed how the first and second Epoch went, they literally reached their capacity in just a couple of hours. Therefore in similar fashion, I believe for Epoch 3 we’re probably going to see the same.

But before we go any further, let’s breakdown some of the basics shall we?

What is Mitosis?

In a nutshell, Mitosis is a cross-chain liquidity protocol for modular blockchains. Just as Celestia ($TIA) provides data availability for other blockchains, Mitosis is another EVM-compatible Cosmos chain that will act as a liquidity layer for different DeFi protocols — providing increased capital efficiency while at the time same accruing high yields. From what I’ve gathered, similar to bridges like Across, with an intents-based approach, Mitosis will essentially act as an orderbook relayer for different DeFi apps. Across has already proven how fast, efficient, and secure intents can allow people to bridge assets from Ethereum and different L2s, so it only seems natural that someone found a next iteration for doing this at scale with not just individual users on L2s, but also with different DeFi apps on various IBC/Cosmos SDK chains.

Additionally, I think it was only a matter of time that more protocols took a look at liquidity under the modular thesis, especially as the blockchain spaces seeks to become more and more interoperable. The big hurdle with many up-and-coming protocols is that they need to attract liquidity in order to “make it,” and using services like Mitosis provides a solution in order for them to do so, just as Celestia has become a cheap way for apps/chains to have cheap and secure data availability.

Mitosis Expedition

Still in its liquidity bootstrapping campaign known as Mitosis Expedition, users can deposit their liquid re-staked $ETH and receive miAssets in return. However, as I'll outline further, there’s several ways (not just depositing for miAssets) that can earn you 100k’s of MITO points, so even if you’re not keen on entering Mitosis this upcoming epoch, I highly recommend that you still participate on a basic level in order to pick up some of the freebies at little risk.

Let’s break down each of the ways in which you can earn MITO points:

- Depositing during Epochs 1, 2, or 3

- Galaxe check-in

- Badges

- Referrals

1. Depositing during Epochs 1, 2, and/or 3:

There are a total of 4 different epochs, the second which has which has just recently ended:

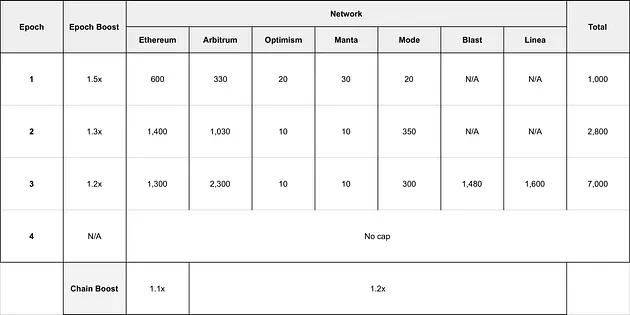

Epoch 3, which begins later this week will see an increased threshold of LRT deposits which is capped at a total of 7,000 $eETH, split across Ethereum mainnet and six of its different Layer-2s:

As you can see from the graphic above, each Layer 2 has its own deposit cap and each epoch has its own different epoch boost, with the 3rd epoch having a 1.2x boost.

How and what do I deposit? As I mentioned before, the only LRT that you can technically deposit at this point is $eETH, which is EtherFi’s version of liquid re-staked $ETH. As we saw in Epoch 2, with the exception of Mode, both $eETH and $weETH on Ethereum mainnet could be deposited into all vaults (both mainnet and all L2s). So for instance if my $eETH was on Ethereum mainnet, I could directly deposit into Arbtirum’s L2.

Subsequently however, if you already hold $weETH on one of the L2s, then your tokens can only be deposited on that specific L2s network’s vault. So for instance, if you hold a lot of $weETH on Manta, you might consider bridging it to another network seeing as the deposit cap for Manta is 10 $weETH and the deposit cap might fill up pretty quick.

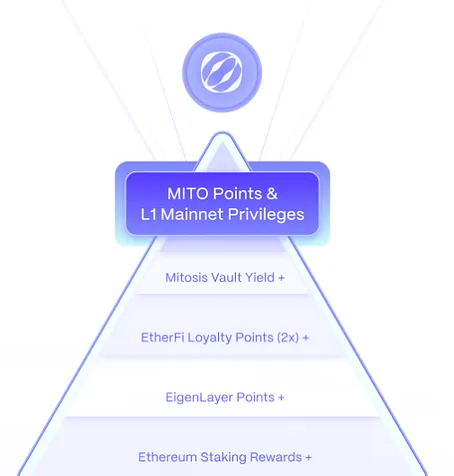

Depending on how much you deposit, this is perhaps the most lucrative way to accrue points and secure a lot of yield, as you’ll earn not only all the normal benefits of holding a LRT, but also returns from Mitosis’ Vault Yield as well as MITO points:

Despite the extra yield that you’ll be earning, it is important to note for those of you that might be depositing during epoch 3, is that for the duration of the epoch your funds will be essentially locked until the epoch’s end (give or take a few weeks). Therefore, if you’re going to need immediate access to your liquidity or if you have a strong aversion to locking up your funds, depositing into epoch 3 might not be the best move for you. This brings me to my next two options…

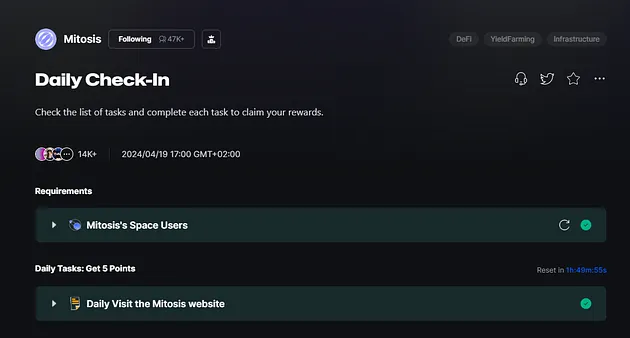

2. Galxe daily check-in’s

This is relatively straight forward, but Mitosis has an ongoing daily check-in quest on Galxe that literally just requires you to follow their space as well as visit their website:

I consider this a pretty low-risk play as you’ll only to sign a verification for your connected wallet. Unfortunately it’ll only give you a daily 5 points for doing so, but hey…free is free.

3. Badges

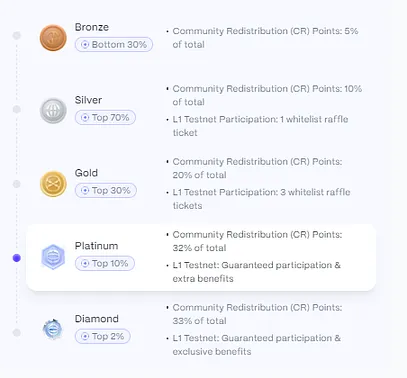

The last method, is through earning badges which can help you earn 10’s of 1000’s of points. Depending on how many points you earn, you can make your way up the following 5 tiers:

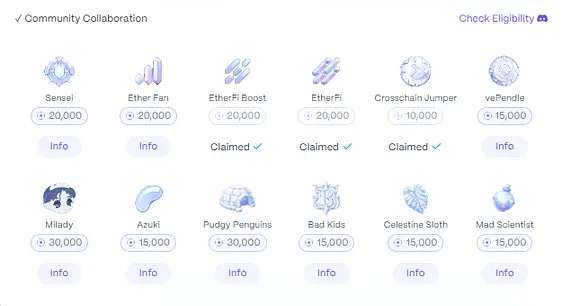

Without depositing anything into Mitosis’ first 2 epochs, I was still able to accrue more than 50k points and am currently sitting in the Platinum tier. Currently there are 28 total badges you can collect, the majority of mine that were collected through simply already having assets on EtherFi:

4. Referrals

The final method of accruing MITO points for free of course is through referrals. Referrers can gain an additional 1.2x boost for 14 days per friend, as long as they meet the following requirements:

Referrers must have their X account connected to the app

Referred Participants must have their X account connected to the app

Referred Participants must have at least 0.1 miLRT

You can apply a referral code retroactively after signing up, but once applied it can’t be changed. (If you’d like to support this blog, feel free to use mine: https://expedition.mitosis.org?referral=9UYGPC, otherwise you can enter referral code 9UYGPC.

Risks and other things to consider

Apart from general smart contract risk, there’s a lot of things to consider with any new protocol, and Mitosis is no different.

Lock-ups: I’ve already talked about this before, but assuming that epoch 3 reaches its full threshold, the LRTs are essentially locked up or irredeemable until the epoch is over, which could be a few weeks. I’ve been burned by lock-ups in the past, but you’ll have to consider your own risk-to-reward appetite on this one.

Audits: Mitosis has been audited twice, both from earlier this year by Secure 3 and Omniscia, with links to both reports in their docs. In full transparency I’m not a developer, but from what I’ve gathered, there were either no critical issues found, or if there were, then they were fixed immediately.

Modular security: Going along with the modular thesis, Mitosis’ primary means for security are through Inter-chain Security Modules (ISM) powered by Hyperlane. You can read more about ISMs in Hyperlane’s docs, but essentially they allows for modular security that can scale to the size of the liquidity, and also reconfigured easily depending on what type of security is actually needed.

Conclusion:

Assuming I can make the window for deposits before the caps get reached, my ultimate plan is to deposit some $weETH onto both Blast and Linea — the two L2s on Mitosis’ deposit lists that have yet to introduce their own native tokens. From what I’ve gathered, there’s no guarantee that you’ll be able to earn any Blast Gold or Linea XP, but I figure that it can’t hurt my chances any for giving it a shot.

Although this is also stacking another layer of risk on top of my $ETH, personally I think it’s worth getting at least some exposure, for I wouldn’t be surprised if Mito’s token once it drops will be just a valuable and lucrative as Celestia’s $TIA.

Were you already lucky enough to get into one of Mitosis’ first two epochs? I’d be curious to hear your experiences using Mitosis in the comments below. And once again if you’re keen to join Mitosis’ Expedition yourself, consider supporting this blog and using my referral code (9UYGPC) when you sign up.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone! allocation, but I’m also earning some pretty significant yields on my assets at the same time.